Tuesday was pretty damaging for any bears left out there. Everyone was bracing themselves for the Wednesday Fed meeting, but there was a one-two punch early on Tuesday that was unexpected in its scope: first, the Draghi capitulation, and second, the Trump-Xi meeting tweet.

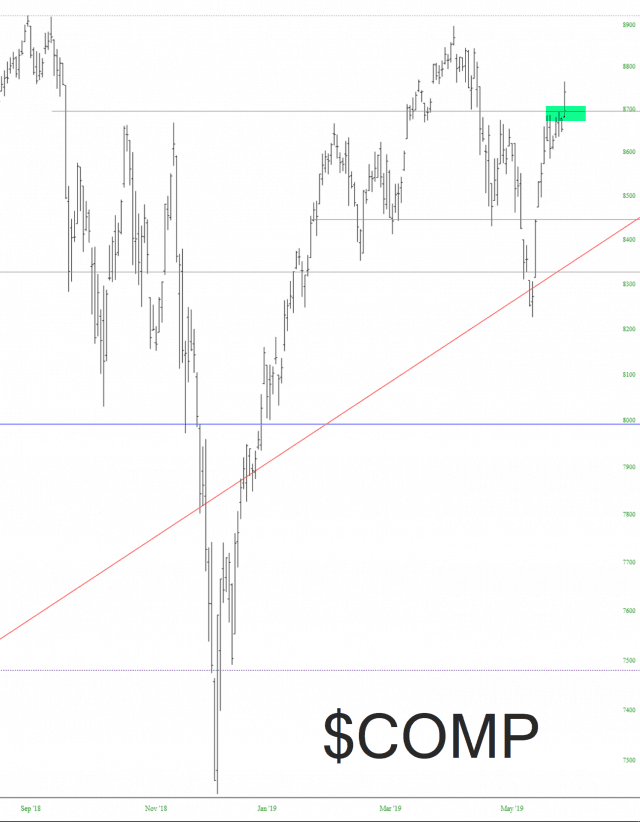

A number of major cash indexes broke above medium-important resistance levels, putting more wind into the bullish boat sails. Here is the Dow Jones Composite:

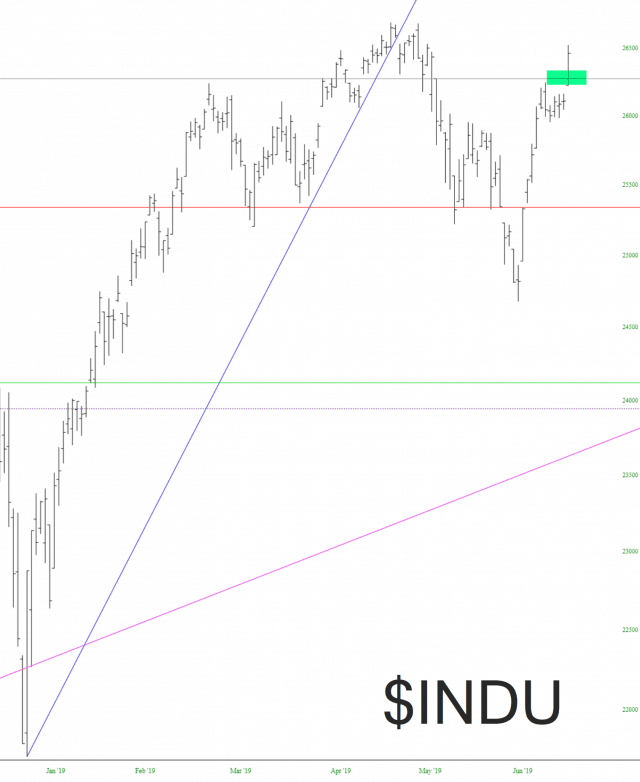

The Dow Jones Industrial Average:

