I can’t feign surprise at the market getting bid up right out of the gate this morning. It’s the New World Order. Looking at some ETFs, there are a few interesting areas of strength. One, broadly speaking, is commodities, although I don’t think the potential from here is substantial. I’ve tinted what I think is a reasonable target area.

PowerShares DB Commodity Tracking (NYSE:DBC)

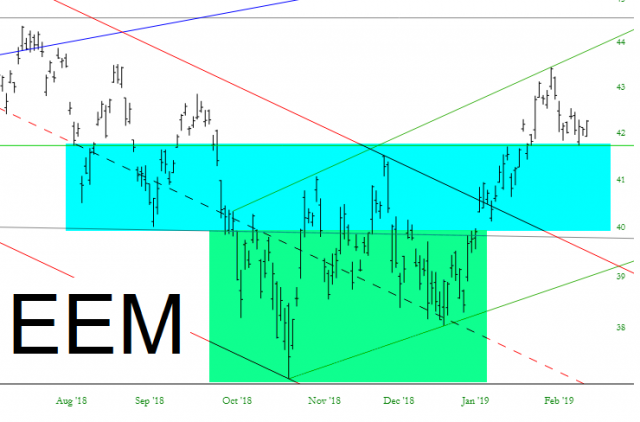

As I am typing this, the ES is down a tiny bit, and the NQ is up a tiny bit – basically a snooze-fest. The emerging markets, however, looking fairly well-formed for a bullish base. As long as we don’t re-enter that cyan area, this looks like a solid buy.

iShares MSCI Emerging Markets (NYSE:EEM)

Precious metals is particularly strong today. Ever since last August, it has been carving out higher highs and higher lows. Maybe the public’s faith in central bankers isn’t infinite, eh?

SPDR Gold Shares (NYSE:GLD)

The next challenge for precious metals, I’d say, is represented with the arrow below. Miners have had a terrific run, but we’ve come all the way back up to an important trendline. This could represent a meaningful area of repulsion for further price advance.

VanEck Vectors Gold Miners (NYSE:GDX)

As a side note, cryptos have shaken off their doldrums. Yesterday we broken above the descending green trendline, and we’re very close to crossing above the psychologically-important $4,000 level. I don’t think we’ll ever come within several light years of the $20,000 peak again, but at least the battering of cryptos seems to have abated.

VanEck Vectors Gold Miners