As the UK100 (FTSE 100) approaches the record highs that were hit back in the middle of January, there are signs that the rally is starting to run out of steam which may suggest that the gains – which have been largely built on the pounds weakness and commodity rally – may have reached a near term peak.

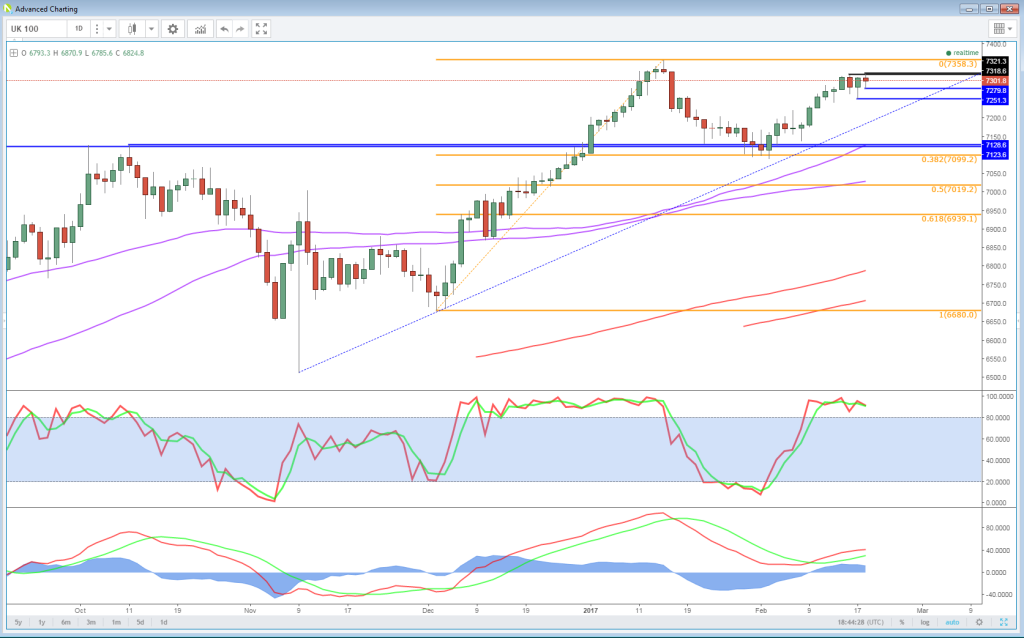

The rally itself over the course of the last few weeks has been very gradual in nature, as has been the case in equity markets elsewhere, but as we once again move above 7,300, the momentum indicators at the bottom of the chart are throwing up red flags.

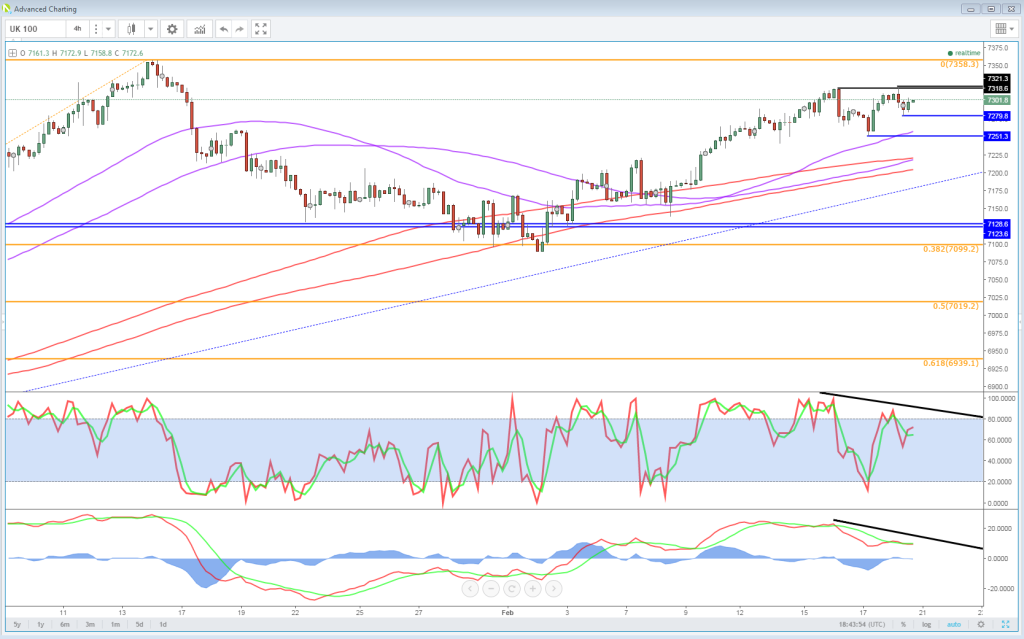

This isn’t quite as clear on the daily chart, although there has been a clear drop in the moving averages on the MACD despite the index trading only just below the January highs. The drop off in momentum though is much clearer on the 4-hour chart and is actually more focused on the near term action as we’ve approached those January levels.

Having hit a new high earlier in today’s session (just), the UK100 once again pulled back and the MACD, both the histogram and MAs, and the stochastic displayed clear negative divergence with price. The fact that this happened as we also near the previously mentioned all-time high gives further possible reason to why this happened.

The result is that we may be seeing the index failing to make a new record high from a longer term perspective and the short term rally running out of legs. This brings two important levels into consideration. To the upside, 7,318-7,321 in an important resistance and if the rally is going to be sustained into those record highs, the momentum indicators may need to confirm what’s happening on the chart.

To the downside, 7,250 marks the possible neckline of a double top on the 4-hour chart, a break of which would be quite bearish and, based on the size of the formation, could trigger a move back towards the 7,180 region.