Earlier today, I saw in the comments section someone mentioned they were going to “BTFD” and that doing so for month after month was “boring”. Well, yeah, they were right (again), because the market…….for absolutely no reason at all………..chugged higher. I’m not feeling that grouchy about it since I’m so focused on energy shorts, and those took most of the sting out.

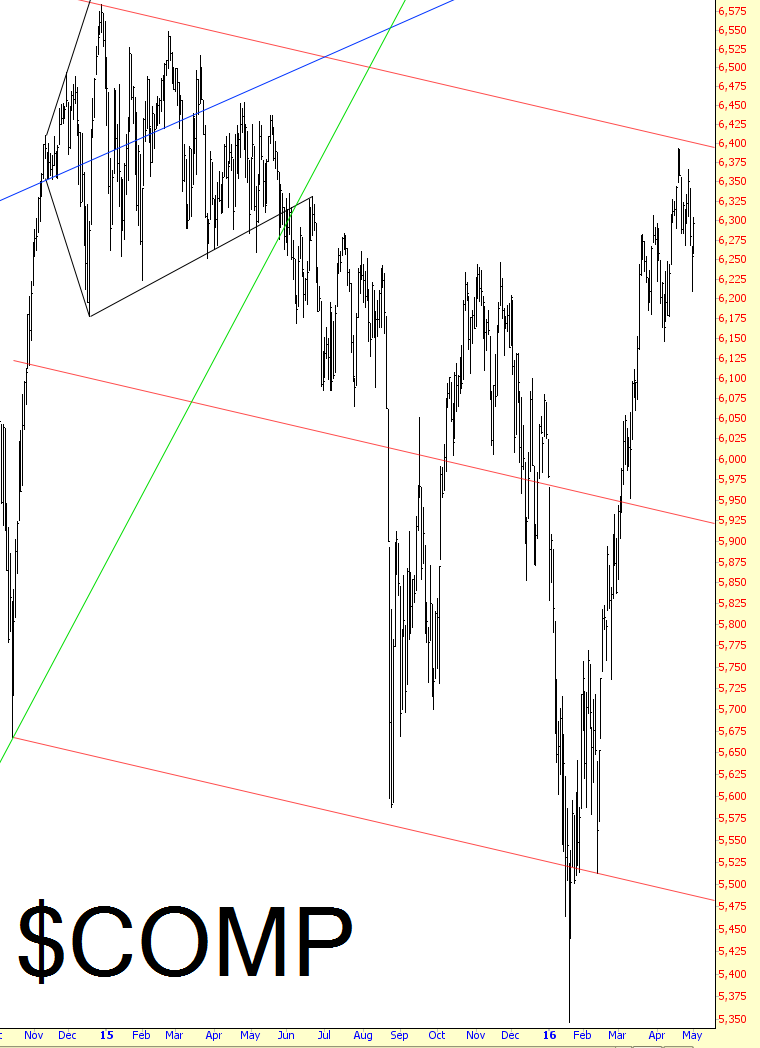

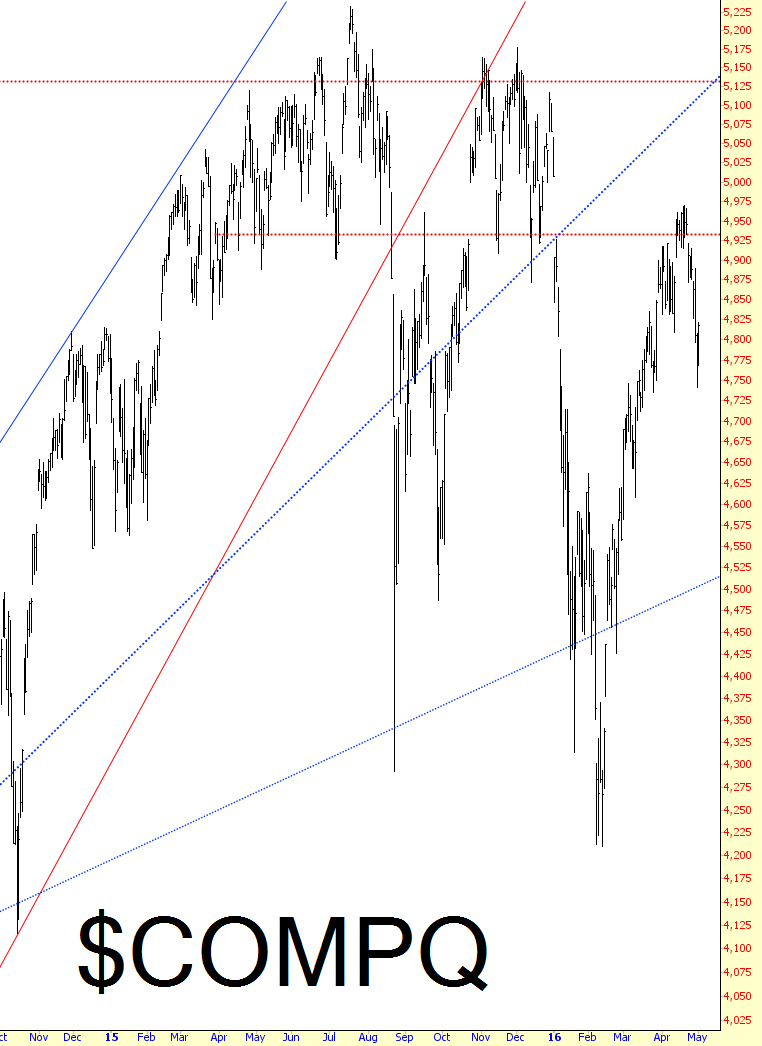

All the same, I think the kind of over-the-top arrogance which leads one to believe that they, in perpetuity, can simply buy any dip and profit later is yet another sign that the market is, shall we say, priced for perfection. I’m going to keep the words to a minimum and ask you to drink in these broad index charts and try to convince yourself that they are screaming “buy.” Here’s the Dow Jones Composite:

And, even more vulnerable, the NASDAQ Composite (side note: do you realize Apple (NASDAQ:AAPL) has already lost 30% of its value the past year?)

