On Friday the Brent oil price grew due to the information that Russia is ready to decrease the volumes of the oil production in the nearest future.

The Saudi Arabia Administration assures the market that Russia will meet the Agreement before the treaty expiration in June. In addition the Foreign Minister of the Saudi Arabia Adel al-Jubeir in his interview to the Reuters agency said that the OPEC and the largest oil producers are close to the agreement upon the production limitation, but the prolongation of the agreement for another 6 months is necessary to stabilize the prices. On the other hand the growth of the USA oil rig count during the last 16 weeks made the Brent Crude Oil price consolidate above the psychological level of 50 USD per barrel.

The OPEC members’ meeting is due at May, 25, in Vienna. The great amount of the commentaries of the representatives of the largest exporters before the summit can cause the great volatility of the trade instrument. The nearest publication which can significantly affect the oil price is the USA EIA Crude Oil Stocks change data. If it reflects the growth of the resources, the oil prices will lower again.

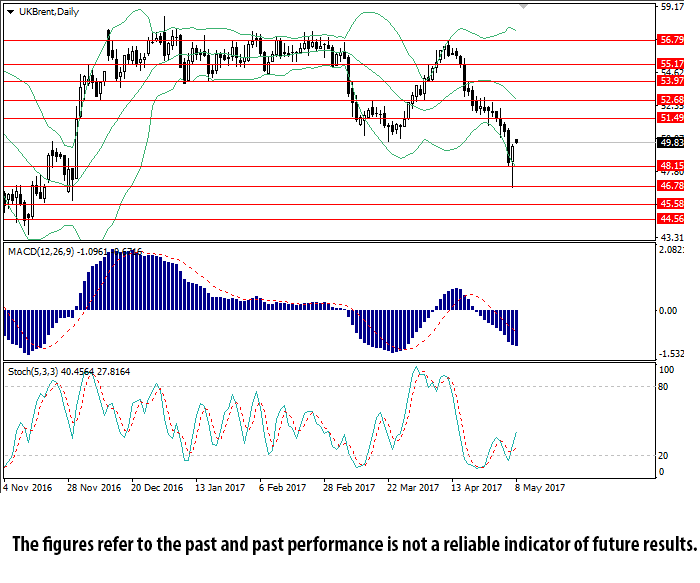

On the daily chart the price is corrected in the lower part of the Bollinger Bands. The indicator is reversing downwards, as the price range is widening, which reflects the possibility of the development of the current trend. MACD histogram is in the negative zone, keeping the sell signal. Stochastic left the oversold area and formed a buy signal.

There is no clear signal from the indicators, so it’s better to use buy stop and sell stop.

Support levels: 48.15, 46.78, 45.59, 44.56.

Resistance levels: 51.50, 52.69, 53.97, 55.17. 56.80.