The Zacks Technology Services industry comprises companies that are engaged in manufacturing, developing and designing of an array of software support, data processing, computing hardware and communications equipment.

These include integrated powertrain technologies, advanced analytics, technology solutions and contract research services, semiconductor packaging and interconnect technologies, collaboration software, specialty printers, and data acquisition and analysis systems.

The industry includes consumer as well as business-oriented products and services. It comprises companies with diversified end-markets and customer base.

Here are the industry’s three major themes:

- The industry is continuously adopting and implementing technologies like the Internet of Things (IoT) and edge computing, cloud, artificial intelligence (AI), blockchain and biometrics, advanced data analytics and machine learning. This trend should keep increasing demand for services from the industry participants.

- The tax reform has turned out to be a boon for the industry with most of the technology companies gearing up to pour tax savings either into enhancing shareholders value or to fund mergers and acquisitions to expand into new markets and technologies. Industry participants are also gearing up to assess global operations, which include supply chain, treasury, distribution, sales and marketing and finance, to function more effectively.

- Increasing U.S. protectionism is limiting the industry’s growth prospects. Lack of skilled workers in the United States has been bothering the industry participants for quite some time. Moreover, the U.S. government’s plan to reduce the issuance of H1-B visas to foreign nationals, particularly from countries like India, is a key concern for this industry. The ongoing trade war tension between the United States and China is another major concern.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Technology Services industry, which is housed within the broader Zacks Business Services sector, currently carries a Zacks Industry Rank #100. This rank places it at the top 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term growth prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock market performance and current valuation.

Industry’s Stock Market Performance

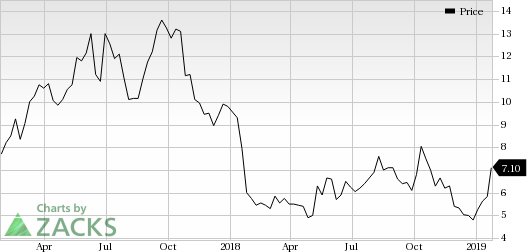

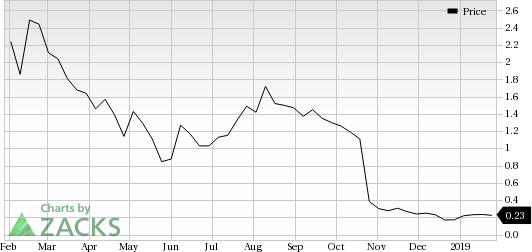

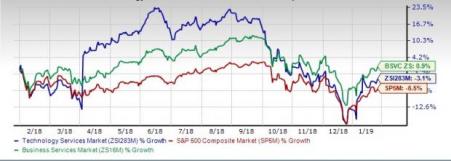

Over the past year, the performance of the Zacks Technology Services industry compared favorably with the Zacks S&P 500 composite but unfavorably with the broader sector.

While the industry and Zacks S&P 500 composite lost 3.1% and 6.5% respectively, the broader sector gained 0.9% in the said time frame.

One-Year Price Performance

Industry’s Current Valuation

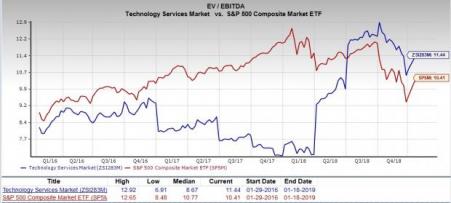

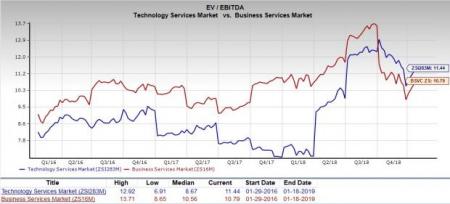

On the basis of EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization) ratio, which is commonly used for valuing technology services stocks, the industry is currently trading at 11.44X compared with the S&P 500’s 10.41X and the sector’s 10.79X.

Over the past three years, the industry has traded as high as 12.92X, as low as 6.91X and at the median of 8.67X, as the charts below show.

EV-to-EBITDA

Bottom Line

Growth opportunities from emerging technologiesand prudent investments post the tax reform are likely to offset challenges arising from U.S. protectionism and trade war related uncertainties.

Two stocks in the Zacks Technology Services universe currently hold a Zacks Rank #2 (Buy). Below, we have also mentioned one more stock from the same industry, which we believe investors should hold on to as it carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s take a look at the stocks.

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Luna Innovations Incorporated (LUNA): Get Free Report

Inspired Entertainment, Inc. (INSE): Get Free Report

AMERI Holdings, Inc. (AMRH): Get Free Report

Original post

Zacks Investment Research