Then there are the small caps, as viewed via the Russell 2000:

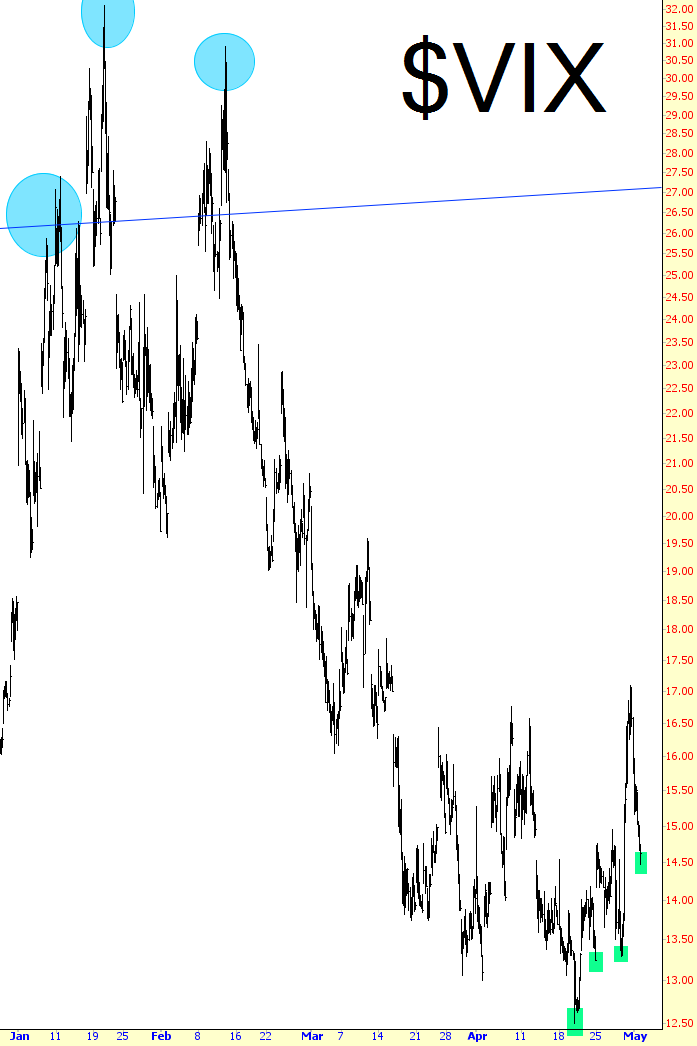

On an intraday basis, you can see how volatility has been beaten to death for the past four months. It seems almost like science fiction to think that the almost prepubescent VIX was in the 30s not long ago. Take a look at the green tints, however. To me, it looks like a new uptrend is in the offing.

Also, on an intraday basis, don’t dismiss the ES broken trendline I pointed out (with some derision) last week.

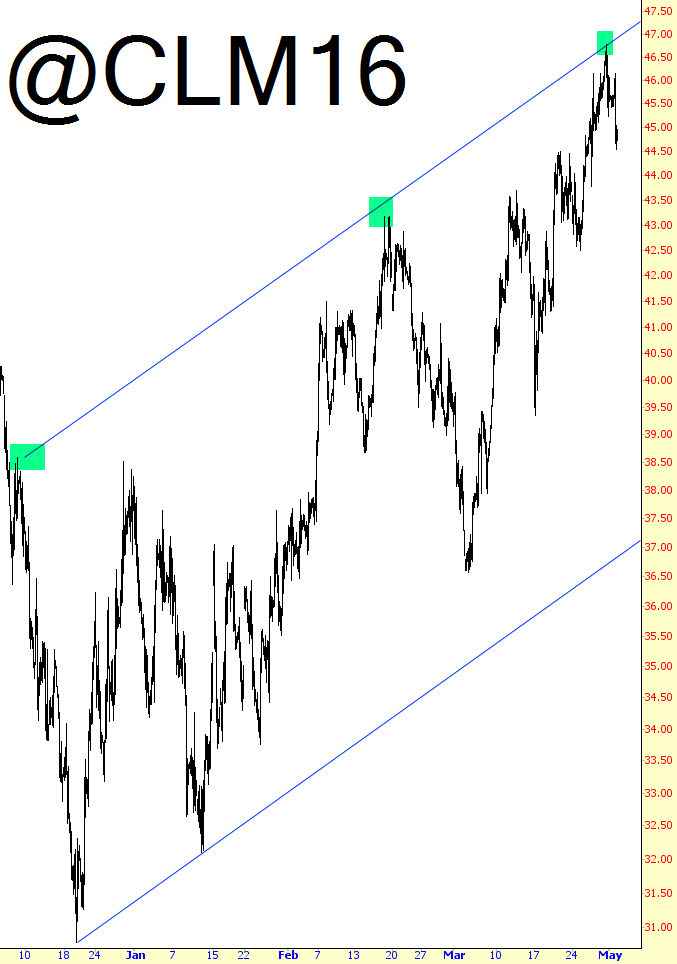

And, for me, by far the most important, crude oil seems to be at the upper end of its own channel.

You don’t seem me trot out anything sports-related here, but I think the video below is fitting, since it illustrates many examples of premature celebration, only to find that their opponents, who decided not to give up, wound up winning in the end.