On June 24, 2024 I wrote a daily called, Big Brother Biotechnology Sector Revives.

“IBB sits just below the 200-WMA. Plus, he is in the middle of the weekly channel range. Furthermore, back in May, IBB handily cleared above the 50-WMA.

We have eyes here next week as the weekly close was solid and IBB could hit 140or higher.”

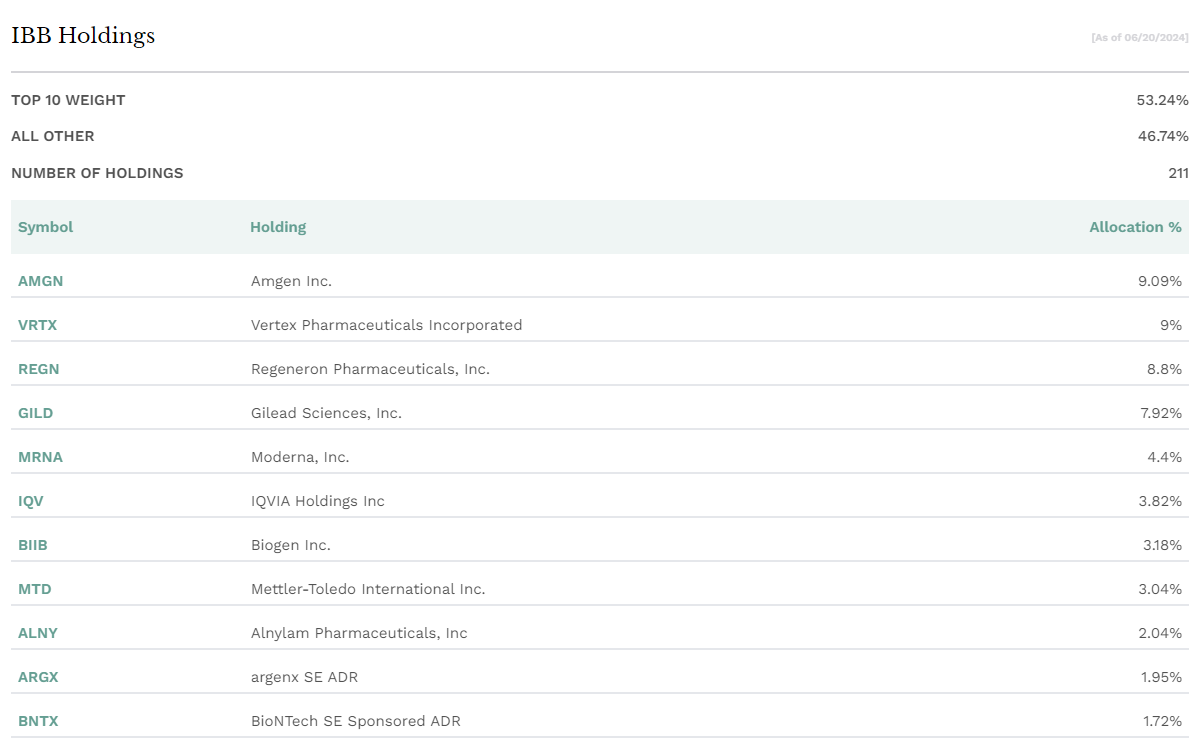

I also included the top holdings

I ended the Daily with this:

Should IBB hold over 140 as the week and end of the month progresses, we see a potential $20 move up from here.

IBB is back over 140. What comes next?

ETF Summary

- S&P 500 (SPY) 5400 support 5600 resistance

- Russell 2000 (IWM) 197-205 tightest range to watch

- Dow (DIA) 40k resistance

- Nasdaq (QQQ) all-time high

- Regional banks (KRE) Watching the range 45-50 CAREFULLY

- Semiconductors (SMH) 260 -280 range

- Transportation (IYT) Not pretty under 64

- Biotechnology (IBB) 140 cleared-now needs to hold

- Retail (XRT) 200-week moving average support at 72.75. Needs to recapture 74.50

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) Pointing more risk on for now