Shareholders of Boeing (NYSE:BA) have seen the stock reach some incredible heights in recent years. The stock has increased nearly 170% over the last five years, easily beating the 46% return of the S&P 500. Shares touched as high as $446 on 3/1/2019. Since then, the stock is down nearly 17% while the S&P 500 has increased in value by 5%.

Boeing stock has been quite volatile in the past few months as two 737 MAX aircraft have crashed, causing governments around the world to ground the airplane. The 737 MAX contributes a significant amount of revenue to the company, which will impact results for a period of time.

For this reason, we believe that this Dow Stock remains a hold for the time being.

Recent News

On October 29th, 2018, Lion Air Flight 610 crashed shortly after takeoff. A few months later, Ethiopian Airlines Flight 302 crashed on March 10th, 2019. The two plane crashes collectively killed 346 people.

Ethiopian Airlines grounded its fleet of 737 MAX aircraft the next day. That same day, China grounded the plane, making it the first government body to do so. Other governments around the world did the same, with the U.S. following suit on March 13th. All 737 MAXs remain grounded.

The likely culprit was the 737 MAX’s Maneuvering Characteristics Augmentation System, or MCAS. In both cases, the MCAS was suspected of responding to flawed data and sending the airplane into a dive shortly after takeoff.

Boeing has suspended deliveries of 737 MAX, though the company has continued production of the aircraft. Prior to the grounding, Boeing had more than 4,600 unfilled orders for the 737 MAX. However, multiple airlines around the world began canceling orders. Net orders through the end of May totaled a minus 125. The company also reduced production of the 737 MAX from 52 per month to 42.

After initially thought to begin flying again this summer, the 737 MAX could remain grounded through the end of 2019.

Boeing delivered just 30 aircraft to customers in the month of May, a decline of 56% from the previous year.

It was also revealed earlier in June that the FAA had found a new and separate issue involving the 737 MAX. The FAA believes that more than 300 of these aircraft as well as the previous generation of 737s could contain improperly manufactured parts that will need to be replaced.

Recent Financial Results

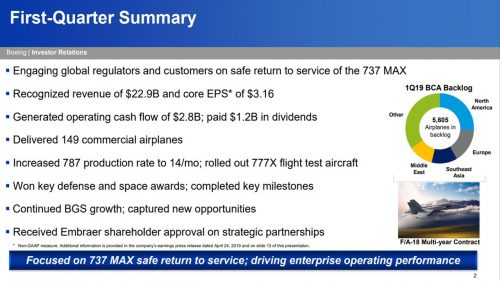

The issues with the 737 MAXs are already having an impact on Boeing’s business. The company released first quarter results on 4/24/2019.

The company earned $3.16 per share, $0.03 below estimates and a 13.1% decline from the previous year. Revenue declined 2% year-over-year to $22.9 billion. This was $130 million lower than analysts had expected.

Total commercial airplane delivers fell 19% to 149 during the first quarter. In addition, operating margins for Boeing Commercial Airplane segment fell 100 bps to 9.9% as the pause in 737 deliveries weighed on results.

The company did have pockets of growth. It has increased its 787 production to 14 planes in March and the first 777X flight test airplane has been produced. Boeing ended the first quarter with a backlog of more than 5,600 airplanes. The total value of the backlog is $400 billion.

And even after some cancellations, the company has a backlog of 4,500 737 MAX aircraft. Using the reduced production rate of 42 aircraft per month, Boeing has almost nine years of production in its backlog.

Sales for the Defense division improved 2% while operating margins increased 110 bps. Higher volumes for weapons, satellites and surveillance aircraft were the main contributors to growth in the quarter. Boeing also delivered its first seven KC-46 Tankers to the U.S. Air Force. This program had been several years behind schedule so this is a positive development.

The Global Services segment grew 17% because of higher volumes across its business. These services are mostly aftermarket services, which is a high margin business. At 14.1%, operating margins for Global Services was the highest among Boeing’s three segments, though this was a 210 bps decline from the prior year. Product mix and less favorable performance were the reasons for the drop.

Outside of the 737 MAX, Boeing had a decent quarter. The issue that should give investors pause is that the company has pulled its guidance for 2019. Boeing had expected to earn $20 per share this year, but there remains too much uncertainty surrounding the 737 MAX for the company to offer guidance. The company also suspended its share repurchases.

Because of this, we have lowered our estimate for earnings-per-share for the year to $16 from $20 to reflect the impact of the 737 MAX on results. We have also decreased our expected earnings-per-share growth through 2024 to 8% from 12% as we are more comfortable with a lower rate until issues with the 737 MAX are resolved.

Dividend Analysis

Boeing has increased its dividend for the past eight years. Though this prevents the company from qualifying for a dividend growth database like the Dividend Aristocrats, Boeing has increased its dividend by an average rate of nearly 19% over the last five years.

Shares of Boeing yield 2.2% at the moment, slightly higher than the average yield of the S&P 500.

Importantly for income investors, Boeing’s dividend appears to very well protected from a dividend cut.

As stated above, Boeing earned $3.16 per share in the first quarter and paid a quarterly dividend of $2.06 per share. This equates a payout ratio of 65% for the first quarter.

Looking out over a longer time horizon, the dividend appears to be in even better position. Boeing generated $16.01 of adjusted earnings-per-share last year while paying out $6.84 in dividends during the same time period. This resulted in a dividend payout ratio of 43% for 2018.

Boeing generated $2.8 billion of cash flow from operating activities in the first quarter of this year and spent $500 million on capital expenditures during the same time period for free cash flow of approximately $2.3 billion. The company distributed $1.16 billion of common share dividends during the same time period for a free cash flow dividend payout ratio of 50%.

Looking out over a longer time horizon, the company’s dividend appears to be even safer. Boeing generated $15 billion of cash flow from operating activities over the last twelve months and spent $1.8 billion on capital expenditures for free cash flow of $13.2 billion. The company distributed $4.1 billion of common share dividends during the same time period for a free cash flow dividend payout ratio of 31%.

Using either earnings or free cash flow, Boeing’s dividend appears to be very safe.

Expected Returns

In addition to earnings growth and dividend yield, Sure Dividend also factors in changes in valuation to help determine total expected returns.

Shares of Boeing closed 6/21/2019 at almost $372. Using our expected earnings-per-share of $16 for the year, the stock has a current price-to-earnings, or P/E, ratio of 23.3. Our 2024 target P/E is 18, which is slightly above the stock’s decade average valuation of 17x earnings.

If the stock reverts to our target multiple by 2024, then valuation could be a 5% headwind to annual returns.

Annual returns would consist of the following:

- 8% earnings growth.

- 2.2% dividend yield.

- 5% multiple reversion.

Added up and Boeing is expected to return just 5.2% annually over the next five years.

Final Thoughts

The grounding and pausing of deliveries of the 737 MAX has already made a material impact on Boeing’s business. Deliveries are down and the company has already seen some cancelations from customers. Even as other segments of the business have performed well, Boeing’s future appears cloudy until the 737 MAX is once again flying.

Only stocks with the potential for at least 10% annual returns through 2024 are rated as a buy by Sure Dividend. Given the mid-single digit return potential, Boeing receives a hold recommendation at this time.

Original Post