Bitcoin soared to a new high above $4,300 today, rising more than 28% over the past week. The digital currency has now more than quadrupled in value from around $997 at the start of the year. $1 invested in bitcoin seven years ago is now worth over $1.4 million.

Recent surge in bitcoin price resulted from strong investor demand from Japan as also some safe haven buying. Investors have also become increasingly bullish after the smooth split of the cryptocurrency into two. (Read: 4 ETF Ways to Hedge Against Volatility)

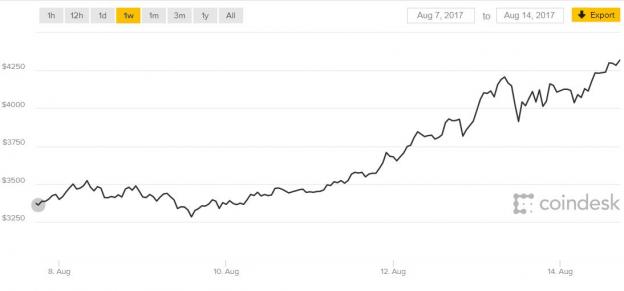

Bitcoin’s gains this weekend appeared to be at the expense of other newer digital currencies. Below is the one-week price chart from coindesk.com:

What is Bitcoin?

Unlike traditional currencies, which are issued by central banks, bitcoin is a decentralized digital currency. It trades 24/7 around the world without any involvement of central administrator or clearing agency. The market, which remains largely unregulated, is more like a peer-to-peer digital payment network.

Creation and transactions in bitcoin are controlled through cryptography to keep transactions secure. And, while users remain anonymous, the record of these transactions is available on the bitcoin network.

Bitcoin Becoming Mainstream?

Bitcoin now has a market value exceeding $70 billion per coinmarketcap.com. Total value of all cryptocurrencies is more than $139 billion now. They are no longer fancy assets with few backers.

In April, Japanese regulators announced rules for bitcoin, establishing it as a legitimate method of payment in the country.

Per Goldman Sachs (NYSE:GS) analysts, “whether or not you believe in the merit of investing in cryptocurrencies (you know who you are), real dollars are at work here and warrant watching.”

Nvidia (NVDA)’s CEO said in a recent conference call, “cryptocurrency and blockchain is here to stay. The market need for it is going to grow, and over time it will become quite large.” Nvidia and AMD (AMD) are among the main supplier of chips used for cryptocurrency mining.

Is Bitcoin a Bubble?

Bitcoin’s astronomical surge has raised bubble fears. Some are even comparing it to tulip mania. But unlike tulips, bitcoin has real value and is accepted by hundreds of thousands of merchants worldwide.

One of the reasons behind the surge is bitcoin’s limited supply. According to the Economist, there are about 16.3 million bitcoin in circulation, with only 1,800 new ones minted every day. The currency’s total supply would be capped at 21 million units. (Read: Follow Gundlach with These ETF Strategies)

On the other hand, demand has been rising due to geopolitical uncertainty. Many consider bitcoin a safe have asset like Gold. Due to its low correlation with other asset classes, it also acts as a portfolio diversifier.

It is difficult to arrive at a fair value for the bitcoin. I read about a model in FT that is based on the presumption that bitcoin’s core utility value is serving as a currency for the dark economy. The model found the cryptocurrency to be grossly overvalued.

Standpoint's Ronnie Moas raised his price target on bitcoin to $7,500 today as he told CNBC, "I believe there are hedge funds and very deep-pocketed individuals going into this now, really hundreds of millions of dollars."

Another bitcoin bull Max Keiser predicts $5,000 would be the next target, driven by panic buying by the world’s affluent with “rising war tensions and central bank malfeasance.”

If bitcoin’s surge looks excessive, consider this—bitcoin’s closest rival ethereum is up more than 3,400% this year. (Read: Ethereum ETF? The Bitcoin Crushing Digital Currency Explained)

Bitcoin ETFs Under SEC Review

The race to the first digital currency ETF is heating up. VanEck Vectors recently filed for an actively managed “Bitcoin Strategy ETF” which will invest in exchange-traded bitcoin-linked derivative instruments and other investment vehicles that provide exposure to bitcoin.

Earlier this year, the SEC had rejected the ETF proposed by Winklevoss twins but they are now reviewing the decision again. Another bitcoin ETF, proposed by SolidX Management, was also rejected in March. The third one proposed by Grayscale’s Bitcoin Investment Trust (GBTC) is being reviewed. (Read: 5 Smart Beta ETFs with Brilliant Returns)

Bitcoin derivatives are likely to be available to investors much sooner. CBOE plans to launch bitcoin futures in the fourth quarter of 2017 or early 2018, pending regulatory approval.

Last month, the Commodity Futures Trading Commission (CFTC) approved digital currency-trading platform LedgerX to clear bitcoin options. The exchange plans to launch bitcoin options in early fall, and ethereum options within a few months, per CNBC.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Advanced Micro Devices, Inc. (NASDAQ:AMD): Free Stock Analysis Report

GOLD (LONDON P (GLD (NYSE:GLD)): ETF Research Reports

NVIDIA Corporation (NASDAQ:NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research