The U.S. bond market is at a tipping point, with the 10-year Treasury note yield rising above 4.95% for the first time since 2007.

This is significant and marks a point where the median returns on treasury bills (and even savings accounts) pay a higher return than real estate and the S&P500.

The US has been in better shape

In addition to this, several key indicators suggest potential challenges ahead for the U.S. economy:

- Debt levels have surged by an astounding $2 trillion since the resolution of the debt ceiling crisis in May. This rapid increase underscores the gravity of the current fiscal situation.

- The 30-year mortgage rate has surged to 8%, marking the highest level in over two decades, which reinforces concerns regarding the affordability of housing and its broader implications for the real estate market.

- The Consumer Price Index (CPI) has resurged to a five-month high, underscoring the persistent challenges posed by inflation.

All of this is happening at a time when the US is now engaged in financing not one but two major military conflicts.

The Fed is still not at the finish line.

The Fed has not yet achieved its goal of reducing inflation to the target of 2%. This is becoming a bit worrisome as the conflicts in especially the Middle East could push up oil prices, which will affect inflation numbers negatively.

Crypto Lens: Bitcoin Surges by 10% in a Day!

The moment of excitement was very short-lived as it was quickly discovered that the reported news was not accurate.

The wild price swings up and the subsequent retraction resulted in the liquidation of over $70 million worth of short positions during the price increase. Additionally, when the price later corrected, approximately $31 million in long positions were liquidated.

Tough waters for traders to operate in!

On a positive note, it is worth noticing that BTC is still trending upward and at the time of writing maintains a 7.3% gain over the past week.

The Really Positive News

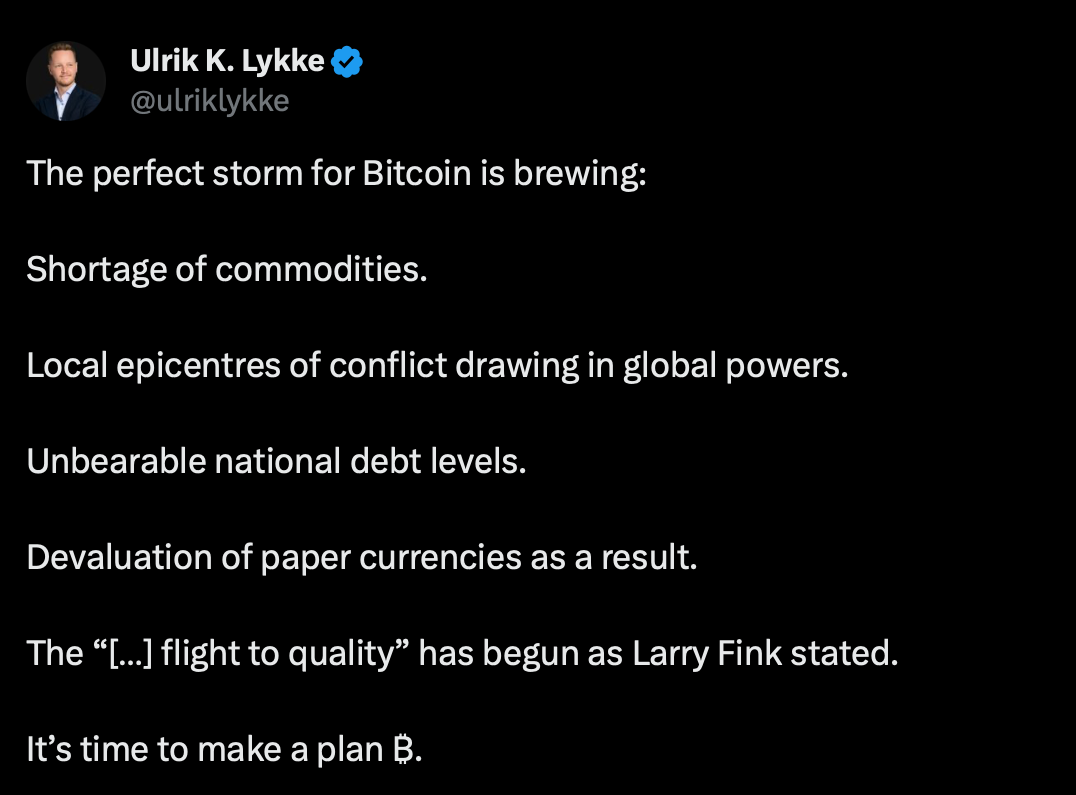

While the ETF news turned out to be a fad what was really exciting for this week was Blackrock’s CEO, Larry Fink, making remarks that the increased interest in BTC lately could be seen as a “flight to quality” driven by current geopolitical tension.

That’s pretty big.

I can’t remember a time when I have heard such positive rhetoric regarding Bitcoin from one of the world’s largest asset managers

Noteworthy Mentions

- Crypto Security In 2023: Dissecting Hacks, Exploits, And Other Insights. Our latest research covers the state of crypto security in 2023, highlighting the top 10 breaches alongside other notable trends. Here is the full link to the article.

- Lots of take-aways from the yearly Bitkraft Summit. Last week, I participated in the yearly summit by Bitkraft Ventures, which specializes in gaming-related investments. It has been a long time since I’ve received that many great take-aways from a conference so that naturally deserves a shout-out! Read my condensed notes on everything game-related here.

Industry Shakers

- EU Formally Agrees on New Crypto Tax Data Sharing Rules. The European Union's finance ministers formally approved new regulations allowing the sharing of data on individuals' cryptocurrency holdings. These rules, known as the Eighth Directive on Administrative Cooperation (DAC8), were proposed last year to prevent the hiding of assets abroad through crypto. They oblige cryptocurrency companies to report customer holding information, which will be automatically shared among tax authorities.

- Digital Euro Project Moves to 'Preparation' Phase. The European Central Bank (ECB) has initiated the transition of its digital euro project into a preparation phase, a step that could potentially lead to a future decision to issue a digital euro. This preparation phase, formerly referred to as the "realization phase," is scheduled to commence in November and is anticipated to span a duration of two years. Its primary objectives include finalizing the framework for a digital euro, selecting service providers for the development of a Central Bank Digital Currency (CBDC) platform, and conducting further testing.