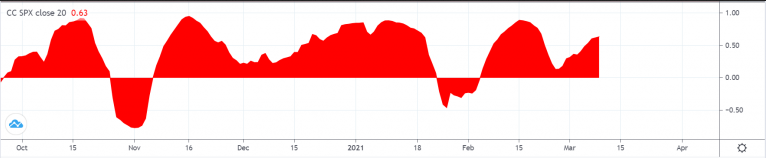

Bitcoin needs to recoup bullish strength to break above $60,000 again. The cryptocurrency market has resumed its rally after a weekend shakeout that saw more than $10 billion in liquidations. More patient traders are testing the validity of buy-the-dip action. As the drop comes after 1000% gains in one year, fear around a generational market top is palpable. At least three factors influenced the cryptocurrency sell-off: possible insider selling by Coinbase executives, a decline in Bitcoin’s mining hash rate, and the U.S. Treasury’s decision to charge 32 Russian entities for election interference via crypto-related transactions. Prior to the crash, Bitcoin reached its peak price ($65,000) when Coinbase Global (NASDAQ:COIN) listed its stock on Apr. 14. This could be considered a “buy the rumor, sell the news” event. A post mortem of the crash revealed a significant inflow of over 9000 BTC to Binance before the crash. Then, cascading futures liquidations forced traders to sell positions, leading to the crash. On-chain expert Willy Woo later found that 20,700 BTC moved out of the exchange after the move, suggesting a strong whale buying action. He tweeted that Bitcoin “continues to move to very strong holders” based on the liquidity drops in its supply. Despite positive news, there are still some concerns about Bitcoin’s price volatility as well as regulatory risks. Justin Chuh, a Senior Trader at Wave Financial, explained: “Whether the BTC tide rises organically or falls more due to news of crypto-related penalties, we can assume others will follow.” Chuh added that Bitcoin could see sideways action before breaking $60,000. Delta Exchange CEO Pankaj Balani, stated that a quick recovery above $60,000 is “a key resistance for any bull-trap rally.” Balani is watching the resistance from the 50-day moving average at $56,800. He predicts that a “conclusive breakdown below the 50 DMA can lead to a sharp price correction” and expects a $36,000 support. The support from the 128-day moving average is at $44,800. Bitcoin’s correlation with the stock market is adding to negative pressure. Positive values of the correlation coefficient indicate that stocks and Bitcoin’s price are moving in the same direction. The magnitude gauges the degree of coupling in percentage gains. S&P 500 dove from the week’s start. The index is down 70 points from an all-time high of $4193. Therefore, Bitcoin’s price faces much resistance to the upside before confirming the local bottom of $51,000. A drop in Bitcoin’s market dominance from 60% to 51% this month shows considerable retail euphoria in the markets. Chuh also told Crypto Briefing that “institutional money is still flowing into Bitcoin and Ethereum,” while retail traders who are looking to build their portfolios are adding volatility to the market. Whether the inflow comes from whales buying Bitcoin or retail traders moving into altcoins, the trend seems to be strong. Moreover, the idea of crypto reaching the mainstream tipping point is consistent, as companies like PayPal, WeWork, TIME, and others continue to increase investment and payment adoption. Crystal Rose Pierce, CEO of Make Sense Labs, told Crypto Briefing: “As more large-scale financial institutions and consumer-facing apps like PayPal adopt Bitcoin, the less likely it is to see failure.” Bitcoin was worth $56,039 at the time of publishing.Key Takeaways

Various Factors Influenced Crash

What Will Come Next?

Stock Market Correlation

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Rests After Drop, Tests Buy-The-Dip Narrative

Published 04/22/2021, 01:16 AM

Bitcoin Rests After Drop, Tests Buy-The-Dip Narrative

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.