Brightcove Inc. (NASDAQ:BCOV) is slated to report second-quarter 2017 results on Jul 26 after the closing bell. Last quarter, the company posted a negative earnings surprise of 44.44%. Moreover, it has delivered negative earnings surprises in two of the trailing four quarters, resulting in an average negative earnings surprise of 81.94%.

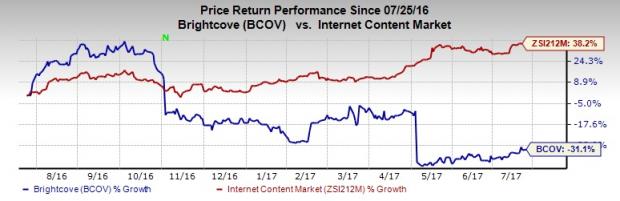

Furthermore, we note that shares of Brightcove have fallen 31.1% in the last one year, substantially underperforming the industry‘s growth of 38.2%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Brightcove is a well-known provider of cloud solutions for delivering and monetizing video across connected devices. The company exhibited strong year-over-year bookings performance in the last reported quarter, despite a significant decrease in its revenue retention rate, primarily among media customers. Back then, the company had stated that it expects this to be a headwind over the next few quarters.

However, we are optimistic that its robust product portfolio and new product enhancements will drive bookings momentum, going forward.

Notably in April, the company launched Brightcove Live – an API-driven scalable, cost-effective solution to deliver and monetize live broadcasts, events and 24/7 channels. In May, it unveiled a broad set of innovative technologies, including Context Aware Encoding and Dynamic Delivery. Management believes these newly introduced features will continue to garner more customer interest and value for media customers, while purpose-built solutions like Social, Audience and Gallery will cater to the needs of enterprises and digital marketers.

We also note that last month, TV Tokyo, one of Japan’s leading broadcast networks, selected Brightcove Live for live stream of the Liebherr 2017 World Table Tennis Championships.

For the second quarter, the company expects revenue of $37–$37.8 million, with non-GAAP loss from operations anticipated to be in the range of $4.2–$5 million. Non-GAAP net loss per share is expected to be in a range of $0.13–$0.15.

Earnings Whispers

Our proven model does not conclusively show that Brightcove is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below.

Zacks ESP: Brightcove currently has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 19 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Brightcove carries a Zacks Rank #3. Though a Zacks Rank #1, 2 or 3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions momentum.

Stocks to Consider

Here are some stocks that, as per our model, have the right combination of elements to post an earnings beat this quarter:

Cypress Semiconductor Corp. (NASDAQ:CY) has an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank Stocks here.

IPG Photonics Corp. (NASDAQ:IPGP) has an Earnings ESP of +3.07% and a Zacks Rank #1.

Lam Research Corp. (NASDAQ:LRCX) has an Earnings ESP of +1.33% and a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Brightcove Inc. (BCOV): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research