Markets didn‘t buy into the Fed messaging, and quite a few moves were reversed. Stocks declined, commodities were put under pressure and oil took it on the chin. Long-dated Treasuries plunged again as the dollar reversed Wednesday's losses. The overall picture is one of nervousness as the Fed's statements and its consistency are getting a second look. Plus, triple witching can exaggerate today's trade swings, getting reversed in subsequent sessions, too.

The greatest adjustment is arguably in the inflation projections – what and when is the Fed going to do before inflation raises its ugly head in earnest. There is still time, but the market is transitioning to a higher inflation environment already.

In moments of uncertainty that hasn't yet turned into sell first, ask questions later, let's remember the big picture. Plenty of fiscal support is hitting the economy, the Fed is very accommodative, and all the modern monetary theory inspired actions risk overheating the economy later this year. As I wrote yesterday:

(…) Rates are rising for the good reason of improving economy and its outlook, reflation (economic growth rising faster than inflation and inflation expectations) hasn‘t given way to all out inflation, and stocks with commodities remain in a secular bull market. We‘re in the decade of real assets outperforming paper ones, but that will become apparent only much later into the 2020s.

The largely undisturbed rise in commodities got checked yesterday just as stocks did, but the higher timeframe trends (technical and fundamental drivers) hadn't changed, which will be apparent once the dust settles. As I lay out in today's analysis, the gold market is springing back to life, the precious metals upswing rationale is still very much on the table, and the decoupling from rising nominal yields goes on. I view yesterday's selloff in the miners as partially equity markets driven.

Bottom line, I made good decisions, to subscribers' benefit, by closing profitable stock market positions before the downswing hit, and not writing off gold.

Let's move right into the charts (all courtesy of www.stockcharts.com).

Gold And Silver

Gold not following the declining TLT path is the most important green shoot within the market. The yellow metal held up very well in yesterday's selling pressure across the board, and not even gold miners (viewed through a HUI overlay or HUI:GOLD ratio) gave up on the upswing – more downside price action in the latter would have to come today to cast real doubts.

Weekly chart examination of essentially equivalent metrics (enriched with the key copper ingredient) shows clearly the precious metals decoupling stage – silver cast off the shackles still in 2020, while gold is doing so now. It's still early on in the process, but invalidating excessively bearish targets – gold has the benefit of my doubt, until I call that one off. I don't think that would happen today.

Crude Oil

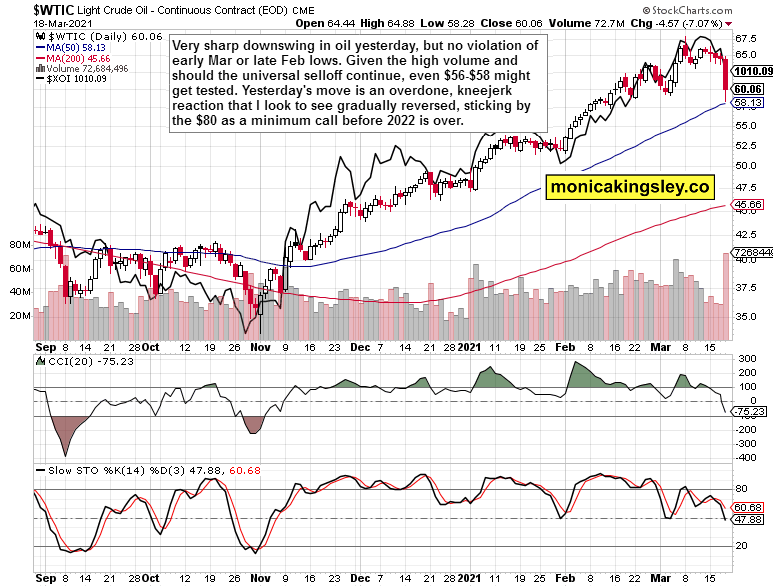

The one-way trip starting in November met its largest downswing yesterday, signifying we better get used to oil no longer moving in one direction only. Amid the reports of excess stockpiles and European lockdowns denting the demand, OPEC+ is keeping up with the production cuts, undermined largely by Iranian exports only.

But look how little has the oil index ($XOI) declined. It's relative position shows the excessive nature of yesterday's move. In my view, oil would be range-bound once it bottoms, before breaking higher again. The world economy is improving, leading indicators are rising, and the only fly in the ointment are yields, and a stronger dollar pressuring emerging markets. The forces of reflation, liquidity and demand growth will outweigh this unfolding, temporary setback.

Summary

Gold has been quite resilient lately, and yesterday's developments also outside of the bonds arena are boding well for the $1,670 bottom hypothesis – especially given the hints presented above, and that stock market weakness coupled with safe haven play attraction, might help here further.

The S&P 500 is once again experiencing a downswing, yet the VIX hasn't truly spiked – and neither has the put/call ratio. While there is no stampede to the exit door, the market internals have deteriorated, and may take more than a few sessions to get repaired. For one, tech is again in the driving seat.