In a series of recent articles (here, here and here) I wrote about seasonality in the bond market. In this piece we will look at a “practical application”.

The Caveats

*Everything that I write here should be considered “food for thought” and NOT “an immediate call to action.”*Trading a leveraged fund has inherent risks that an investor should carefully consider BEFORE entering a position.

The Strategy

This strategy uses funds available at Profunds, as follows:

*FYAIX (Access Flex High Yield) – High yield bonds

*GVPIX (U.S. Government Plus – 20+ year treasuries leveraged 1.25 to 1)

*MPIXX – Government Money Market fund

The Baseline

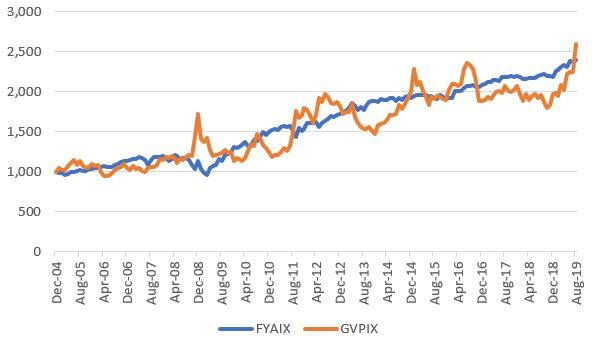

Figure 1 – Growth of $1,000 invested in High Yield Bonds (FYAIX; blue) and Long-Term Treasuries (GVPIX – orange); 12/31/2004-8/31/2019*$1,000 in FYAIX grew to $2,398*$1,000 in GVPIX grew to $2,600

Jay’s Profunds Bond Calendar

Now let’s use the following calendar

Results

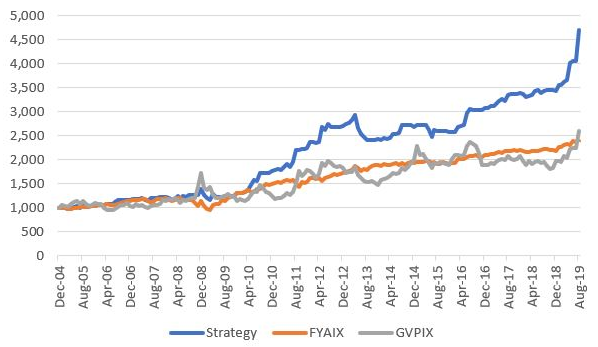

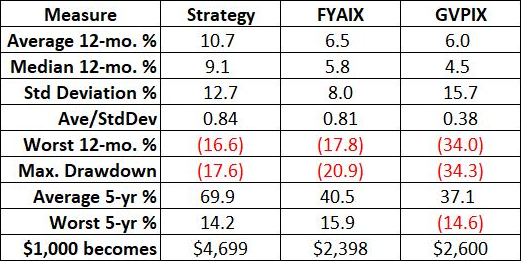

Using Jay's calendar (blue) Vs. Buy And HoldJay’s Profunds Bond Calendar System versus buy-and-holdKey things to note is that the Calendar System:*Generated significantly more return*Had a lower drawdown*Generated more consistent returns

Summary

Is this anyway to trade the bond market?

Well it’s one way.