Broadcom Limited (NASDAQ:AVGO) reported impressive third-quarter fiscal 2017 results. Earnings were $4.10 per share in the reported quarter, which beat the Zacks Consensus Estimate by 7 cents. The figure surged 43% from the year-ago quarter and 11.2% sequentially.

Non-GAAP revenues from continuing operations were $4.47 billion, which increased 17.5% from the year-ago quarter and 6.3% on a sequential basis. The figure was in line with management’s guidance and better than the Zacks Consensus Estimate.

The strong top-line growth was driven by robust performance by the wireless business, which is expected to continue in the fiscal fourth quarter. Higher industrial re-sales also drove revenues. Foxconn was the only direct customer that contributed more than 10% revenues in the reported quarter.

Broadcom now expects fourth-quarter revenue growth in the double-digit range on a year-over-year basis, much similar to the second and third quarter. Gross margin is expected to contract slightly due to unfavorable product mix (higher mix of low margin wireless business).

However, management adopted a cautious stance over growth from end-markets in the long haul. Broadcom operates in relatively matured end markets that are likely to reach closer to GDP rates or in the low single digits over the long term. The company believes that change in market share will not have much positive impact on top-line growth. However, technological superiority will help the company gain more content that will drive revenues.

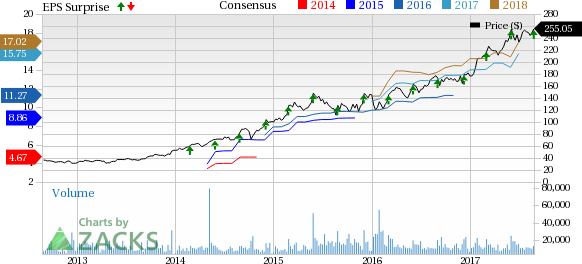

Nevertheless, Broadcom believes that the current growth rate will be difficult to sustain over the long term. Notably, the stock has returned a massive 44.3% year to date, substantially outperforming the 26.3% gain of the industry it belongs to.

Segment Revenues

Wired Infrastructure revenues (49.5% of total revenue) were $2.21 billion, up 7.1% from the year-ago quarter. Sequentially, revenues increased 4.5%, almost in line with management’s guidance.

Revenues were driven by seasonally strong demand for set-top box products as well as merchant and custom silicon products from datacenters. Strong adoption of Jericho and Tomahawk helped the company gain strong market position in the network connectivity business.

However, management witnessed softness in demand for optical and broadband access products from Chinese customers.

Wireless Communications (28.7% of total revenue) revenues were up 27.3% year over year and 11.6% quarter over quarter to $1.28 billion. The top line benefited from the rise in production volumes of the company’s large North American smartphone customer’s (Apple (NASDAQ:AAPL)) next-gen platform (iPhone). Management noted that increase in total dollar content in the upcoming platform drove revenues.

Enterprise Storage (16.5% of total revenue) revenues increased 39.5% from the year-ago quarter and 3.2% sequentially to $735 million. Revenues benefited from strong demand for the company’s Hard Disk Drive (HDD) products.

Industrial & other (5.3% of total revenue) revenues increased 17.8% year over year and 6.3% sequentially to $238 million. The increase was primarily driven by higher revenues from Intellectual Property (IP). Management noted that re-sales of its industrial products was significantly strong, which is anticipated to continue.

Operating Details

Gross margin expanded 290 basis points (bps) on a year-over-year basis and 20 bps sequentially to 63.3% owing to favorable product mix. The figure was 30 bps better than management’s guidance.

Operating expenses declined 5% year over year and 3.9% to $768 million, lower than management’s guidance of approximately $787 million.

Operating expenses, as percentage of revenues, decreased 410 bps from the year-ago quarter driven by lower research & development expenses (down 290 bps) and selling, general & administrative expenses (down 110 bps). Sequentially, operating expenses declined 180 bps.

Operating margin expanded 690 bps from the year-ago quarter and 200 bps from the previous quarter to 46.1%. The figure surpassed management’s long-term target of 45%.

Liquidity

As of Jul 30, 2017, cash & cash equivalents were $5.5 billion as compared with $4.3 billion in the previous quarter. Long-term debt was $13.6 billion at the end of the third quarter, almost unchanged from the previous quarter.

Broadcom generated cash flow from operations of $1.7 billion, up $73 million from the prior quarter. Capital expenditures were $255 million, slightly down from $256 million in the previous quarter. Free cash flow was almost $1.4 billion (31% of net revenues).

Acquisition

Broadcom continues to proceed with the acquisition of Brocade, which is anticipated to be concluded in the fourth-quarter of fiscal 2017. Most recently, the company received conditional approval in China.

Management still expects Brocade to generate approximately $1.3 billion plus in revenues and $900 million plus of EBITDA on a run rate post integration.

Guidance

For fourth-quarter fiscal 2017, Broadcom forecasts non-GAAP revenues of almost $4.8 billion (+/- $75 million). The revenue figure reflects almost 7% sequential growth.

Management anticipates Wired Infrastructure business revenues to decline sequentially due to seasonal weakness in demand for broadband access products industry wide.

Wireless Communications revenues are anticipated to grow strongly in the fourth quarter, both on a sequential and year-over-year basis. The upside is likely to be driven by higher dollar content in the company’s large North American smartphone customer’s next-gen platform.

Despite delayed shipments to this large customer, management expects first-quarter fiscal 2018 revenues to be similar to that of the current quarter.

Moreover, Broadcom expects sharp decline in demand for its HDD products, driven by the start of an anticipated correction in a hard disk drive market. This will hurt Enterprise Storage revenues in the current quarter. However, strong growth expectation in the server and storage connectivity business will fully offset this negative impact from HDDs. Enterprise Storage revenues are projected to report double-digit growth.

Management expects Industrial re-sales to continue to trend up strongly in the fourth quarter.

Gross margin is anticipated to be 63% (+/- 1%), while operating expenses are expected to be approximately $780 million.

The company expects capital expenditures to be approximately $230 million.

Zacks Rank & Key Picks

Currently, Broadcom carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader sector are Applied Optoelectronics (NASDAQ:AAOI) , NVIDIA (NASDAQ:NVDA) and FormFactor (NASDAQ:FORM) . All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings estimates for Applied Optoelectronics, NVIDIA (NVDA) and FormFactor (FORM) are pegged at 17.5%, 10.3% and 16%, respectively.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

FormFactor, Inc. (FORM): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research