From BlackRock: So-called “Trump trades” have rolled back on political uncertainty, yet we see the broader reflation trade having room to run. Richard Turnill explains why, with the help of this week’s chart.

“Trump trades” have run out of steam lately, amid growing market skepticism about the likelihood of significant near-term U.S. tax reform and infrastructure spending. Yet we believe the bigger-picture reflation trade has room to run. This week’s chart helps explain why.

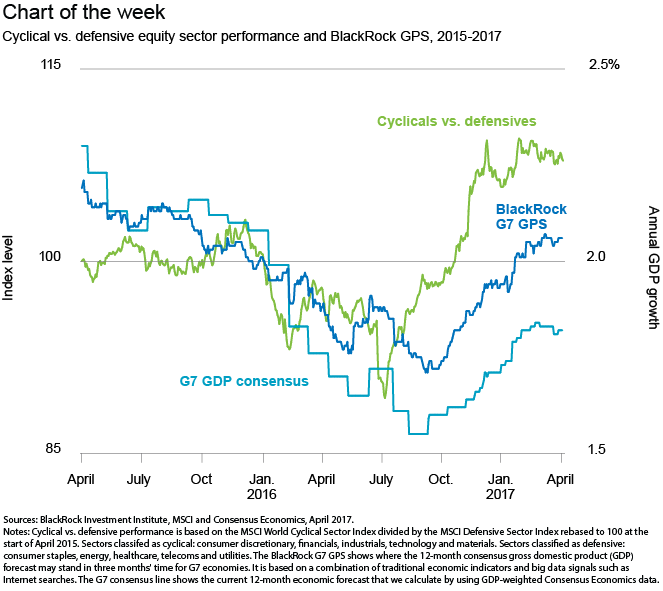

We are in the early stages of a global reflation cycle that started in mid-2016. The chart shows the better economic growth outlook reflected in our BlackRock GPS economic indicator relative to consensus views. The BlackRock GPS rise has coincided with the outperformance of cyclical shares geared to improving growth.

The big picture

Another sign reflation is going global in 2017: a synchronized pick-up in economic activity and corporate earnings. We define the reflation trade as favoring assets likely to benefit from rising growth and inflation, such as cyclical equities and emerging markets (EM), while limiting exposure to long-term government bonds. The reflation trade is not contingent on looser U.S. fiscal policy, in our view. Rather, tax reform or infrastructure spending could amplify it.

In the U.S., some reflation trades that experienced a post-election run-up as “Trump trades,” such as small caps and bank stocks, have underperformed this year amid waning expectations of a fiscal boost. Bond market inflation expectations have also fallen lately back to December lows. Meanwhile, market segments with strong fundamentals that initially fell after the election, such as EM equities, have reversed. Political uncertainty may be holding back the reflation trade, but we see the macro environment ultimately mattering more. Consensus growth expectations have scope to rise further, even if the biggest gains may be behind us.

Most reflation trades aren’t crowded or expensive, our research suggests. U.S. stock prices more fully reflect the maturing reflationary cycle, and we see better opportunities in Europe, Japan and EM stocks. A reflationary outlook also underpins our preference for U.S. credit over government bonds.

The iShares MSCI Emerging Markets Index (NYSE:EEM) ETF was trading at $39.11 per share on Tuesday afternoon, down $0.1 (-0.26%). Year-to-date, EEM has gained 11.71%, versus a 5.01% rise in the benchmark S&P 500 index during the same period.

EEM currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #2 of 77 ETFs in the Emerging Markets Equities ETFs category.