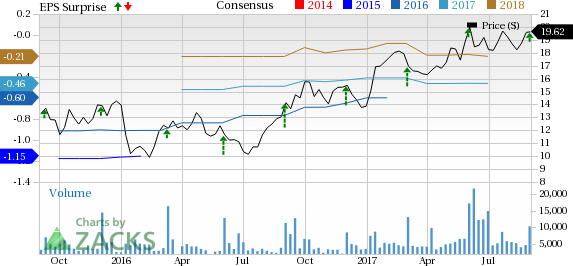

Box, Inc. (NYSE:BOX) fiscal second-quarter 2018 adjusted loss was 11 cents per share, narrower than the Zacks Consensus Estimate of a loss of 13 cents per share. Revenues came in at $122.9 million, surpassing the consensus mark of $121.6 million.

The company’s top line gained traction driven by strength across international markets including EMEA and Japan, growing add-on products and positive contribution from its strategic partnership with Microsoft Corporation (NASDAQ:MSFT) .

Box is currently working on enriching its cloud content management and AI platforms and made some notable partnership extensions in this regard during the quarter with Alphabet Inc.’s (NASDAQ:GOOGL) Google, Apple Inc. (NASDAQ:AAPL) and Microsoft.

The company launched Box Elements, a set of tools that enables businesses to incorporate Box content experience into any application developed with its platform. The company also unveiled Box Drive, an unlimited cloud drive to enable enterprises to create, find, edit and share files without using a web browser.

The company’s rich technology partner ecosystem has been a strong driving force behind its growth and we expect this to continue going forward.

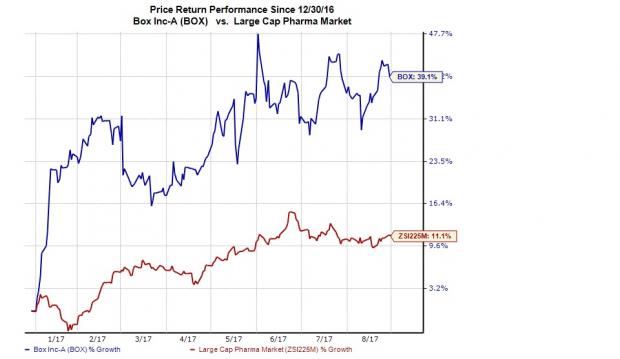

The stock has rallied 39.1% year to date, significantly outperforming its industry’s gain of 11.1%.

Numbers in detail

Revenues and Billings

Net revenue of $122.9 million was up a 28.4% on a year-over-year basis and came ahead of the guided range of $121 and $122 million.

Billings were $139.5 million, up 30.9% year over year. Deferred revenues were $240.8 million, up 31.6% year over year.

Box, Inc. Price, Consensus and EPS Surprise

Margins and Net Income

Non-GAAP gross margin was 73.3%, up 218 basis points (bps) year over year. Box’s operating expenses (general and administrative, sales and marketing, research and development) of $129.2 million increased 21.8% year over year. As a percentage of sales, all expenses decreased.

Non-GAAP net loss was $15.2 million compared with $18.1 million in the year-ago quarter. On a GAAP basis, the company recorded net loss of $39.3 million or loss of 30 cents per share compared with a net loss of $38.1 million or loss of 30 cents per share a year ago.

Balance Sheet and Cash Flow

As of Jul 31, 2017, cash and cash equivalents, and accounts receivables balance were $165.3 million and $107.9 million, respectively compared with $183.7 million and $82.8 million as of Apr 30, 2017.

Long-term debt was $40 million, flat with the previous quarter. During the quarter, cash used in operations was $9.5 million and capital expenditure was $1 million.

Outlook

For the third quarter of fiscal 2018, Box expects revenues between $128 million and $129 million. On a non-GAAP basis, the company projects loss per share in the range of 13 cents to 14 cents. GAAP loss per share is expected in the range of 33 cents to 34 cents per share.

Box is currently a Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research