The Zacks Investment Management industry consists of companies that manage securities and funds of clients to meet specified investment goals and earn by charging service fees or commissions for managing such assets. Investment managers are also called asset managers and they manage hedge funds, mutual funds, private equity, venture capital and other financial investments for third parties.

By appointing an investment manager to manage one’s assets, investors get more diversification options than they would have by themselves. This diversification helps in reducing volatility and hence spreads and smoothens returns over time, as investment managers invest their clients’ assets into different asset classes, depending on their need and risk-taking ability.

Here are the industry’s three major themes:

- The uncertainty related to the U.S.-China trade war led to volatility in the equity markets. While some months have experienced active equity inflows, most witnessed outflows. The majority of asset managers’ revenues come from performance fees and investment advisory fees. Given the increase in outflows, assets under management (AUM) growth has been hampered.

- As investors look for low-cost investment strategies, demand for passive investing is on the rise. The year 2018 saw many investors shifting their preference from active to passive management. The same trend is expected to continue in 2019. Because of the continued shift to institutional investment in lower-cost passive mandates from the more-profitable active strategies, margins of these asset managers may continue to remain under pressure.

- The tightening of regulations to increase transparency led to rise in compliance costs for investment managers. Moreover, as wealth managers are trying to upgrade technology to keep up with evolving customer needs, technology costs should continue to rise. This could result in an increase in overall expenses.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks Investment Management industry is a 51-stock group within the broader Zacks Finance sector. The industry currently carries a Zacks Industry Rank #215, which places it at the bottom 16% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. In the past year, the industry’s earnings estimate for 2019 has declined by 21.4%.

Despite this disappointing picture for the near term, we will present a few stocks that are well positioned to outperform the market, based on a strong earnings outlook. Before doing this, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags on Stock Market Performance

The Zacks Investment Management industry has underperformed both the S&P 500 composite and its own sector over the past two years.

While the stocks in this industry have collectively lost almost 1.6% over this period, the Zacks S&P 500 composite has rallied 18.4% and the Zacks Finance sector has gained 3.8%.

Two-Year Price Performance

Industry’s Valuation

One might get a good sense of the industry’s relative valuation by looking at its price-to-tangible book ratio (P/TBV), which is commonly used for valuing finance companies because of large variations in their earnings results from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 2.46X. This compares with the highest level of 3.55X, the lowest level of 1.34X and median of 2.12X over the past five years. Additionally, the industry is trading at a significant discount when compared with the market at large, as the trailing 12-month P/TBV for the S&P 500 composite is 14.90X, which the chart below shows.

Price-to-Tangible Book Ratio (TTM)

As finance stocks typically have a low P/TBV ratio, comparing investment managers with the S&P 500 may not make sense to many investors. But a comparison of the group’s P/TBV ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector’s trailing 12-month P/TBV of 3.01X for the same period is above the Zacks Investment Management industry’s ratio, as the chart below shows.

Price-to-Tangible Book Ratio (TTM)

Bottom Line

Margin compression as well as escalating compliance and technology costs are expected to hurt investment managers’ profits in the near term. Moreover, increasing competition within the sector could make it difficult for small-scale investment managers to grow significantly.

None of the stocks in the Zacks Investment Management space currently sports a Zacks Rank #1 (Strong Buy). However, we are presenting three stocks with a Zacks Rank #2 (Buy) that have an upbeat earnings outlook and hence investors may bet on those.

You can see the complete list of today’s Zacks #1 Rank stocks here.

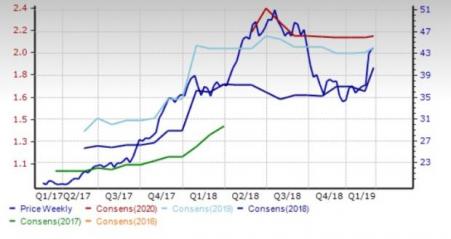

Hamilton Lane Inc. (HLNE): The stock of this Pennsylvania-based company has gained 21% over the past year. The Zacks Consensus Estimate for fiscal 2019 EPS has been revised 9.2% upward over the past 60 days.

Price and Consensus: HLNE

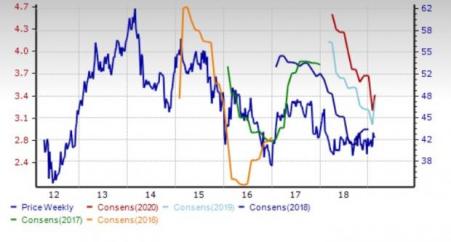

Oaktree Capital Group, LLC (OAK): The stock of this Los Angeles, CA-based company has lost nearly 1% over the past year. The consensus estimate for 2019 EPS has been revised 4.1% upward over the past 60 days.

Price and Consensus: OAK

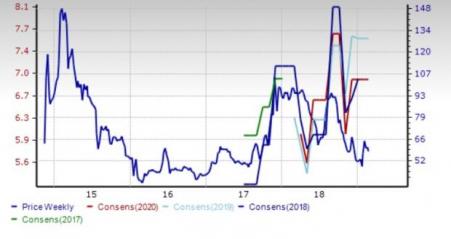

Ashford Inc. (AINC): The consensus estimate for 2019 EPS for this Dallas, TX-based company has remained unchanged over the past 60 days. The stock has lost 41% over the past year.

Price and Consensus: AINC

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Oaktree Capital Group, LLC (OAK): Free Stock Analysis Report

Hamilton Lane Inc. (HLNE): Free Stock Analysis Report

Ashford Inc. (AINC): Free Stock Analysis Report

Original post

Zacks Investment Research