The second quarter earnings season is off to a strong start. As of July 25, approximately 128 S&P 500 companies or 36.1% of the index’s total membership have reported results. A deep look into the results show that earnings for the companies reported so far are up 7% year over year on 4.2% higher revenues. Of these, 77.3% have topped earnings estimates while 70.3% have beat on revenue estimates.

However, the pace of growth is below the first quarter but in line with the four-quarter average and has improved over the 12-quarter average. Going forward, estimates for the third quarter are going down. The estimate for Q3 growth is 4.8%, down from 6% at the start of the quarter.

The Pharma sector has more or less combated the overall decline in the financial markets and maintained momentum. Last week, industry bellwether Johnson & Johnson (NYSE:JNJ) reported mixed second-quarter results, beating on earnings but missing on sales. Swiss major Novartis AG (NYSE:NVS) reported encouraging second-quarter results. Meanwhile, biotech giant Biogen Inc. (NASDAQ:BIIB) surpassed expectations both for earnings and sales in the second quarter of 2017 and raised its annual guidance.

Let’s take a look at three biotech companies that are set to report second-quarter results on Jul 27.

Bristol-Myers Squibb Company (NYSE:BMY) is scheduled to report before the opening bell. Last quarter, the company beat earnings estimates by 16.7%.

Bristol-Myers has a decent track record so far. The company’s earnings beat estimates in three of the trailing four quarters, with an average positive surprise of 8.39%. Currently, the company has a Zacks Rank #3 (Hold) and a 0.00% Earnings ESP . Although the current rank increases the predictive power of ESP, its 0.00% ESP makes it unlikely for the stock to beat estimatesthis quarter.You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Bristol-Myers’ high-profile immuno-oncology drug, Opdivo, is expected to continue to drive the company’s top line in the to-be-reported quarter. Although the first quarter saw some stability in the second-line lung cancer, the recent FDA approval of Merck & Co., Inc. (NYSE:MRK) Keytruda for the first-line treatment of metastatic nonsquamous NSCLC will impact sales. (Read more: What's in the Offing for Bristol-Myers in Q2 Earnings?)

Celgene Corporation (NASDAQ:CELG) is scheduled to report before the opening bell. Last quarter, the company beat expectations by 4.08%.

Celgene’s key product, Revlimid, is expected to continue to be the main growth driver as in the first quarter, driven by share gains in important markets and longer treatment duration in newly diagnosed multiple myeloma (MM). Other key products – Pomalyst/Imnovid, Abraxane and Otezla continue to perform well. In the second-quarter call, investors are expected to remain focused on the company’s performance and label expansion efforts, along with updates on the pipeline front. Celgene has submitted a new drug application to the FDA for Idhifa in relapsed refractory AML in 2016. The NDA for Idhifa was granted Priority Review with a Prescription Drug User Fee Act (PDUFA) action date of Aug 30.

Celgene’s track record has been pretty decent with the company toppingearnings estimates thrice in the trailing four quarters. Overall, the company has delivered an average positive surprise of 3.01%. Currently, the company carries a Zacks Rank #3 and an Earnings ESP of +0.62% which indicates a likely earnings beat in the quarter. (Read more: Is Celgene Poised For a Beat This Earnings Season?)

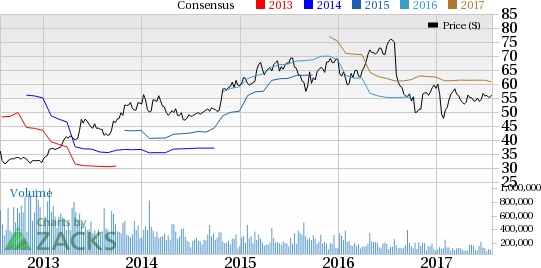

Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is scheduled to report results before the opening bell.In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate.

Alexion’s blockbuster drug, Soliris, continues to perform well. Label expansion of the drug for additional indications is expected to boost revenues. Among new products, while Strensiq is doing well, Kanuma lagged expectations and management is reassessing its strategy for the drug going forward.

Alexion’s track record is excellent as the company has consistently topped expectations in the last four quarters with an average positive earnings surprise of 7.49%. Currently, the company carries a Zacks Rank #3 and an Earnings ESP of +6.48% which indicates that it is likely to beat estimates in the quarter. (Read more: Is a Beat in Store for Alexion this Earnings Season?)

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Original post