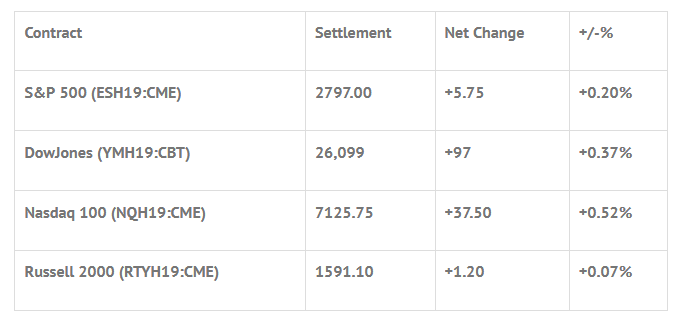

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -0.67%, Hang Seng -0.65%, Nikkei -0.37%

- In Europe 10 out of 13 markets are trading lower: CAC -0.25%, DAX -0.28%, FTSE -1.09%

- Fair Value: S&P +0.04, NASDAQ +4.05, Dow -6.67

- Total Volume: 1.24mil ESH & 385 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Housing Starts 8:30 AM ET, Redbook 8:55 AM ET, S&P Corelogic Case-Shiller HPI 9:00 AM ET, FHFA House Price Index 9:00 AM ET, Jerome Powell Speaks 9:45 AM ET, Consumer Confidence 10:00 AM ET, and Richmond Fed Manufacturing Index 10:00 AM ET.

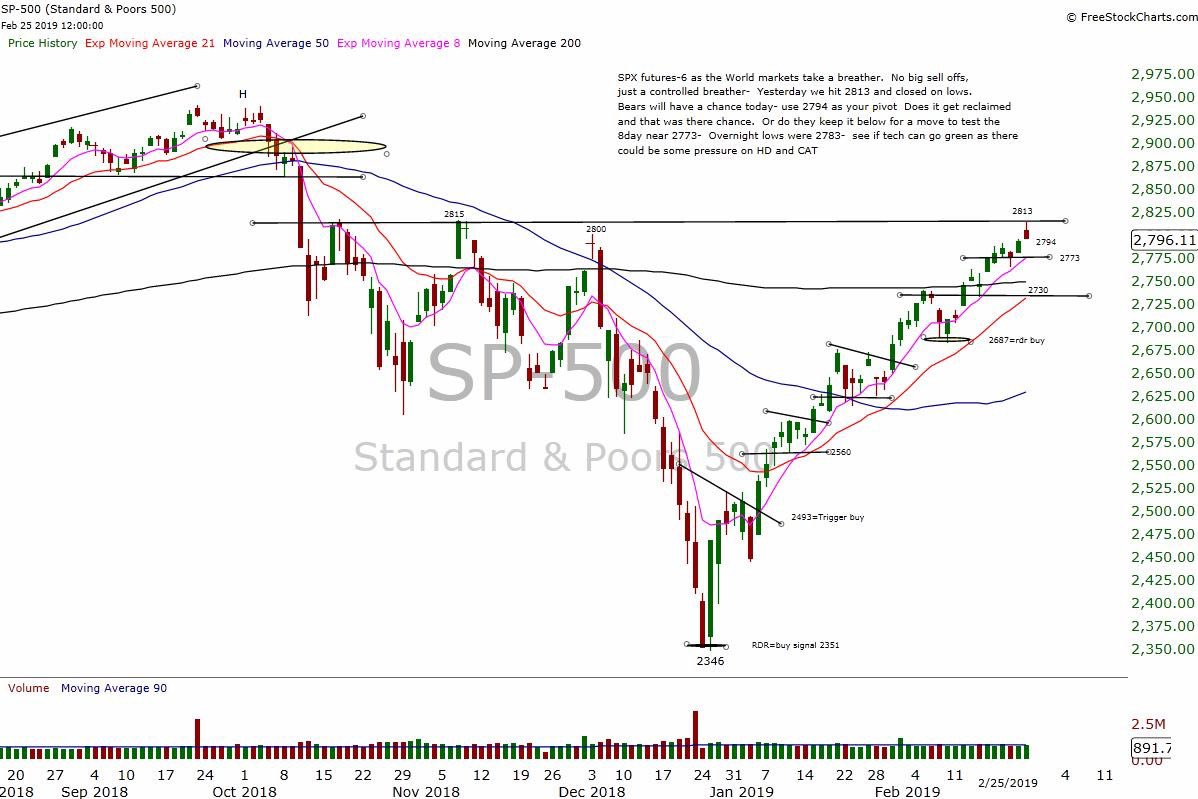

S&P 500 Futures: 10 Week Rally Continues To Roll

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -5 as World markets take a breather. We’ll see if the Bears have any power. See if 2794 gets reclaimed. Or not!

Sometimes even the greatest investing minds in the world can make mistakes, and yesterday Warren Buffett said that he ‘overpaid for Kraft-Heinz’. While I do not think the loss will make investors lose faith in Berkshire Hathaway (NYSE:BRKa), it is a good example of how fast things can change.

Just think, the #ES sold off down to 2316.75 on December 26, and traded up to 2814.00 yesterday.

During Sunday nights Globex session the S&P 500 futures (ESH19:CME) traded up to of 2808.50, up +17.25 handles, and opened Monday’s regular trading hours at 2807.75. After stutter stepping up to 2811.50 at 8:52 am, the ES sold off down to the vwap at 2805.25, rallied up to a lower high at 2810.75 and then made a lower low at 2804.75 and then shot up to 2814.00, up +23 handles at 10:10 am.

After the high the ES got hit by several small sell programs, pulling the future all the way back down to 2800.25 at 12:41. Once that low was in the ES rallied a few handles up to 2805.00, made a higher low at 2801.50, rallied up to a lower high at 2804.25, then sold back off down to new lows at 2796.75 just after the MiM started to show over $600 million to buy.

The futures short covered up to 2801.25 as the MiM paired back its buys, traded 2798.50 on the 2:45 cash balance reveal, which showed $600 million to buy, then traded 2796.50 on the 3:00 cash close, and settled the day at 2797.00, up +5.75 handles, or +0.20%.

In the end, the ES was firm early in the day, and weak late in the day. In regards to the markets overall tone,, it felt like a sell the news day. In terms of the days overall trade, total volume was 1.19 million futures contracts traded, which would be high for a Monday.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.