Bitcoin (BitfinexUSD): The number of search requests for the world's leading cryptocurrency fell by 80%

The interest in bitcoin is rushing down at the speed of an express train, regulators around the world are tightening control, and users are expecting the next hacker attack. Against this background, it was very difficult for BTC/USD bulls to take the resistance at 11800 by storm. The inability to overcome an important level became evidence of their weakness and launched a wave of sales. Fans of the world's leading cryptocurrency immediately said that these are the weakest holders getting rid of the asset. True believers will not stop believing until they change the world.

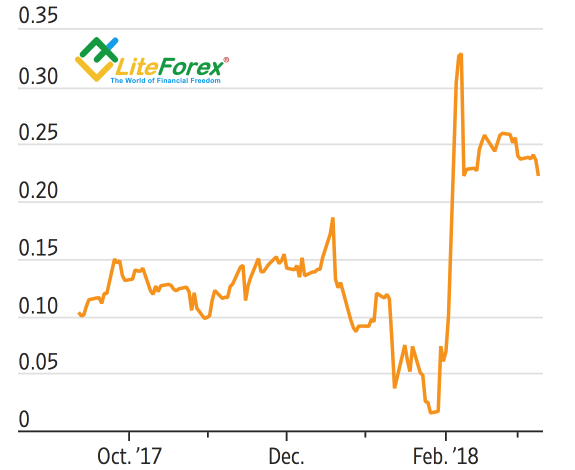

According to Google Trends, as the bitcoin price falls from the December highs, the number of search requests has dropped by 80%. In the context of a decrease in the volume of operations, this fact is yet another proof of a decrease in interest in the cryptocurrency.

Source: Bloomberg.

The pressure on the BTC/USD bulls has been created by the regulators that seem to have found the Achilles' heel of the asset. In the opinion of the European Banking Administration, it is necessary to monitor not the bitcoin, but the financial institutions that use it. Immediately after that there was information that Japan suspended the operation of two exchanges, which traded cryptocurrency - FSHO and Bit Station - due to the lack of proper procedures for protecting clients' assets. The regulator represented by the Financial Services Agency also noted that 7 exchanges do not have proper internal control and they must submit measures for its establishment and improvement until March 22.

In the United States, the Securities and Exchange Commission went even further. It warned investors that several cryptocurrency exchange platforms are cocky enough to call themselves "exchanges," which is misleading. Such a financial institution as the exchange is subject to regulation, therefore they must be registered with the SEC as a national stock exchange or present documents confirming their refusal to register.

The BTC/USD bulls were also not at all pleased with the information that the anti-crisis managers of the oldest exchange site of bitcoin, Mt.Gox, began selling assets to pay debts, and at the Hong Kong Binance Exchange there was a case of mass unauthorized customers selling their cryptocurrency for the purpose of buying viacoin. The institution was forced to acknowledge the hacker attack, which, it said, they managed to stop in time.

Curiously, bitcoin is being considered by some investors as a leading indicator for the S&P 500. Apparently, its collapse occurred a few days before the 10% correction of the stock index. Accordingly, the behavior of the cryptocurrency can show where the speculative demand is going. In my opinion, this is a rather controversial point of view. Still, these assets had absolutely different bearish drivers.

Source: Wall Street Journal.

BTC/USD quotations are trying to find out the boundaries of the new consolidation in the range of $8300-11800. The further fate of bitcoin will depend on the degree of pressure on the cryptocurrency from the regulators.