Key Takeaways

- The overall cryptocurrency market lost nearly 6% of its value over the past 24 hours.

- Bitcoin fell by roughly 5% today, while Ethereum and the remainder of the crypto market saw losses of upward of 6%.

- Those losses coincide with similar but more moderate losses in the stock market, as the Nasdaq fell by 3.3% today.

- The market slump is likely related to inflationary concerns around the US Federal Reserve's plans to raise interest rates.

- itcoin prices fell by roughly 5% today alongside news that the US Federal Reserve will raise interest rates in the coming months.

Bitcoin and Ethereum Are Down

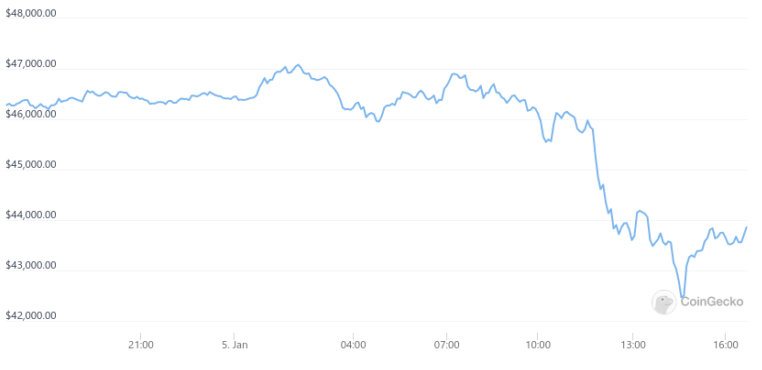

Bitcoin (BTC) prices fell by 5.3% over the past 24 hours, as the asset's value dropped from $45,800 to $43,500. That amount is the lowest price the cryptocurrency has seen since September 2021.

Ethereum (ETH) 's value fell by 6.7% over the same period. Meanwhile, prices dropped from $3,780 to $3,545.

Leading cryptocurrencies and altcoins such as Binance Coin (BNB), Cardano (ADA), Ripple (XRP), Avalanche (AVAX), Dogecoin (DOGE), and Shiba Inu (SHIB) all saw similar losses of 5.7% to 6.9%.

Polkadot (DOT), Terra (LUNA), and Solana (SOL) were hit somewhat harder, with losses of 7.3%, 7.9%, and 8.4% respectively.

Losses extended to the rest of the crypto market, down 5.9% today, resulting in a total market cap of $2.2 trillion.

Federal Reserve Interest Raise May Be at Play

Reasons for the market slump are uncertain, as there were few significant announcements in the crypto industry today.

However, Bitcoin and the stock market correlate often, with a 100-day correlation of 0.33 reported late last year. As such, losses today may be related to similar but milder losses in the stock market.

The NASDAQ lost 3.3% over the past 24 hours, while the S&P 500 saw losses of 1.9% in the same period.

Those losses in the stock market have been attributed to the US Federal Reserve confirming that it will begin to raise interest rates in the coming months, thereby spurring concerns over inflation.

It is believed that this rate hike could take place sooner than expected and as early as March. Such a short time frame may have motivated widespread sell-offs among investors today.