Investing.com’s stocks of the week

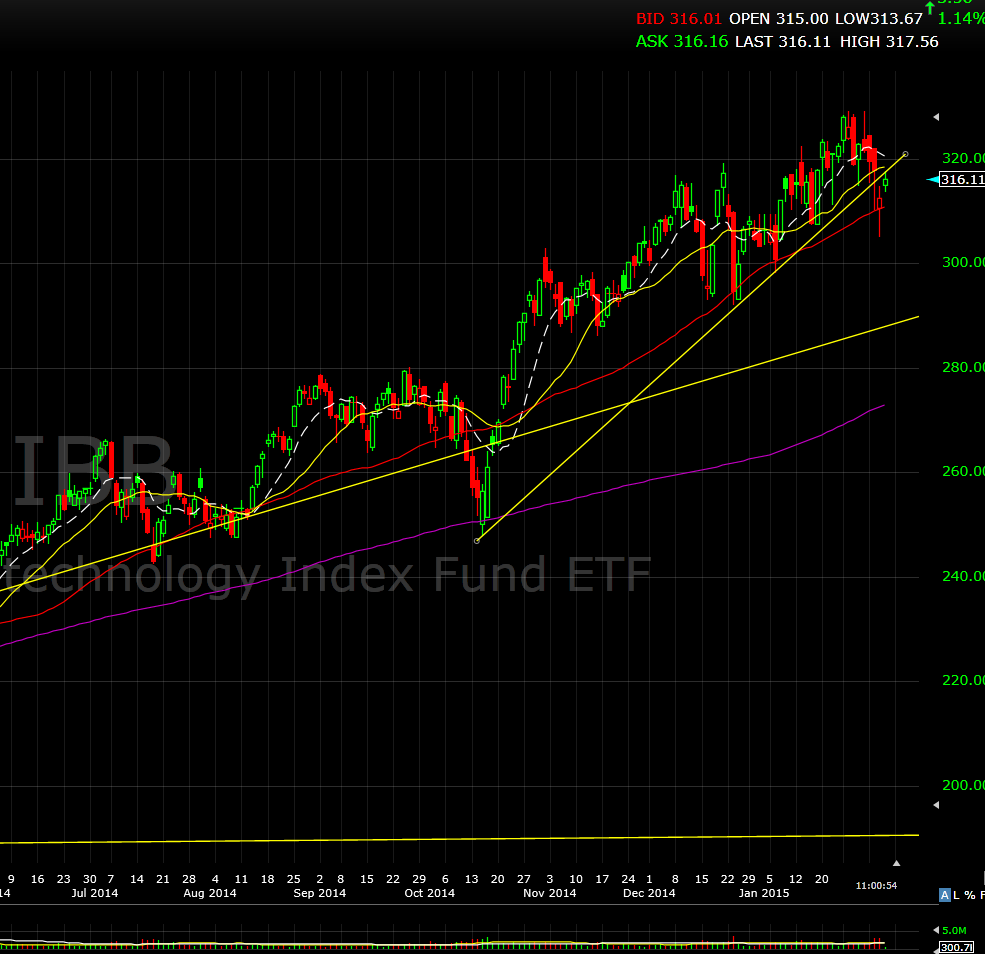

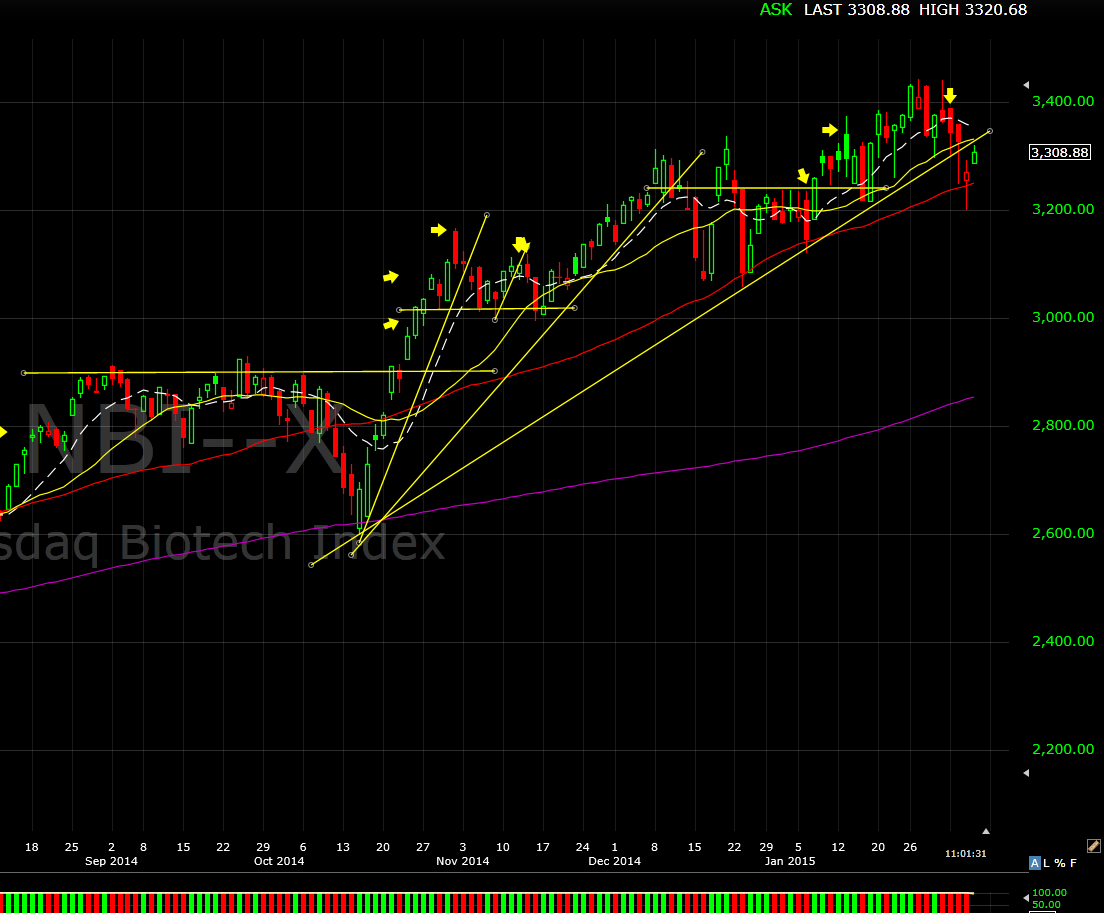

The Biotech sector has been a Wall Street darling for the last 5 years, with the NASDAQ Biotechnology index up roughly 350% in that time frame. I believe that the sector is in a precarious position, as the (NASDAQ:IBB) and (NYSE:XBI) have come under some pressure over the last week with a few stocks like (PARIS:BLUE) selling off on what many believed was good news.

The XBI, IBB and NBI are all trading below their 20-day moving averages and below an ascending trend-line that started in October. But, if you put all the chart noise aside, I believe this sector has become over loved and is not reacting to news or bouncing with the same gusto it has in the past after multiple down days. The sector has become so loved that you now hear things like, “recession or no recession, regardless of what happens in the market, doctors won’t stop prescribing drugs” etc… And while that may be true, at the end of the day stocks go up and down not up or down.

From a trading perspective, I would look to short the sector as close as possible to the 20-day moving average/ascending trend-line with a stop at their respective 52-week highs.