CNBC anchors are now shilling shitcoins they just heard about last week only because of their violent price rises. The S&P 500 has performed tremendously since 2009, however, volatility, trading volumes, and general investor interest has collapsed alongside a secular bull market. For those who make their money in financial media and advice, volatility is needed.

Volatility is the lifeblood of traders and digital currency markets. While the usefulness of bitcoin in everyday commerce is limited by volatility, it captures the attention of traders.

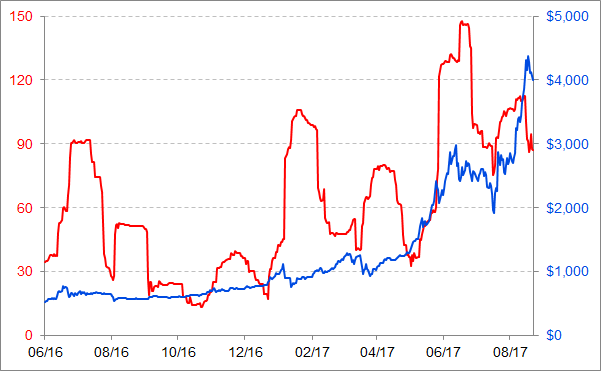

Figure 1. 30day Realised Vol (LHS) vs. XBTUSD (RHS)

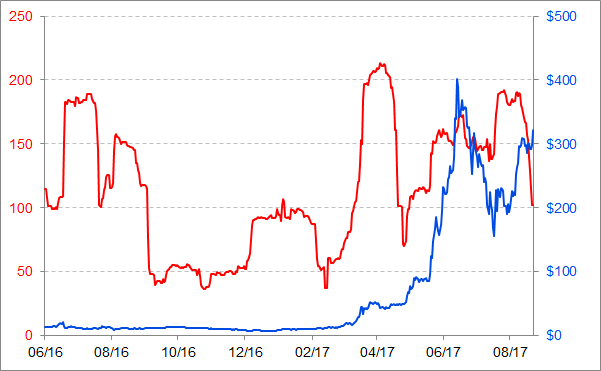

Figure 2. 30day Realised Vol (LHS) vs. ETHUSD (RHS)

The two charts above plot the 30 day realised volatility of bitcoin and ether against its USD value from June 2016. A linear regression of the realised volatility against the USD price produces a positive correlation of 66% and 48% for bitcoin and ether respectively.

It is clear that higher volatility correlates with a higher price. Digital currencies are call options. The greater the volatility, the more valuable the option. If you desire a non-volatile store of value, try gold. Unfortunately, gold isn’t up 30x on the year.

Observing the charts, bitcoin and ether were much less interesting this time last year. Those who scoffed at the digital currency complex because of the high volatility back then look even sillier today. Traders and investors crave volatility. Volatility creates opportunities for differences of opinion. Volatility creates headlines, which brings new players to the game.

The Hedgies Are Coming

The intense upside volatility creates an environment where investors are finally excited about investing again. Bloomberg recently ran a story about an ex-Harvard endowment fund manager who is starting a digital currency hedge fund in Hong Kong. Another Bloomberg piece profiled the new $100 million crypto hedge fund founded by a former Hong Kong art dealer. Like moths to a flame, enlightened fund managers are hopping on the next train to 2 and 20 riches.

I receive linkedin messages daily from newly minted fund managers on the crypto haj through Asia. Many of these newbies come from legacy financial institutions. In most cases they have commitments for $5 to $25 million.

One thing many managers convey to me is how much easier it is to raise money for a digital currency hedge fund. While the AUM is much smaller at this stage, investors will gladly hand over their money even after you inform them it is entirely possible that they will swiftly lose every cent.

An AUM Thought Experiment

A properly structured hedge fund takes somewhere between 60 to 90 days to set up. As always, lawyers and banks must be greased. That costs between $50k to $100k depending on the jurisdiction and the complexity of the structure.

Most of the funds I have met contain a money man and an ideas man. The money man possesses a Rolodex of wealthy people and the pedigree necessary to separate rich people from their assets. The ideas man has a trading background, and will be the one formulating and executing trading strategies.

These individuals were earning mid to high 6-figure salaries at traditional banks, hedge funds, and or asset management firms. Even though they will take a pay cut to enter this new field, they will still draw decent salaries. Budget $300k per annum combined for their salaries.

On the technology side, depending on the strategies employed, the fund must have wallet security and trading technology. Assume this costs $100k per annum. This figure can easily balloon if the fund aims to execute algorithmic strategies. That will require a CTO with financial services experience. Anyone good is going to either want a serious cut of the equity or beaucoup d’argent.

