The summer is rapidly closing and a new season will shortly be upon us. The seasonality of the markets this time of year has always been a tricky proposition as well. With that in mind, I’m going to outline my current thoughts on some of the big picture charts.

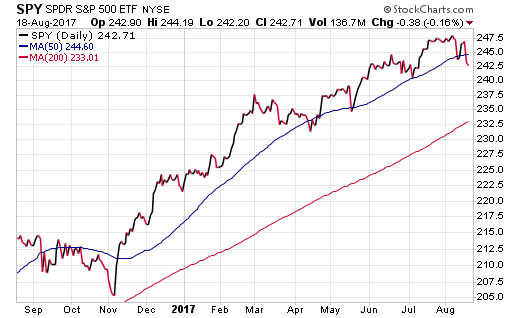

SPDR S&P 500 ETF (NYSE:SPY)

Over the last ten months, the 50-day moving average has played a prominent role in the uptrend of U.S. large-cap stocks. After testing this trend line a week ago and rebounding, the market has now broken past the 50-day and carved out a lower high on a short-term time frame. Will this time be different and mark a more prominent top in stocks?

It’s difficult to get too bearish when we are 2% off the highs and the U.S. continues to show extreme endurance on the bull side. I’m not ready to say that this is the big one, but it’s certainly looking promising for new opportunities to develop.

The real test for SPY on the downside will likely be that 2350 level, which is where it consolidated in the April-May time frame and where the 200-day moving average now rests.

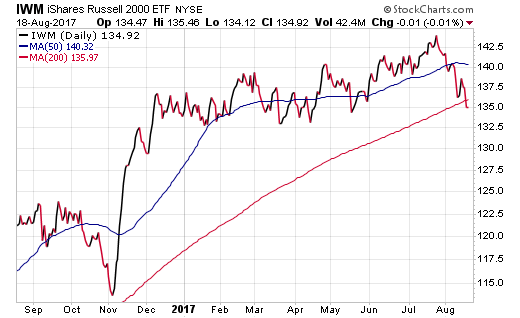

iShares Russell 2000 ETF (IWM)

Speaking of the 200-day moving average. Have you looked at IWM lately? The famous small cap stock index just recently broke below its long-term trend line and is just barely clinging to positive returns on the year.

Many of the smart technicians and traders I follow have noted there is a big bifurcation between the trends of individual stocks and the major indices. IWM is indicative of this spread and speaks to a much different story than you find in SPY, the DJIA, or even the NASDAQ Composite.

The relative weakness of small cap stocks hasn’t weaved itself into the market narrative for 2017 thus far. However, as we all know, nothing changes sentiment like price.

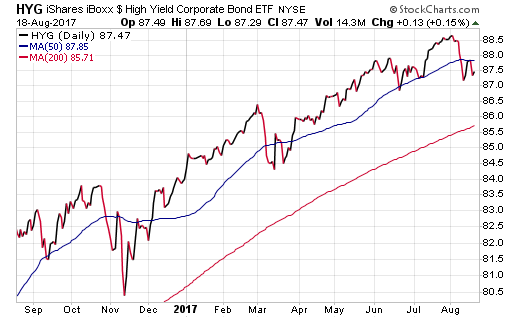

iShares Global High Yield Corporate Bond ETF (NYSE:GHYG)

Liquidity and strength in the high yield credit markets has been a consistent theme of the rally in risk assets this year. HYG appears to be taking a short breather at these levels similar to SPY. Nevertheless, there doesn’t appear to be too much angst in the credit markets just yet.

High yield bond spreads peaked at nearly 900 bps over Treasuries near the 2016 lows and have since fallen to a cycle low of 350 basis points. This trend “feels” like it’s probably due for another turn, but perfectly timing that bottom is never an easy task. It’s also noteworthy that European high yield bonds are sporting similar yields to U.S. Treasuries. That can’t end well for buyers at these levels….

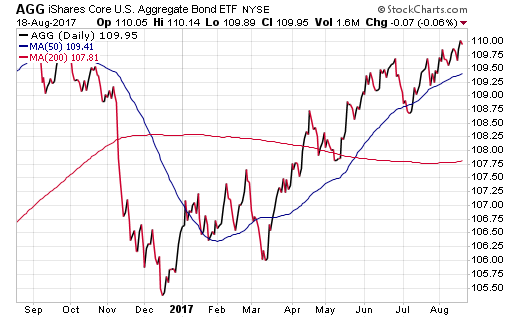

iShares Core US Aggregate Bond ETF (NYSE:AGG)

Looking at the quality side of the bond market in AGG tells a much different story. Despite fears of rising interest rates, many core/diversified bond indexes are trading near all-time highs and continue to offer stability for conservative-minded income investors.

I think this is a precarious time to be adding long-duration bond exposure in any credit tranche. Our client portfolios are mostly centered around short to intermediate-term funds with an emphasis on active managers.

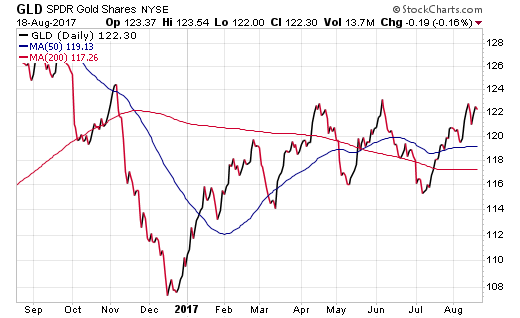

SPDR Gold Shares (HK:2840) ETF (GLD (NYSE:GLD))

I’m not a big commodity guy and rarely (if ever) own precious metals as part of my portfolio strategies. However, I do tend to check in on the trends in gold and silver from time to time as a function of sentiment and money flows. GLD is perking up due to the recent geopolitical volatility, but faces a big hurdle to overcome that 123 level.

I would imagine that a break above 124 in GLD will likely lead to an extension of the intermediate-term uptrend to the prior peak near 130. However, that may take some serious societal panic and let’s not forget that the newish safe haven asset du jour is Bitcoin these days anyways.

Note: I know next to nothing about Bitcoin and don’t plan on trading/owning it soon either.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.