In February I considered if bubble risk for US stocks was elevated. My conclusion: Yes, it appeared that the market was unusually frothy, based on an econometric technique that takes a stab at quantifying the ebb and flow of irrational exuberance. As a sell signal, however, the analysis has been dead wrong this year. The S&P 500 is up more than 6% since that post appeared six months ago.

The lesson: bubbles don’t always burst, at least not on a schedule that offers easy profits for market timers. To cite one of Wall Street’s ancient bits of wisdom: the market can stay irrational for longer than you can stay solvent.

One can argue that the market hasn’t been in a bubble at all and so the rally of late is the crowd’s rational reaction to repricing equities, based on an encouraging financial and economic backdrop. Looking for bubbles, by this logic, is misguided.

But that’s short-sighted. Risk management generally isn’t about instant gratification or juicing returns over a six-month period. Rather, it’s a process for the medium- and long-term, and one that’s going to look pointless at times, on par with owning insurance policies and umbrellas.

It’s clear that bubble can burst and so ignoring this risk as a general rule has consequences. But that message doesn’t sit well with recent history. How can we make sense of bubble risk in the current climate?

We can start by recognizing that bubbles are but one risk factor for evaluating the stock market’s prospects. As with any one variable for developing, managing and monitoring investment strategies, bubble risk alone isn’t the last word. In other words, context is king.

How do you develop a useful level of context? A prudent way to begin is with the mother of all known risk factors: the business cycle. If recession risk is low, as it has been this year, an elevated level of bubble risk in the stock market is less threatening than it would be if the macro trend was threatening.

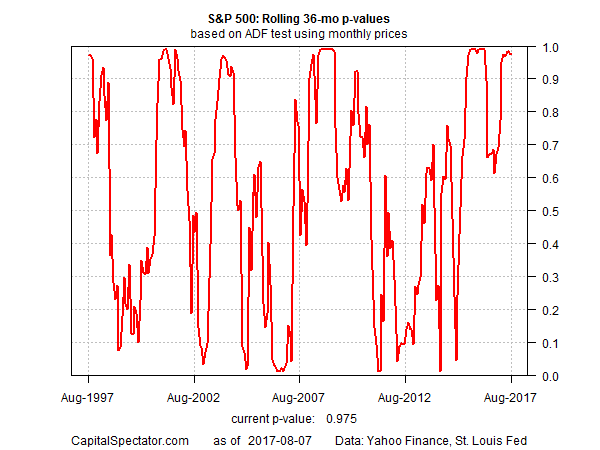

In the first quarter of 2008, for example, the econometric technique I use to estimate bubble risk was flashing red (base on the p-value via a rolling 36-month ADF Test that crunches data on the S&P 500’s average monthly prices). In the space of a few months, this indicator jumped from below 0.4 to 0.975 by March 2008 – a nosebleed level that also marks the current reading (based on S&P data as of yesterday, Aug. 7).

A critical difference between now and then: recession risk at the moment is low, based on data published to date. By contrast, the macro profile for the US was worrisome in the first quarter of 2008.

An elevated bubble-risk signal at a time when the threat of recession is also elevated poses a much bigger hazard vs. a frothy market at a time of low recession risk, which describes current conditions.

Don’t misunderstand: market corrections can strike at any time, when recession risk is low or high. But if you’re inclined to consider if stocks are vulnerable when bubble risk is elevated, the first order of business is adjusting the analysis by way of the business cycle.

By that standard, the high level of bubble risk is less worrisome because recession risk is low. That doesn’t mean that stocks are immune to the nose-bleed level of the current p-value in the chart above. But the potential for trouble generally is lower when the macro backdrop is constructive.

But that introduces another risk: complacency. The rear-view mirror has its uses, but letting it dominate your risk management strategy isn’t one of them.