By now, most technically minded people agree that blockchain technology is good. The big question I've been asking myself lately is.... good for who?

The blockchain was developed to level the playing field between Wall Street and Main Street and through the power of the Internet narrow the gap between rich and poor.

However, lately, it seems that cigar smoking banksters of the world are getting their grubby hands all over the blockchains in ways that are a bit unsettling.

Just yesterday, it was announced that IBM will be taking charge of an ongoing project known as HyperLedger, which is Wall Streets version of a Blockchain for Bankers.

IBM has a particularly nefarious history when it comes to misusing technology, but that was a long time ago. We sincerely hope that they'll get it right this time.

Today's Highlights

No More Stress

Benedict Carney

Bitcoin Buyers

Please note: All data, figures & graphs are valid as of June 29th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

For the first time since the financial crisis in 2008, the Fed has declared all big banks to be safe in their annual stress tests.

This is a huge follow-up to Janet Yellen's statement that we will likely not see another financial crisis in our lifetimes.

The banking sector is having a party at the moment and has managed to pull up the rest of the markets. Many firms have announced that they will be rewarding their shareholders in celebration with things like extra dividends and share buybacks.

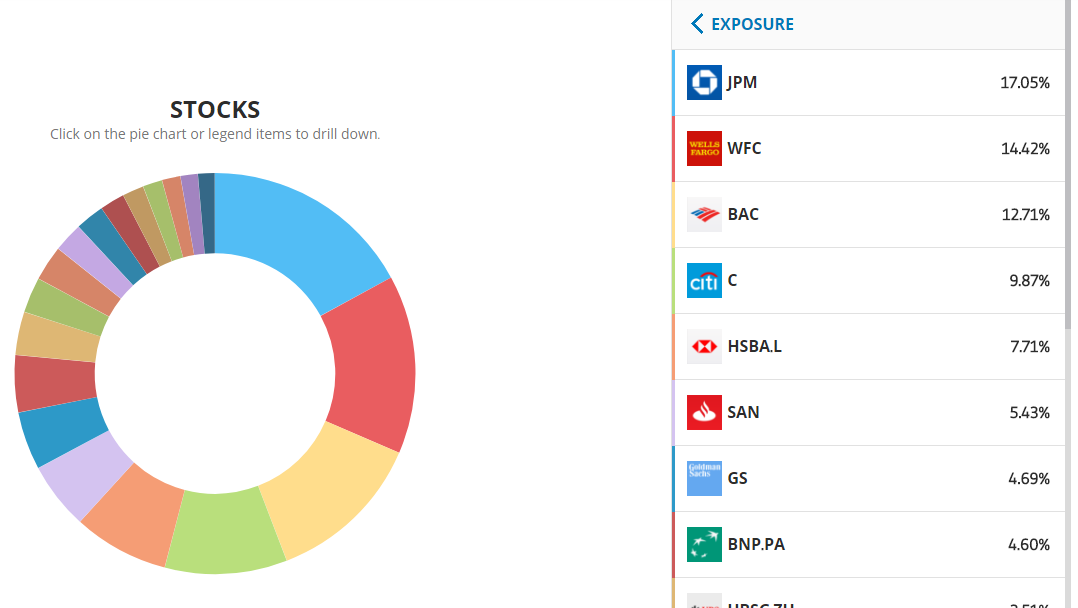

As of yesterday, the @TheBigBanks copyfund that we set up 12 months ago is now up 43% since inception. With this good news, it will likely see even further gains when Wall Street opens for business today.

Even the tech stocks, who were performing very poorly this month managed to pull off some gains. Here's the Nasdaq since the beginning of May.

Carney Flipping

During the last meeting of the Bank of England, it was surprising to see that many members actually voted to raise the interest rates in the UK.

The BoE has kept rates on the floor for a while like many central banks since the crisis. Following the brexit, they lowered their rates even further to encourage lending and spending during this uncertain time.

The President of the BoE, Mark Carney, was one of the biggest advocates of keeping the rates low, but it seems that even he has now bowed to the pressure and signaled that it may be time to get inline with the rest of the globe and start thinking about raising the rates gain.

For those of you who are reading this far, you'll now find out why this is so important.

Here's a chart of the GBP/USD since the last BoE meeting on June 15th.

