On the first working day of the new year, global stock exchanges failed to maintain a positive outlook due to intensified political confrontation on several fronts at the same time.

US markets came under increased pressure due to the senate runoff in Georgia, as markets fear that Republicans will lose two Senate seats to Democrats.

This is a downside risk for the markets, where the November-December rally was mainly fueled by hopes that the Senate will block reforms that cut support for companies. Also worrying for investors is the fact that the Democrats are often the first to call for budget discipline and tax increases.

The uncertainty surrounding the election in Georgia has led to a spike in the VIX volatility index. A rare situation has developed where the short-term outlook is now seen by investors to be more cloudy than the long-term one.

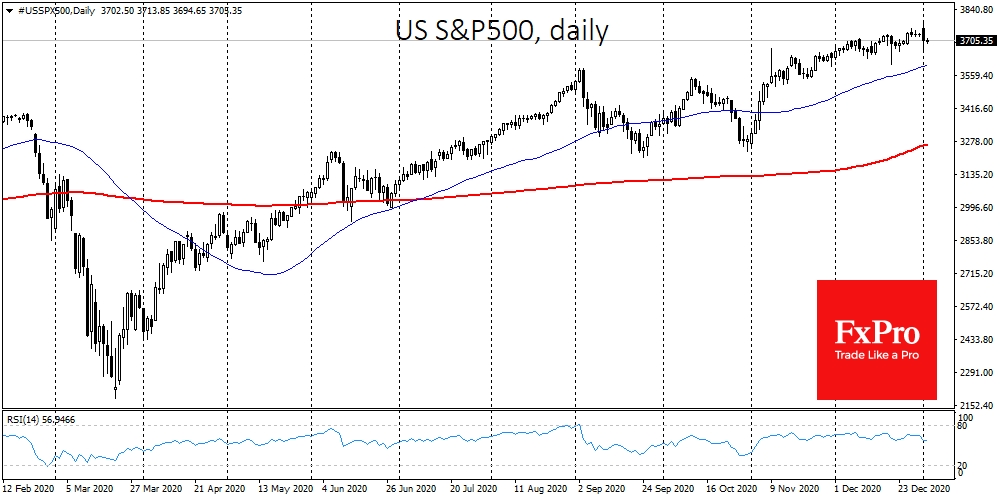

This uncertainty put pressure on US equity indices, which rewrote all-time highs early Monday but lost about 1.5% over the day.

Technically, this could indicate a very sharp fall from the highs. Often such dips from the highs become the catalysts for trend reversals. Therefore, it is worth keeping a close eye on the performance of the S&P500 in the coming days. The development of the decline runs the risk of initiating a correction.

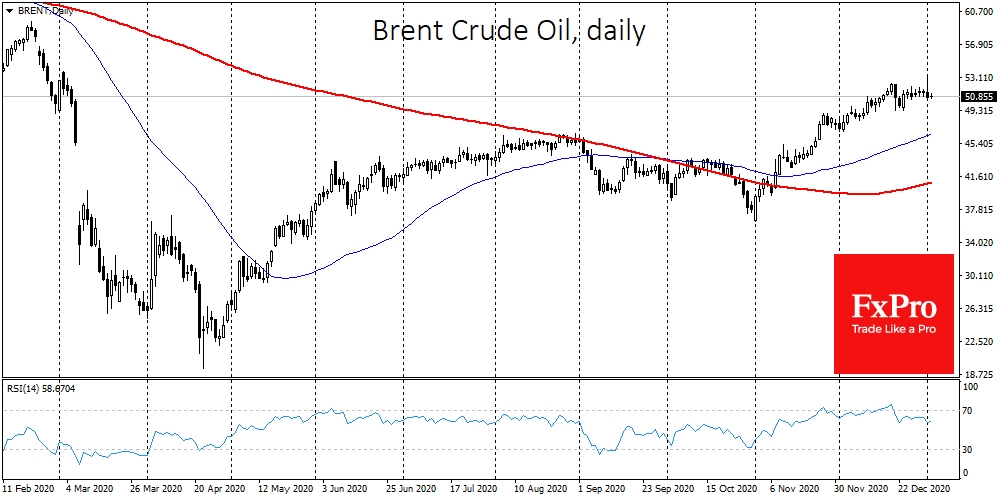

The technical picture painted by the daily oil charts is even more worrying for the bulls. The rallies of Brent and WTI in previous weeks sent quotations into overbought territory. The Brent rally above $53 early in the day turned into a sell-off, which plunged the oil below $51 on the news of OPEC negotiation progress.

The meeting of the cartel unexpectedly encountered a serious disagreement between Saudi Arabia and Russia, with the latter insisting on an increase in production. Russia is re-engaging in a battle for market share, watching the US ramp up its drilling activity and noting a healthy increase in oil demand in Asian countries.

Self-restraint by the cartel could give back the lead in oil production to The States fairly quickly.

Having failed to reach an agreement yesterday, OPEC+ hopes to come to a consensus today. However, the rift in the alliance between the Russians and Saudis has once again become apparent. This is likely to make buyers warier of the prospect of further price increases in the medium term and may lead to a pullback in the coming days.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Blue Wave Risks And OPEC+ Disagreement Resets Markets From Highs

Published 01/05/2021, 06:13 AM

Updated 03/21/2024, 07:45 AM

Blue Wave Risks And OPEC+ Disagreement Resets Markets From Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.