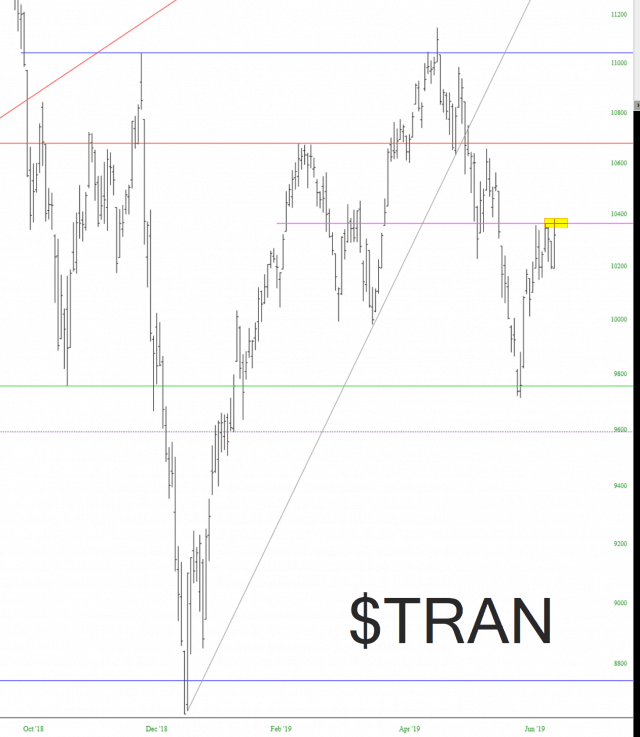

The Dow Jones Transportation Index:

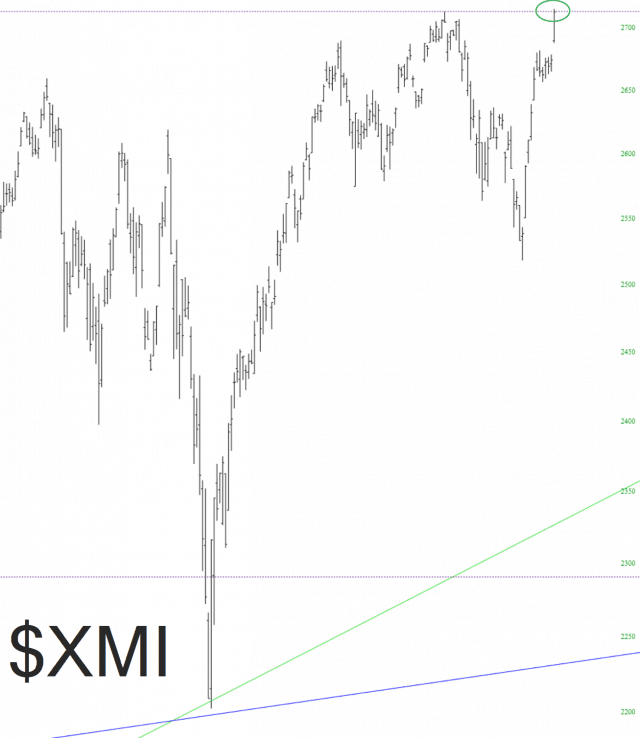

And in one case – – the Major Market Index – – not just a breach of a resistance line, but a breakout to the highest point in human history.

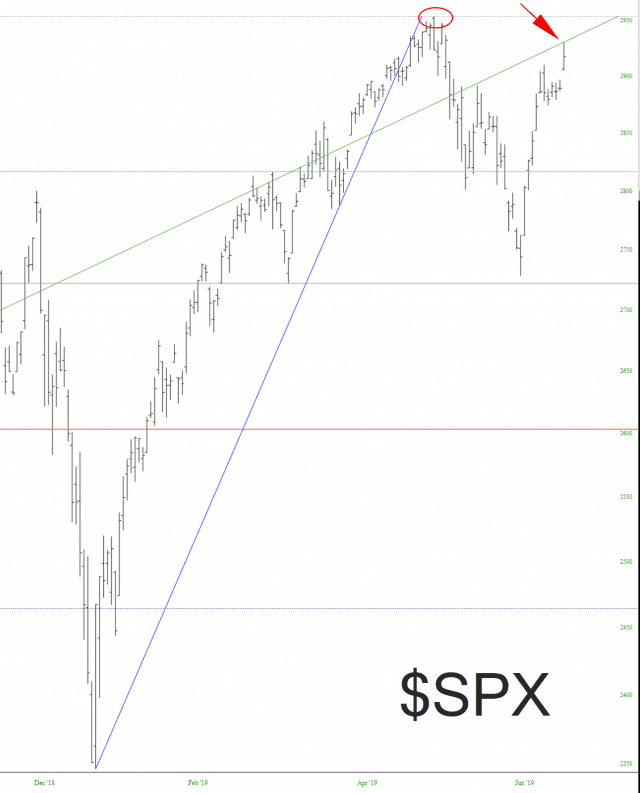

Just about the only major index remaining below a key resistance level is the S&P 500 itself, which tagged the underside of its long-term trendline (the biggie, dating back to 2009). Of course, even a modest “up” day would push past this line, and we are terribly close to a lifetime high on this as well (note circled area).

For myself, I have no ETF or options positions at all, and a “medium-heavy” assortment of 45 relatively evenly-weighted short positions. Let’s see if my hair catches on fire after the Fed meeting or not.