Box, Inc. (NYSE:BOX) has announced changes at its management level. The cloud storage company recently appointed Stephanie Carullo, former Apple Inc. (NASDAQ:AAPL) executive, as its new chief operating officer (COO).

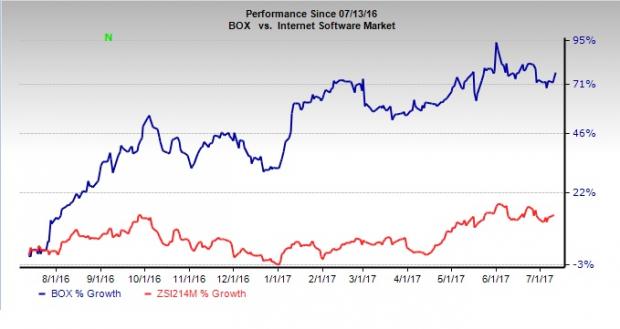

Following the news, the company’s share price increased 2.08%. Also, the stock has been steadily treading higher for the last one year. The stock has returned 77.1% compared with the Zacks Internet-Software industry's gain of 13.7%.

More Into The headlines

Stephanie Carullo will succeed Dan Levin, President and Chief Operating Officer, who has worked for seven years with the company. However, Levin will continue to remain on the company’s board.

In her illustrious 25-year career, Carullo has served in responsible positions at a number of reputable tech companies. She started her career at IBM (NYSE:IBM) and worked there for 14 years, holding a number of positions namely general management, leadership and consulting positions. A few other big companies where Carullo worked include Telstra, Cisco and Apple.

At Box, Carullo will lead and integrate the global sales, marketing, customer success and business development organizations.

Management believes that her experience in marketing, governance and leadership among other qualities, will be instrumental in helping the company achieve long-term goals.

Bottom Line

Box is a provider of a cloud content management platform. The company sells cloud-based file storage and transfer services to enterprise customers. It has a customer base that includes prominent names like General Electric (NYSE:GE) and The GAP. Box has a rich technology partner ecosystem and it rides on strong free cash flow, billings and retention rate.

The company’s first-quarter fiscal 2018 adjusted loss per share narrowed on a year-over-year basis. The top line witnessed solid growth year over year.

The company is likely to report its second-quarter fiscal 2018 results on Aug 30.

Zacks Rank & Stocks to Consider

Currently, Box has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector are Alibaba Group Holding Limited (NYSE:BABA) and PetMed Express, Inc. (NASDAQ:PETS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alibaba Group Holding Limited delivered a positive earnings surprise of 20.53%, on average, in the trailing four quarters.

PetMed Express delivered a positive earnings surprise of 9.32%, on average, in the trailing four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research