In our last post about a week ago we noted the slow pace of economic growth that has unfolded since the financial crisis. This slow pace of growth has resulted in the unprecedented easing programs (quantitative easing-QE) instituted by the Federal Reserve over the past few years. A consequence of these QE programs is the apparent inability of the Fed to embark on a monetary tightening path since the markets seem addicted to these programs. In our view, given the low level of rates today, an initial tightening by the Fed will not have a long lasting negative impact on the overall economy or equity market. With this said, market participants were looking for insight into the Fed's future monetary direction with the release of the Fed's most recent meeting minutes. As was true to form, the Fed seems intent on maintaining its near zero interest policy with a June rate hike most likely pushed back to later in 2015 or maybe 2016. This delay in raising rates may give the market a reason to push bond prices higher (interest rates lower) near term.

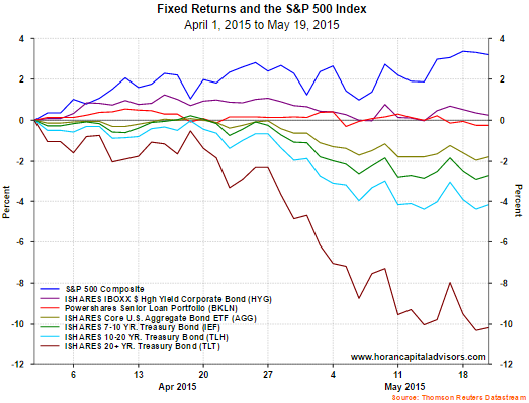

Leading up to the release of the April minutes, the bond market positioned itself for a potential rate hike in June. As the below chart shows, from the beginning of April through the market close on May 19th, treasury bond ETFs sold off significantly. The aggregate bond index was also a weak performer and traded down nearly 2%. Stocks (S&P 500 Index) on the other hand have generated a positive 3.2% return since April 1st.

|

| From Blog of HORAN Capital Advisors 5 2015 |

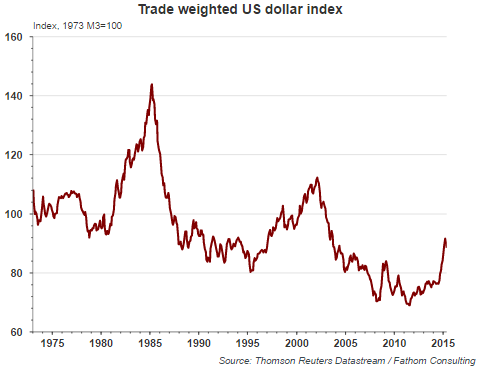

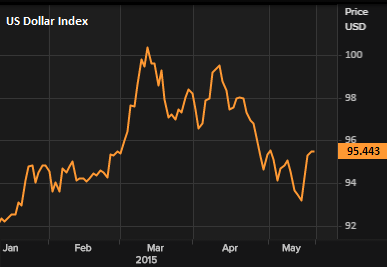

The Fed minutes noted the recently mixed economic data as a probable reason why the Fed is likely not inclined to increase interest rates in June. Additionally, noted in the minutes was the negative impact a strengthening US dollar is having on U.S. economic activity.

|

| From Blog of HORAN Capital Advisors 5 2015 |

|

| From Blog of HORAN Capital Advisors 5 2015 |

The stronger Dollar has a negative impact on U.S. exports as U.S goods become more expensive outside the U.S. as the Dollar does strengthen. Also noted in the minutes was the counter impact of the improving economic growth picture in a number of countries outside the U.S. The stronger growth, ex-U.S., could be attractive to U.S domiciled firms as their products may be in greater demand. The stronger Dollar is acting as a tightening influence and may actually be doing some of the Fed's tightening work; however, the Fed does need to get rates back to a more normalized level sooner versus later.