The Boeing Company (NYSE:BA) , a global leader in the commercial aircraft space, recently released its annual China Current Market Outlook (CMO), reflecting a 6.3% increase in total demand for new commercial jets in the country, over the next 20 years. The fresh outlook once again positions China to become the world’s largest market for aircraft, leaving behind the United States by 2024, per the International Air Transport Association.

Details of the New Forecast

Per the latest outlook, China will require 7,240 new planes between 2017 and 2036; compared to the previous year's projected demand of 6,810 jets, worth $1.03 trillion, for the 2016-2035 period. This time, the Chinese commercial airplane market is expected to reach a value worth $1.1 trillion, up 6.8% from the prior-year market value.

In terms of demand mix, Boeing continues to expect single-aisle jets to be the biggest demand driver in the country, comprising 75% of the total projection. This translates into demand for 5,420 single-aisle jets, worth $570billion, in the next 20 years. When compared with the prior-year numbers, these reflect an increase of 6.1% in demand for single-aisle jets and 6.5% improvement in terms of their value.

Among other aircraft categories, Boeing estimates demand for all wide-body planes (comprising small, medium or large) over the 2017-2036 period to be 1,490 and total value for those is expected to be $450 billion. This figure demonstrates the shift in demand from the large aircraft to efficient small and medium wide-body airplanes for long-haul expansion and flexibility. Meanwhile, regional jets will continue to account for $10 billion.

What’s Driving the Demand?

Randy Tinseth, Vice President of Marketing, Boeing Commercial Airplanes, has identified factors like consistent growth in the Chinese economy, significant investment made in infrastructure and evolving airline business models as the primary driving forces behind the rising demand for commercial airplanes in the nation. Growth in purchasing power of the middle-class Chinese society has also been boosting the market, with air tickets becoming affordable.

With respect to demand for single-aisle jets, which constitute the bulk for commercial jetliners, full-service airlines and low-cost carriers have been the primary reason behind new single-aisle airplanes rising demand and increasing new point-to-point services. This in turn is boosting both leisure and business travel demand in China and throughout Asia.

Focus on Boeing

Boeing released its global 20-year market outlook this June, wherein, the company revealed its estimate for commercial fleet to be fueled by 4.7% annual growth in commercial passenger traffic. Of the total commercial demand, 39% is expected to come from Asian markets. Notably, the bulk amount of this 39% will be from China.

In fact, with expectations to witness an above-average growth in China's fleet size going ahead, almost 20% of global new airplane demand, is estimated to come from the nation.Moreover, China's outbound travel market is estimated to reach 200 million passengers annually, in the near term.

Considering this and the fact that the single-aisle jets will be the major growth driver, it is imperative to mention that Boeing’s new 737 MAX 8 remains at the centre of the single-aisle market and has been in high demand in China. Boeing forecasts the demand for the fleet of this wide-body jet over the next 20 years to be 1,670.

As a result, the increased demand for commercial jetliners will boost Boeing’s revenue growth.

However, the Chinese commercial aircraft market has witnessed the rise of indigenous manufacturers in recent times, with the first ever Chinese jet having completed its maiden flight in May. Moreover, other plane makers like Airbus Group (OTC:EADSY) and Embraer S.A. (NYSE:ERJ) have also been expanding their base in the country, to exploit the nation’s growing demand for commercial jetliners.

Nevertheless, Boeing’s market share still remains significant in the country. Notably, in 2016, the company earned 11% of its revenue from China, which we believe will grow in the coming days. With the recently released outlook, it is comprehensible that the Chinese market is growing rapidly buoyed by increasing demand for commercial jetliners and Boeing’s family of jets will play a key role in promoting the growth of China's long-haul jet market.

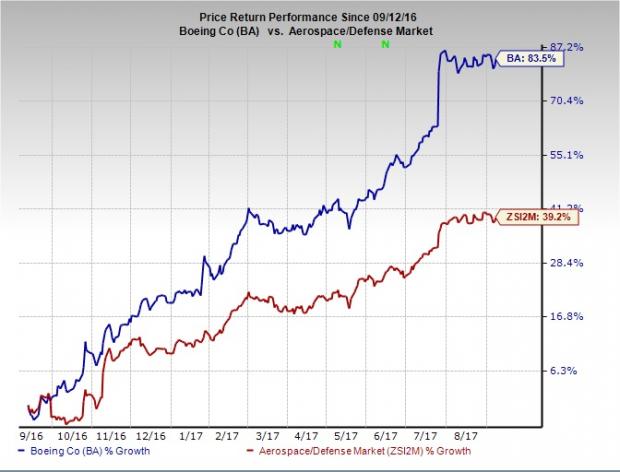

Price Performance

Shares of Boeing have surged 83.5% over the last 12 months, outperforming the broader industry’s gain of 39.2%. This might have been driven by the company’s strong balance sheet and cash flows that provide financial flexibility in matters of incremental dividend, ongoing share repurchases and earnings accretive acquisitions.

Zacks Rank & Key Picks

Boeing currently carries a Zacks Rank #2 (Buy).

A better-ranked stock in the same space is Leidos Holdings, Inc. (NYSE:LDOS) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Leidos Holdings has surpassed the Zacks Consensus Estimate in the trailing four quarters with an average surprise of 18.01%. The company has a long-term EPS growth rate of 10%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Embraer-Empresa Brasileira de Aeronautica (ERJ): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

Airbus Group (EADSY): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Original post

Zacks Investment Research