Now, don’t forget the accountants. Managing OPM requires periodic audits by accredited firms. I hear Friedman LLP is quite excellent. Budget another $100k per year for these services.

Setup Costs: $100k

Yearly Operating Costs: $500k

Like most hedge funds, the crypto managers will charge 2% of AUM and 20% of returns. To cover the $500k operating costs at a minimum requires a $25mm AUM. If you can’t raise that amount of money, you shouldn’t attempt to raise a fund under traditional legal structures and from accredited investors.

That does not mean sub-$25mm funds do not exist. These small funds will take money from friends and family of the principles, and will not feature the same rigour surrounding legal structure and audit.

Anecdotal reports point to over 100 funds globally being formed this year. The FOMO began in earnest this summer. That means by this fall an estimated $2.5bn will need to find a home in one or more digital currencies.

The vast majority of dry powder will deploy into bitcoin and ether. Their combined market cap is $100bn. Many of the current holders are not selling. In the face of a $2.5bn tidal wave, marginal sellers will begin to demand higher and higher prices. Marginal buyers who engage in similar thought experiments will front run the assured demand from new funds.

There are many reasons to be bearish on the short term price of bitcoin and ether. Hard forks, scaling issues, and proof of work changes are respectable reasons to doubt the veracity of this bull market. But these fund managers must shit or get off the pot. A stable and strong bid from hedgies will embolden bullish speculators to BTFD, and shorts to cover quickly.

XBTU17 Basis Forecast

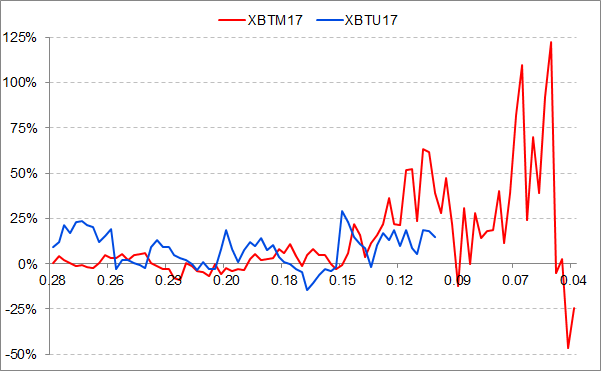

Figure 1. Annualised % Premium against time to expiry

In less than 6 weeks, XBTU17 will expire. Looking to the XBTM17 historical basis helps frame a prediction on how XBTU17 could trade over the next month until expiry.

The above chart plots the annualised basis from the time each futures contract became the on-the-run quarterly contract until it became off-the-run. On 15 September 2017, XBTZ17 will list, and will become the on-the-run quarterly contract. Liquidity will gradually migrate from XBTU17 into XBTZ17.

XBTU17’s annualised basis trading range is much tighter compared with XBTM17’s. The below table lists the max and min annualised basis for each contract.

Table 1. Basis for XBTM17, XBTU17 and XBTM17 t = matching length of current XBTU17 contract

| XBTM17 | XBTM17 t | XBTU17 | |

| Max | 122% | 63% | 29% |

| Min | -46% | -9% | -14% |

With a few weeks remaining, basis traders have a few decisions to make. These decisions depend on their views on the spot price of bitcoin.

Late Stage Rally

Basis tends to spike when the market breaks through a major upside resistance level. XBTU17 basis spiked when spot cracked through $3,000. The next major level is $5,000.

If you believe that spot can rise that high before expiry, go long XBTU17 basis into the rally. Once $5,000 is conquered, reverse directions, go short, to put on a cash and carry arbitrage position.

On the long side, this trade profits from a rise in basis from the current sub 20% p.a. to an upside target of +50% p.a.

On the reversal, this trade profits from earning positive carry by shorting XBTU17 at +50% p.a., and holding until expiry.

Range Bound Trading

The diminishing amount of XBTU17 theta remaining means that the basis volatility will fall. Unless there is an explosive rally or correction, the basis will not move aggressively in either direction, but rather slowly diminish into settlement.

Traders should take advantage of the positive basis, and short XBTU17, placing themselves in a cash and carry arbitrage trade. The short XBTU17 position is held until expiry.

Late Stage Correction

Given the underlying bullishness of the market, dips will be bought. Large XBTU17 % discounts will not persist for very long as bottom feeders load up on cheap bitcoin long exposure.

If such a situation does occur, the previous Range Bound Trading scenario trade recommendation can be closed out early in profit.

Risk Disclaimer

BitMEX is not a licensed financial advisor. The information presented in this newsletter is an opinion, and is not purported to be fact. bitcoin is a volatile instrument and can move quickly in any direction. BitMEX is not responsible for any trading loss incurred by following this advice.