So despite Brexit and despite Theresa May's terrible display in the elections of June 8th, investors feel that the chance of higher rates is enough to push the Pound higher. Now imagine if it actually happens what the effect could be.

Bitcoin Bounce

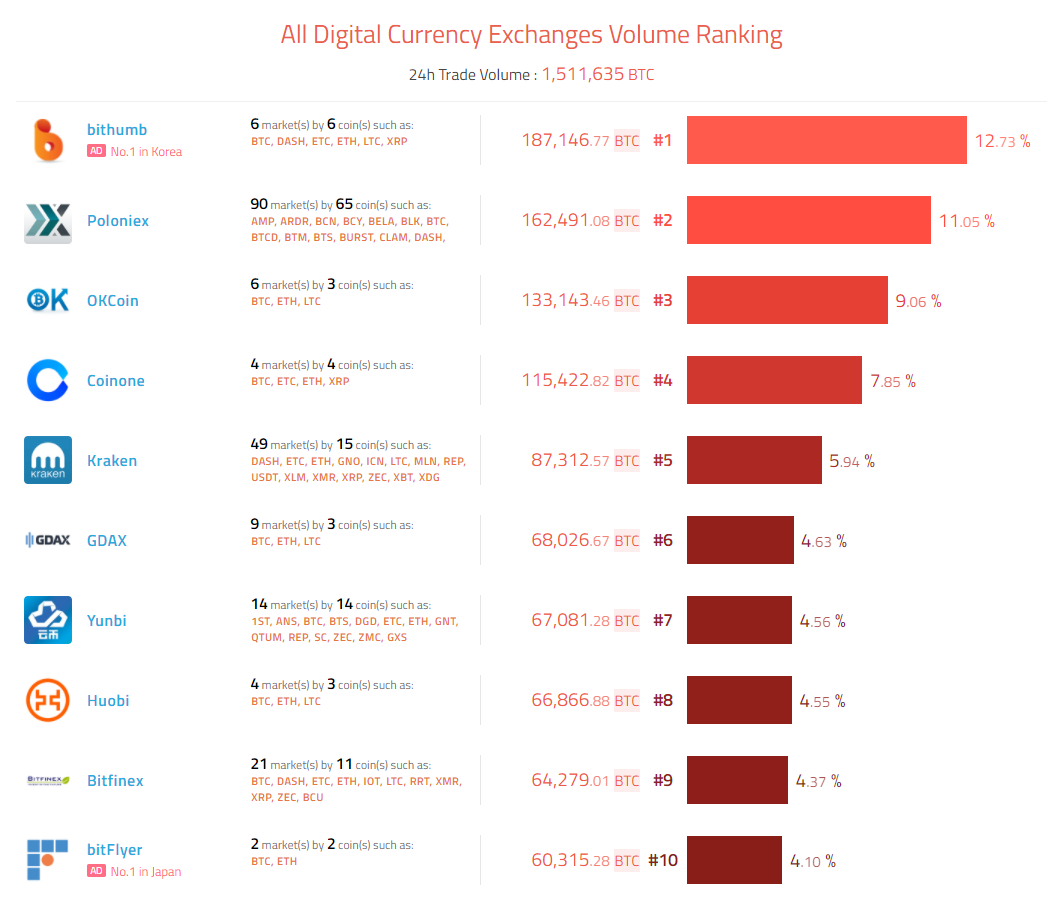

It looks like the bitcoin dip did indeed find some major buyers but not the usual kind. Looking at the volumes over the last 24 hours we can see that the number one customer is the Korean exchange bithumb.

This is the first time that I've seen the Korean's trump volumes of Poloniex.

We need to keep in mind that at this time Koreans do not have any practical use for bitcoins. They don't have many stores that accept them, and the new government has more important things to deal with at this time than a regulatory framework for digital assets.

The only country that does have a rapidly growing number of vendors accepting bitcoin is Japan. As we can see above, bitFlyer is currently number 10. Not that they've gone down recently, but they certainly haven't increased their buy orders since the peak.

Therefore, we can probably conclude that the reason bitcoin has been rising lately is due to speculation. Now, that's not necessarily a bad thing, just something to keep in mind.

As always, please feel free to contact me directly with any questions, comments, and feedback. Have a spectacular day ahead!

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.