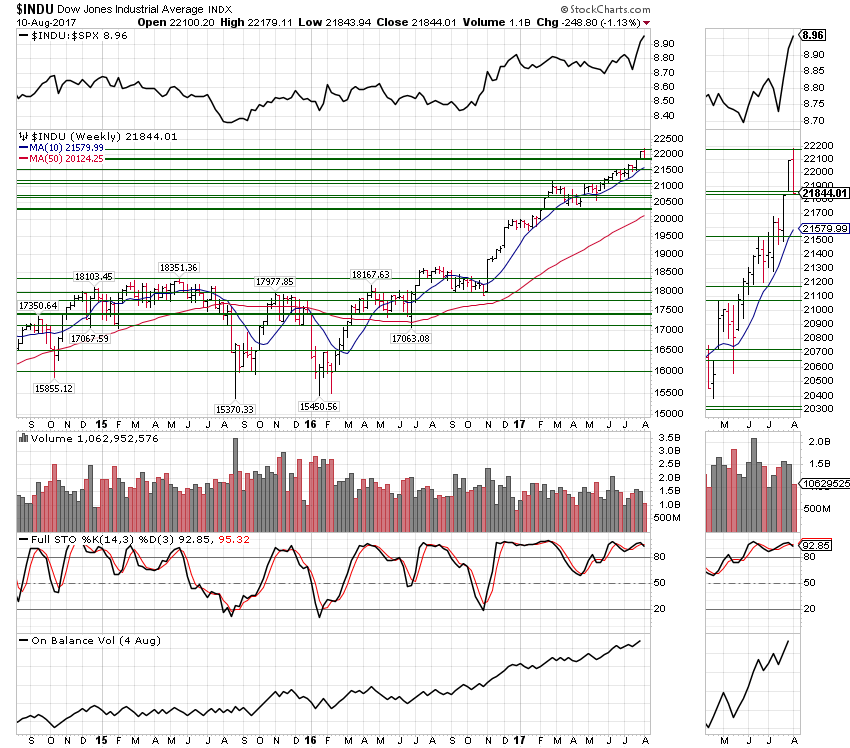

Technical Excess DJIA

As widely reported, the latest run in the venerable Dow was exceptional. By our measures, the strongest since the summer of 2007 when the action registered an Upside Exhaustion, which is momentum. Also registered was a Sequential (9) Sell, which is pattern.

The Dow rally was essentially driven by dollar weakness. What happens when the DX goes up?

In that fateful year, 2007, the September target was eclipsed with the peak being set on October 11.

This time around, the Dow has also accomplished an Upside Exhaustion and the Sequential (9) Sell.

A seasonal chart updated for the period 1983 to 2010, indicates the key high occurring in late August. The next low would be in late October.

We have been looking for a “thrust” into September. The recent “surge” will do, very nicely. On our target for the high, it can be centered in September, with the actual high possible in late August or early October.

Conditions for the completion of this bull market are as clear as they were in August 2007. That’s just using the action in the stock market. The conclusion is supported by developments in credit markets, the dollar and industrial commodities.