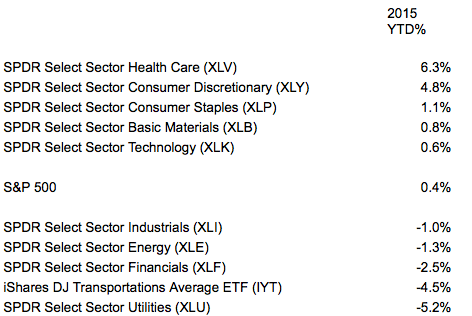

Perma-bulls may note that the S&P 500 eked out a 0.4% gain in the first quarter of 2015. They may also choose to ignore warning signs such as the 5th consecutive month of decelerating economic activity in the manufacturing segment. The last time that this happened? 2008.

A quick check of the individual sectors that make up the overall market demonstrates that an increasing number of them are losing ground rather than gaining it. For example, the transporters in the iShares Transportation Average ETF (ARCA:IYT) are collectively down 4.5% since the start of the year. Meanwhile, safer haven utility corporations comprising SPDR Select Sector Utilities (NYSE:XLU) are down 5.2% in Q1, even with dividends reinvested.

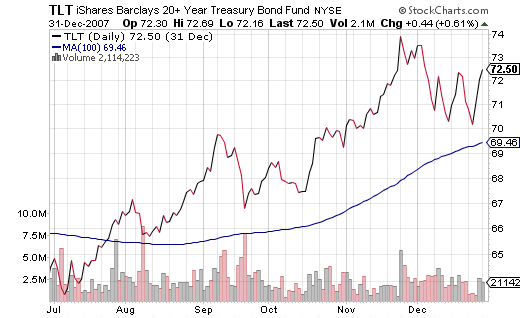

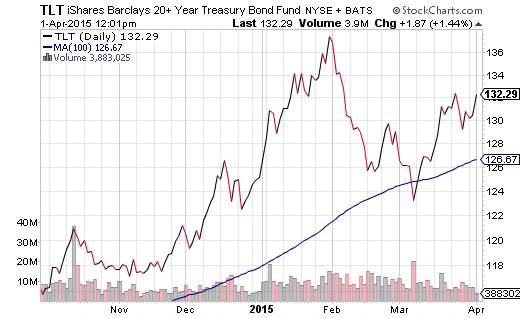

Although some believe that the overall stock market has been handling the uncertainty of rate hikes as well as slower economic growth rather well, historical strength in longer-term treasuries might suggest otherwise. Consider the trend for iShares 20+ Year Treasury (ARCA:TLT) in the six months prior to 2008. Long before the bull market in stocks became decidedly bearish, the demand for long-term treasury bonds began appreciating in dramatic fashion.

Does the trend toward acquiring long-term treasuries via TLT over the last six months resemble what transpired before the 2008 bear?

I certainly cannot say that the next bear market in stocks is here. Heck, we have not even seen an actual correction of 10% since 2011. However, I will take note of several realities that threaten the well-being of U.S. equities. First, ever since the Federal Reserve officially ended its third round of quantitative easing in October, economic indicators have weakened considerably. This has not helped the Fed in its quest to raise overnight lending rates. Not surprisingly, the Fed itself has already downgraded its expectations for the economy in 2015, 2016 and 2017. What’s more, central bank committee members also expressed that the pace of any rate hikes would likely come at a significantly slower pace.

Second, analyst estimates of corporate profit and revenue have been falling faster than the credibility of Brian Williams. (Okay, that was a cheap shot.) Nevertheless, even if the game of beating low-ball estimates continues, 0% earnings per share growth over -3% expectations is downright pathetic. Historically speaking, when sales and profit trends weaken, the stock market wobbles.

I have been sticking with the same lower volatility ETFs that have been working well for clients over the past 18 months. For domestic stock exposure, we still hold iShares USA Minimum Volatility (NYSE:USMV), SPDR Select Sector Health Care (ARCA:XLV) and Vanguard Mid Cap Value (NYSE:VOE). For domestic bond exposure, we still hold Vanguard Long Term Bond (ARCA:BLV) and iShares 10-20 Year Treasury (NYSE:TLH). And, as always, we protect against severe sell-offs with hedges and stop-limit loss orders.