Since Monday night’s USD/JPY drop didn’t amount to a hill of beans (quite the opposite: ES and NQ both opened in the green), let’s turn our attention to the one space that typically has interesting action; cryptos. Specifically, bitcoin.

As we all know, two big exchanges launched bitcoin futures last month, one on December 10, the other on the 17th. Interestingly, the 17th was (so far, at least) the lifetime high for the instrument. After trading at about $20,600, it lost about half its value, only to recover most of that loss based on well-founded optimism as well as a big positive push by Peter Thiel.

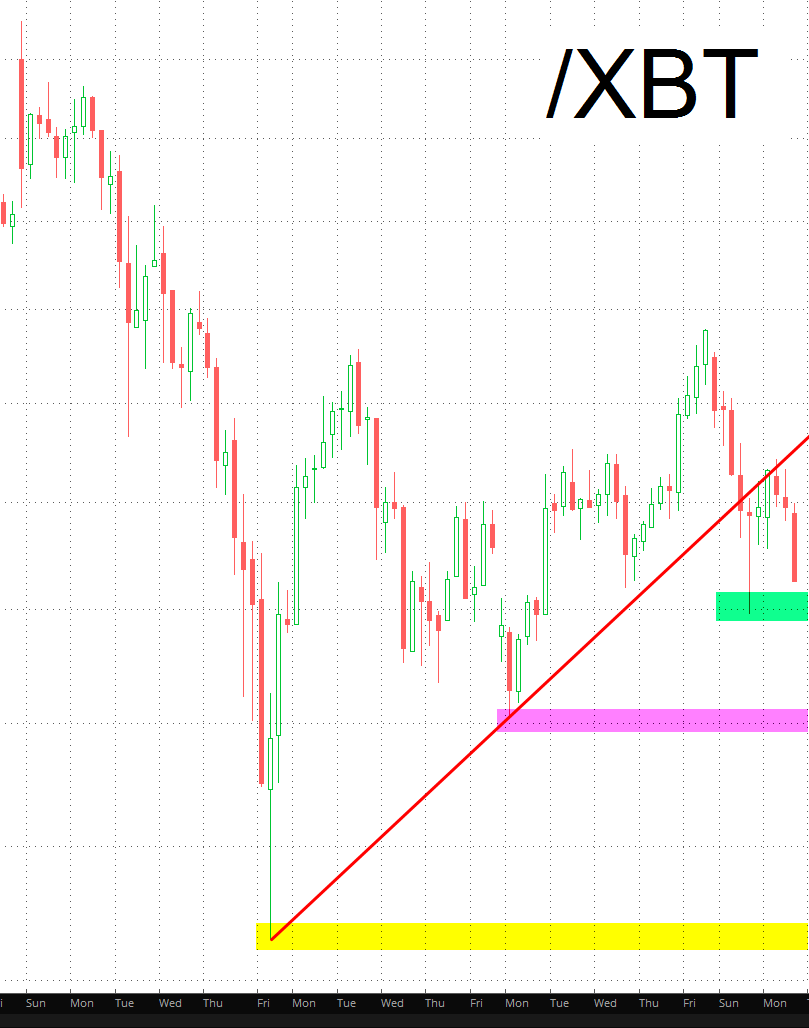

CBOE Bitcoin Futures

However the “Theil Rally” unwound itself swiftly and it’s worth noting some important support levels coming up. The medium-term trendline (red) is already broken, but here are some price levels bitcoin bulls should worry about:

- $14,000 (green tint) – a break here would end the series of “higher lows” in place

- $13,000 (magenta tint) – a failure here would snap the lowest levels of the year so far (and the Big Round Number thing always affects traders’ nerves)

- $10,600 (yellow tint) – this, I think, would send prices swiftly back into the quadruple-digits, since obviously the “besting” of the big price plunge we saw in December would renew the terror that there’s really nothing holding the beast up.

Unlike with equities, I’m actually pretty impartial about the above. Bitcoin is in a humongous range of about $10,000 (from $10,600 to $20,600) and the “escape” from that range is ultimately going to set up the next big move.