The second-quarter earnings season is in its last leg, with reports from 84% or 420 S&P 500 companies (representing 86.7% in terms of market capitalization) on board, per the Earnings Preview.

In fact, the picture that has emerged so far is quite encouraging with total earnings for the above companies expanding 11.6% on a year-over-year basis. Meanwhile, the top line increased 5.6%. Also, 74.3% and 68.3% of the companies have reported better-than-expected earnings per share and revenues, respectively.

Notably, 13 of the 16 Zacks sectors have displayed growth on a year-over-year basis. In fact, the top- and bottom lines expanded 10.5% and 9%, respectively, for the entire S&P 500 fraternity.

One such sector is the highly diversified Consumer Discretionary sector. So far, 69.4% of the sector participants (in the S&P 500 space) have unveiled their numbers with 68% and 56% of them outperforming on earnings and revenues front.

In fact, the Consumer Discretionary sector has seen key players like Royal Caribbean Cruises Ltd. (NYSE:RCL) and Time Warner (NYSE:TWX) reporting better-than-expected earnings per share in the current reporting cycle.

The broad sector includes broadcasting companies as well. A significant event in the broadcasting space was the recent deal inked by Discovery Communications (NASDAQ:DISCA) to buy Scripps Networks Interactive (NASDAQ:SNI) .

On the earnings front, quite a few reports from the broadcasting space are awaited. Investors interested in the space will keenly await reports from the likes of Liberty Media Corporation (NASDAQ:FWONA) (NASDAQ:FWONK) , Tribune Media Company (NYSE:TRCO) and Townsquare Media, Inc. (NYSE:TSQ) .

According to our quantitative model, a company needs the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better – to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Liberty Media Corporation, based in Englewood, Colorado, is a well known media company which focuses on broadcasting music, sports, entertainment, comedy among other things. Its chances of beating the Zacks Consensus Estimate in Q2 are less, despite its Zacks Rank #3. This is because it has an Earnings ESP of 0.00% as the Most Accurate estimate is in line with the Zacks Consensus Estimate.

Tribune Media Company is engaged in broadcast distribution, digital properties and data businesses. The prospects of the company are bleak as far as Q2 is concerned. Tribune Media Company has an Earnings ESP of -4.65% as both the Most Accurate estimate is below the Zacks Consensus Estimate of 43 cents by 2 cents. The company carries a Zacks Rank #4 (Sell).

The unfavorable combination makes an earnings beat highly unlikely in Q2 for the company. In fact, we caution investors against sell- rated stocks (Zacks Rank#4 and 5) going into an earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

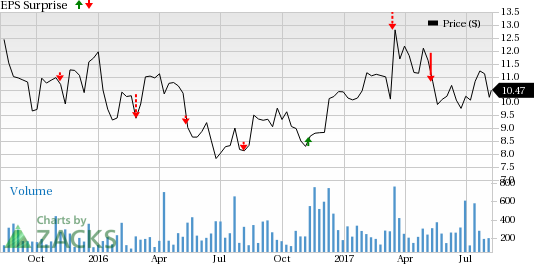

Townsquare Media is a local media and entertainment service provider. It owns and operates radio, digital and live event properties in small to mid-sized markets across the U.S. Its chances of beating the Zacks Consensus Estimate in Q2 are less, despite its Zacks Rank #2 (Buy). This is because it has an Earnings ESP of 0.00% as the Most Accurate estimate is in line with the Zacks Consensus Estimate of 21 cents.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Time Warner Inc. (TWX): Free Stock Analysis Report

Townsquare Media, Inc. (TSQ): Free Stock Analysis Report

Tribune Media Company (TRCO): Free Stock Analysis Report

Scripps Networks Interactive, Inc (SNI): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Discovery Communications, Inc. (DISCA): Free Stock Analysis Report

Liberty Media Corporation (FWONK): Free Stock Analysis Report

Original post

Zacks Investment Research