Investing.com’s stocks of the week

Fed Does Not Have A Singular Mandate

Given the big miss on the job creation side of Friday’s monthly employment report, it may appear to be easy for the Fed to continue to put off a hike in interest rates. However, the Fed has two primary mandates; full employment and keeping inflation in check. From the Federal Reserve Bank of Chicago’s website:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.

Inflation: Glass Half Full

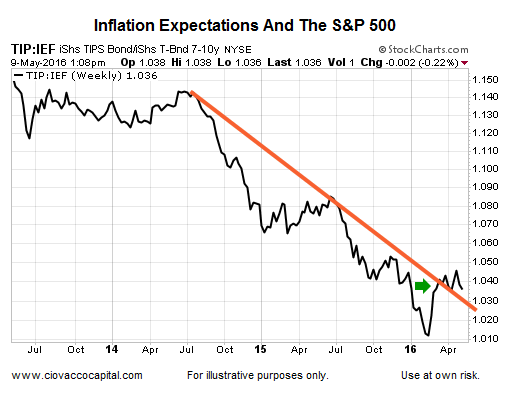

The ratio of Treasury inflation-protected securities (TIP) vs. intermediate-term treasuries (IEF) can be used to monitor inflation expectations. If we use a weekly chart that plots closing prices, you can make an argument that a bullish breakout recently occurred in inflation expectations (see green arrow).

Inflation, Stocks, Bonds, and Commodities

This week’s stock market video examines current inflation expectations in the context of market history/performance of stocks (SPY), bonds (IEF) and commodities (DBC). From The Wall Street Journal:

With the global economy so sluggish, can bond investors rest easy about inflation? Not necessarily. Excluding energy prices, inflation might not be as tame as many think it is.

Inflation: Glass Half Empty

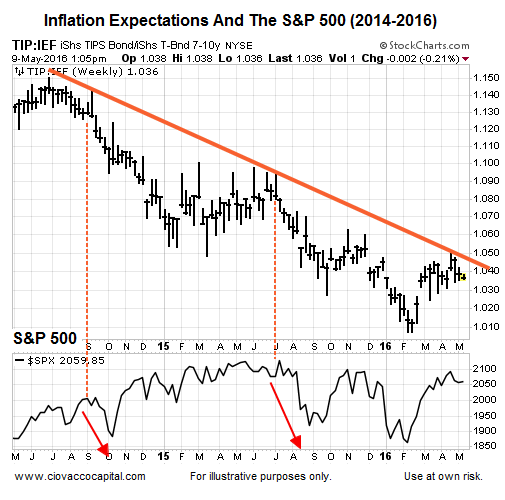

If we use high-low-close bars on the same weekly TIP vs. IEF chart, an argument can be made that we have seen a normal countertrend rally in inflation expectations within the context of an ongoing downtrend. Notice the recent relationship between inflation expectations and the S&P 500 (bottom of chart). We should learn something about the relative attractiveness of stocks, bonds and commodities based on how inflation expectations evolve over the coming weeks.

Yellen Focused On Wages

If a worker gets a raise, they have more money coming in each month. Therefore, they have more money to spend in the real economy. Thus, inflation expectations, closely watched by the Fed, tend to rise when wages start to rise. From Bloomberg:

Three of the world’s most influential bond investors (Gross, El-Erian, and Kiesel) say the Federal Reserve is still on course to raise interest rates this year…Gross and his peers are warning investors not to count out the Fed after the Labor Department reported U.S. employers added 160,000 workers last month, short of the 200,000 positions projected in a Bloomberg survey of economists. Fed Chair Janet Yellen is also examining earnings, which rose 2.5 percent from a year earlier, more than forecast. Two-year note yields, according to Gross, are too low. “I’m not so sure that June is out,” said Gross, formerly of Pimco and who now runs the Janus Global Unconstrained Bond Fund, speaking on Bloomberg Television May 6. “Yellen, more than jobs, is focused on wages. At 2.5 percent, they’re moving up.”

Economic Data Will Play A Role

If economic and earnings data continue to weaken, it is possible the Fed remains on hold for the remainder of 2016. Under that scenario, bonds (TLT) may be the asset class of choice. The market will be watching Friday’s Producer Price Index release closely for the latest read on inflation.