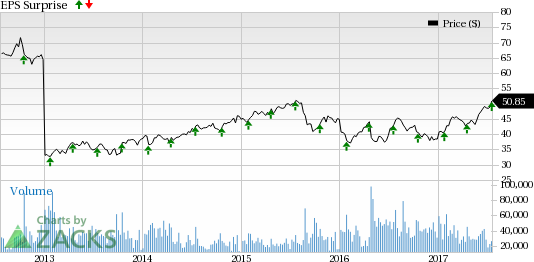

Boston Scientific Corporation (NYSE:BSX) is scheduled to report second-quarter 2017 results before the opening bell on Jul 27. Last quarter, the company’s earnings missed the Zacks Consensus Estimate by 3.3%. However, it posted an average beat of 0.03% in the trailing four quarters. Let’s see how things are shaping up prior to this announcement.

Factors at Play

Ahead of Boston Scientific’s earnings release, we believe, the quarter’s performance will be grossly impacted by the company’s product recall issue within Europe. Notably, earlier this year, the news surfaced that Boston Scientific is recalling one of its prime products, the Lotus range of heart devices from Europe because of device malfunctions.

The company also delayed the submission of its U.S. marketing application for its Lotus Edge device. While ‘LOTUS remediation work’ is currently on track, this product line has little hope to return to the European and other markets before the fourth quarter. This may lead to a major setback for the company’s fast-growing transcatheter aortic valve replacement (TAVR) business within interventional cardiology, which has high chances to severely weigh on the company’s second-quarter revenue results.

This apart, the severe currency headwinds that Boston Scientific has been facing lately remain a concern. We note that as the company records 47% of its sales from international markets, it remains highly exposed to currency fluctuations. In 2017, Boston Scientific expects an unfavorable foreign exchange headwind to the tune of $125 million on revenues and 700 bps or 8 cents per share on earnings. Adjusted gross margin for the full year assumes a negative foreign exchange impact of 50 bps.

From a positive angle, the company’s downbeat interventional cardiology business may get some sort of a boost with the company’s $435-million acquisition of Switzerland-based Symetis SA, a privately-held structural heart company.

With the completion of the acquisition back in May, Boston Scientific should have already begun selling these valve systems in Europe and in other geographies outside the U.S. The company believes that Symetis’ ACURATE group of valve products strongly complements its aortic valve platform.

Integrating these technologies will not only diversify Boston Scientific’s structural heart portfolio but also provide cardiac surgeons with multiple TAVI offerings for varying patient pathologies and anatomy. We expect to see contribution from this development in the second-quarter revenue itself.

Subsegments namely MedSurg is expected to demonstrate a consistent performance, led by endoscopy, while Urology and Women’s Health are also estimated to grow beyond market levels, driven by investment strategies in key international geographies.

As stated earlier, the company’s overall second-quarter 2017 adjusted earnings are expected in the band of 30–32 cents per share on revenues of $2.19–$2.22 billion. The Zacks Consensus Estimate for EPS stands at 31 cents, while for revenues it is $2.21 billion.

Earnings Whispers

Our proven model does not conclusively show that Boston Scientific is likely to beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: Boston Scientific’s Earnings ESP is 0.00% since both the Most Accurate estimate and the Zacks Consensus Estimate stand at 31 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Boston Scientific currently has a Zacks Rank #4 (Sell). Please note that we caution against Sell-rated stocks (#4 or 5) from going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are three better-ranked companies you may want to consider, as our proven model shows that they have the right combination of elements to post an earnings beat this quarter:

Thermo Fisher Scientific Inc. (NYSE:TMO) has an Earnings ESP of +0.44% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dextera Surgical Inc. (NASDAQ:DXTR) has an Earnings ESP of +9.09% and a Zacks Rank #2.

Telefex Inc. (NYSE:TFX) has an Earnings ESP of +1.06% and a Zacks Rank #2.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Teleflex Incorporated (TFX): Free Stock Analysis Report

Dextera Surgical Inc. (DXTR): Free Stock Analysis Report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Original post

Zacks Investment Research