Bitcoin has managed to resume the upside movement and it seems determined to reach fresh new highs in the upcoming period. BTC/USD is trading at 9798 level and it should jump way above the 10.000 psychological level in the nearest hours.

The outlook is bullish and I believe that we’ll see a further increase as the price has made another higher high and it has registered a valid breakout above the 38.2% retracement level. Coronavirus fear and the global risk could boost the BTC/USD price.

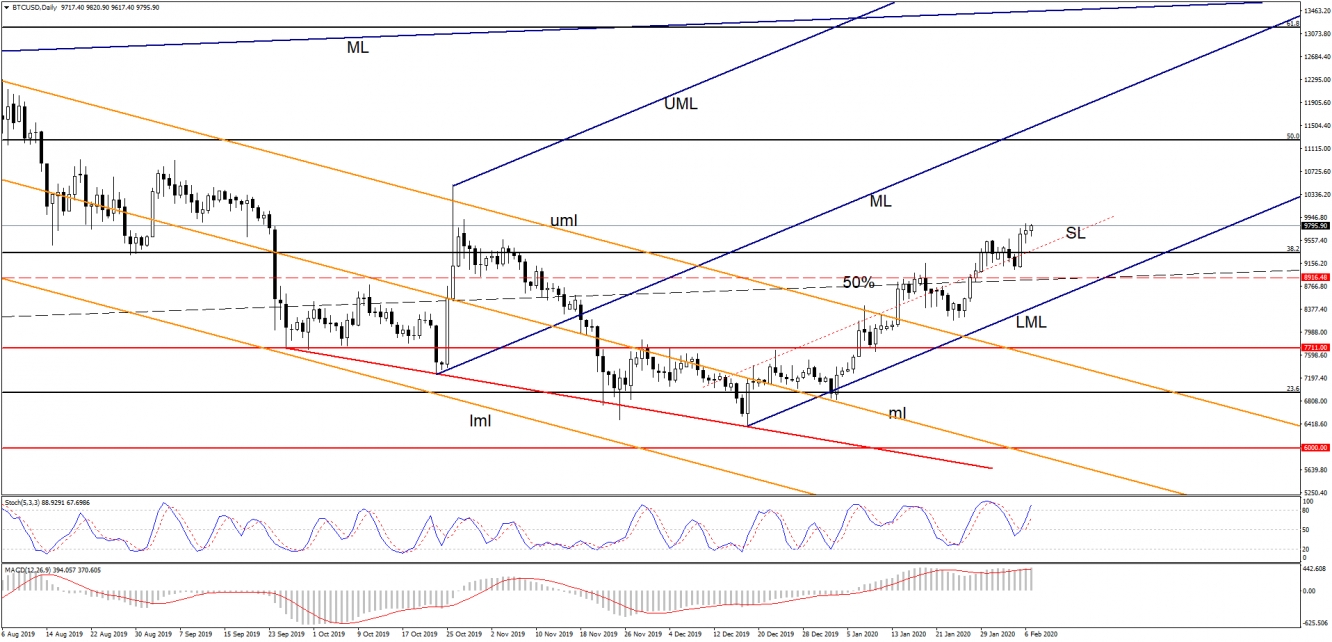

Technically, BTC/USD has escaped from the descending pitchfork’s body (orange), it has passed above the 50% Fibonacci line (ascending dotted line), the sliding line (SL) and above the 38.2% retracement level signaling a broader upside movement. The price was oversold on the daily chart around the 23.6% retracement level, MACD has indicated a bullish divergence, but only the aggressive breakout above the upper median line (uml) of the descending pitchfork has announced a potential reversal.

I’ve drawn an ascending pitchfork to catch a potential upside momentum, you can notice that the rate has validated the lower median line (LML) as a dynamic support. Bitcoin has failed to retest the LML and the broken upper median line (uml) as the price is under huge bullish pressure. So, the perspective is bullish as long as the price is trading above the 38.2% level and above the sliding line (SL), the next upside target could be represented by the 50% retracement level, $11257.

BTC/USD could be attracted also by the median line (ML) of the ascending pitchfork, while the major upside target is seen at the 61.8% retracement level and at the median line (ML) of the major ascending pitchfork.