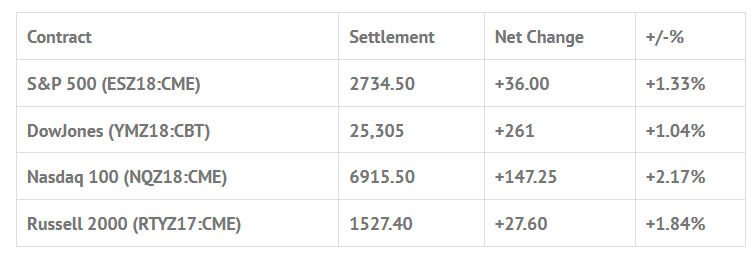

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.41%, Hang Seng +0.31%, Nikkei -0.57%

- In Europe 8 out of 13 markets are trading lower: CAC -0.48%, DAX -0.35%, FTSE -0.65%

- Fair Value: S&P +1.07, NASDAQ +10.44, Dow -6.01

- Total Volume: 2.37mil ESZ & 1,389 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes Industrial Production 9:15 AM ET, Quarterly Services Report (Advance) 10:00 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Charles Evans Speaks 11:30 AM ET, Baker-Hughes Rig Count 1:00 PM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: The Big ‘Drops & Pops’ Continue

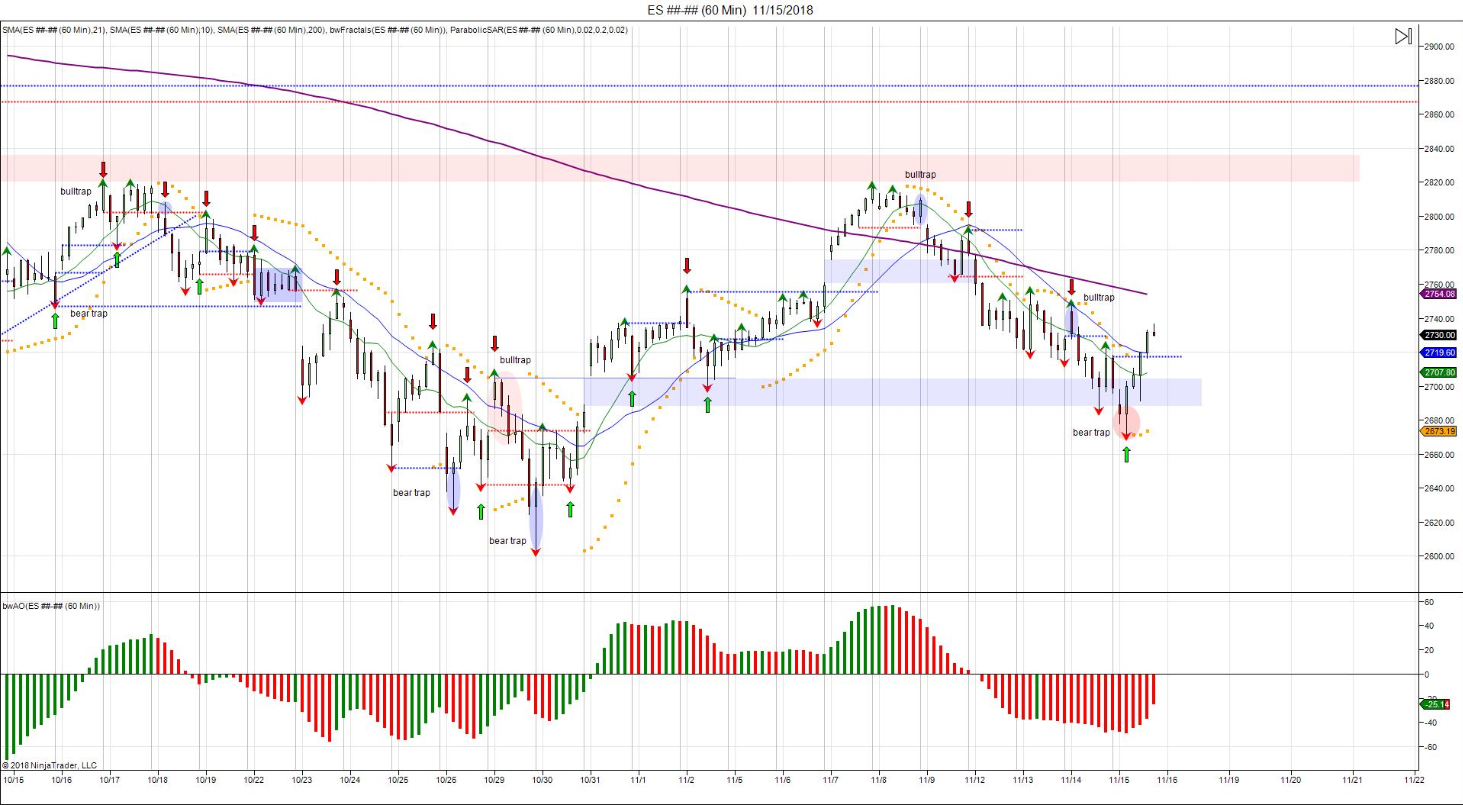

After a small rally and drop, the S&P 500 futures traded down to 2671.25 7 minutes after Thursday mornings 8:30 open. After the early low, the ES made a sequence of higher highs all the way up to 2711.75, 40.50 handles off the low. The futures proceeded to sell back off down to 2699.25, then rallied up to a lower high at 2710.00 at 11:41, and then broke 19.50 handles down to 2691.50. From there, a huge buy program came in that ran the ES up to a new high at 2726.75 after this headline hit the tape:

“US and China step up effort to strike G20 truce on trade negotiators, explore options that could lead to pact but core issues still intractable.”

After some back and fill the ES shot up to 2736.75. The next move was a series of small selloffs that pulled the futures all the way back down to 2711.50. Volume at 2:10 was just over 2 million contracts. As the final hour approached, the ES pushed back up to 2731.75, and then back to 2715.75, before chopping higher into the 2:45 MOC release, which amounted to $403 million to buy. The futures continued higher at the end of the day, printing 2731.75 on the 3:00 close, and then went on the settle the day at 2735.50, up +37.00 handles, or +1.37%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.