The bloom is off the rose at Bloomin Brands (NASDAQ:BLMN).

Nearly seven years past its IPO date, Bloomin Brands' stock is well behind that of the market benchmark S&P 500. Earnings are on the way this week, and alternative data isn't looking too reassuring - shares are down nearly 18% from their peak in 2019 - and that's compared to a market that has been mighty to begin the year.

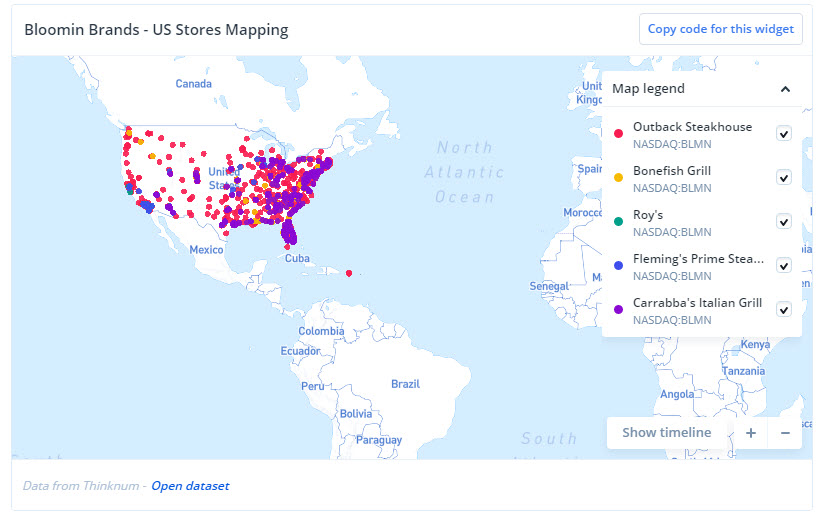

First off - a map of the brands that make up Bloomin: this includes its arguably most famed brand (Outback) and also includes other restaurants like Bonefish Grill, Carrabba's Italian Grill and Fleming's Steakhouse.

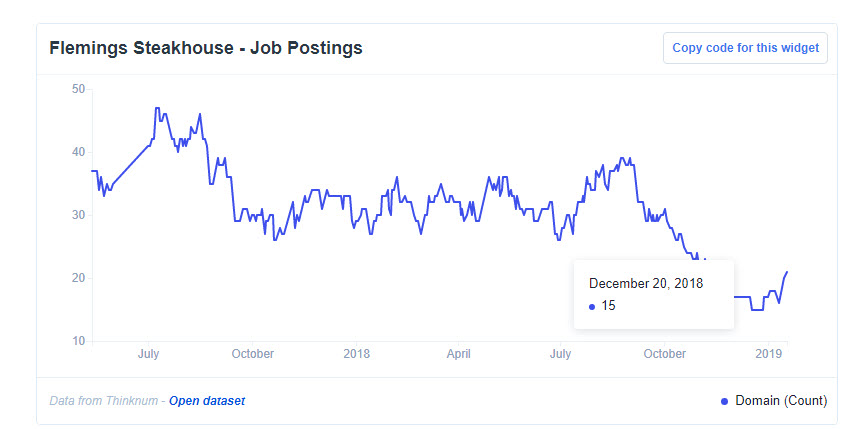

Certain brands, under Bloomin, were doing less hiring when the year began - this isn't uncommon for a company that's weighing leadership transition, and Bloomin Brands replaced its CEO just this past March. The next chart is Flemings Steakhouse - but, similar reductions in job postings can be attributed to other brands, too.

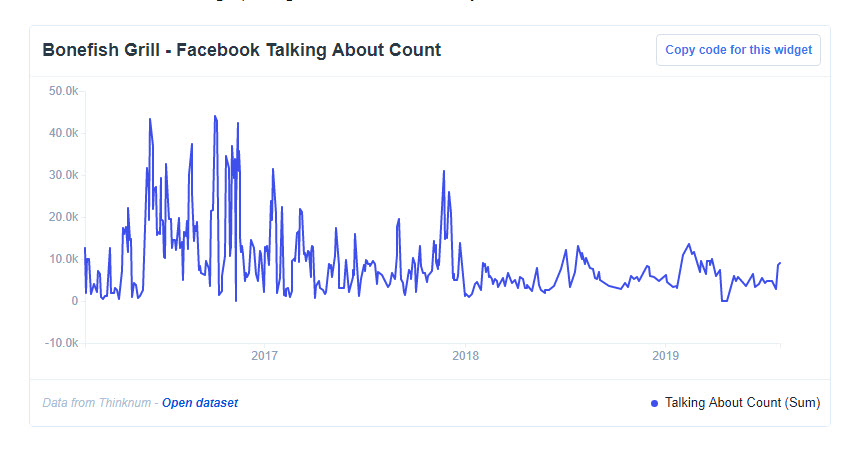

In our final chart, we can check the social media attention of another Bloomin brand - Bonefish Grill. It has been said that consumers are shying away from traditional seafood dining - and the Facebook (NASDAQ:FB) Talking About Count affiliated with the Bloomin subsidiary reflects the same. Consumers aren't talking up a night out for seafood they once were.

Bloomin earnings will be reported Wednesday July 31, and analysts tracked by Zacks Investment Research are looking for EPS of $0.35.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.