I was updating some of my bond strategy charts this morning and one that caught my eye that I thought would be timely and interesting to share is the seasonality charts. No, not the "sell in May" stock market charts, but the much lesser known bond market seasonality charts. Indeed, you might be surprised to see the first chart which shows the impending potential breakout in 10-year bond yields getting a seasonal boost.

The main points on bond yield seasonality are:

-The US 10-year government bond yield has a seasonal tendency to rise in the first ~5 months of the year.

-Albeit it tends to track downwards from June through November, which interestingly is similar to the seasonal effects you see in the stock market.

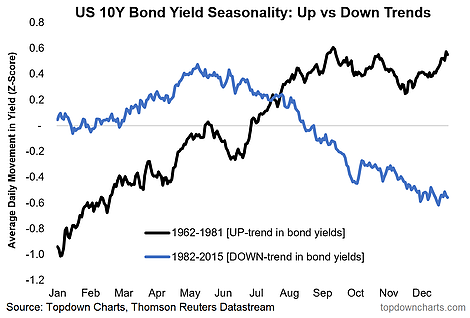

-The seasonal tendency for bond yields to rise is more prolonged (until around September) in an environment where bond yields are rising.

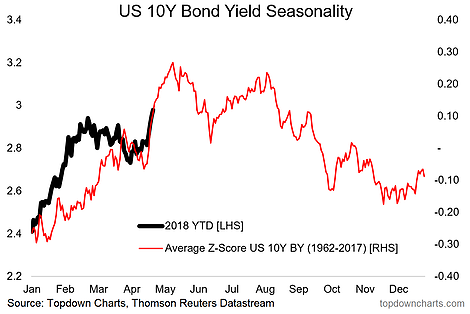

1. US 10-Year Bond Yield YTD vs Historical Seasonal Pattern: Seasonal influences impact a variety of markets and economic data trends, and wouldn't you know it, it also seems to be a thing in the bond market too. The chart below shows in the red line the average movement in bond yield across the year (it is shown as a z-score, because I used z-score to measure the pattern in change by business day across each individual year because basis point or percent change become problematic when you transition from double digit yields to low single digit yields).

The bottom line is that the red line shows you the historical average *pattern* in bond yields from 1962 through 2017. The second bottom line is that Year To Date the US 10-year government bond yield is trading remarkably closely to its historical seasonal tendency. Given the broader macro argument for higher yields and the reset in sentiment, this seasonal quirk has turned out to come at an opportune time...

2. US-10 Year Yield Seasonality in a Secular Up trend vs Down trend: The second chart in today's brief shows the seasonal tendencies in an up-trending yield environment vs in a down-trending yield environment. Interestingly, in both regimes the 10-year bond yield has a tendency to rise in the first ~5 months of the year. Also worth highlighting is that the tendency is for yields to continue to press higher until around September in an up-trending environment (and depending who you ask we may well be in precisely that situation now).