Snap Inc. ( (NYSE:SNAP) ) just released its first-quarter 2017 financial results, posting a loss of $2.31 per share and revenues of $149.6 million.

Currently, SNAP is a Zacks Rank #3 (Hold), but this ranking could change based on today’s results. The stock was down 19.97% to $18.39 per share in after-hours trading shortly after its earnings report was released.

Snap:

Beat earnings estimates. The company posted earnings of -$2.31 per share, beating Street estimates of -$2.33.

Beat revenue estimates. The company saw revenue figures of $149.65 million, beating our consensus estimate of $146.42 million.

Quarterly revenue of $149.648 million was up 286% year-over-year. Daily active users grew 36% to 166 million. DAUs were also up 5% quarter-over-quarter. Average revenue per user grew 181% to $0.90.

Snap Inc. spent about $805.9 million on research and development this quarter. Total costs and expenses totaled nearly $2.36 billion.

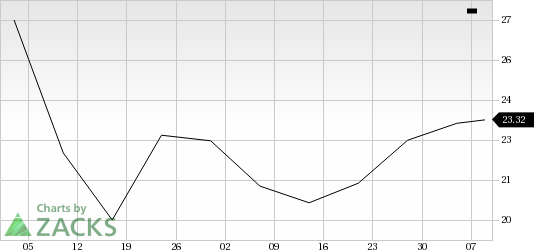

Here’s a graph that looks at Snap’s price movement since its IPO:

Snap Inc. provides technology and social media services. The Company's principal product Snapchat, is a camera application that helps people to communicate through short videos and images. Snap Inc. is headquartered in Venice, California.

Check back later for our full analysis on SNAP’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade, which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Snap Inc. (SNAP): Free Stock Analysis Report

Original post

Zacks Investment Research