It was a relatively slow week for the biotech sector though companies like CoLucid (NASDAQ:CLCD) and Dynavax (NASDAQ:DVAX) came out with important pipeline updates.

Recap of the Week’s Most Important Stories

CoLucid Hits 52-Week High on Positive Migraine Data

CoLucid’s shares shot up 123.6% on positive late-stage data on the company’s experimental migraine treatment, lasmiditan. In addition to demonstrating efficacy, lasmiditan was well tolerated with no significant difference in cardiovascular adverse events in patients dosed with lasmiditan vs. placebo. Lasmiditan’s mechanism of action is different from that of existing migraine treatments as it comes without the vasoconstrictor activity associated with these treatments. If developed successfully, lasmiditan has the potential to be an important treatment for patients specially those at high risk for cardiovascular disease whose treatment options could be limited due to the vasoconstrictive effects of currently available acute migraine treatments such as triptans and ergot alkaloids. Lasmiditan is currently in another late-stage study with results expected in the second half of 2017.

Dynavax Shares Seesaw on Heplisav-B Update

Dynavax’s shares were down on news that the FDA has cancelled an advisory panel meeting for the company’s experimental hepatitis B vaccine, Heplisav-B. The meeting was scheduled for Nov 16, 2016. However, shares rebounded when it became clear that the FDA action date remains unchanged – a response from the agency regarding the approval status of the candidate is expected by Dec 15, 2016. The FDA said that remaining questions will be addressed via the normal review process.

BioMarin Faces Delay for CLN2 Disease Treatment

BioMarin (NASDAQ:BMRN) is facing a delay in the regulatory process for its experimental CLN2 disease treatment as the FDA has pushed out the PDUFA date by three months to Apr 27, 2017. The company is looking to get Brineura (cerliponase alfa) approved for the treatment of children with CLN2 disease, which is a form of Batten disease. There are currently no approved treatments for this rapidly progressing and fatal neurodegenerative disease.

The FDA pushed out the PDUFA date following the submission of additional data from an ongoing extension study as requested by the agency. The agency had asked the company to provide the additional data during their initial review of the regulatory application. The FDA also informed the company that an advisory panel will review the drug.

Amgen Provides Pipeline Updates

Amgen (NASDAQ:AMGN) provided quite a few pipeline updates – the company acquired global development and commercial rights for BI 836909 (AMG 420) from Boehringer Ingelheim. BI 836909 is a bispecific T cell engager (BiTE) that targets B-cell maturation antigen and is currently in early-stage studies for multiple myeloma.

Amgen also announced the advancement of its cardiovascular collaboration with Servier for omecamtiv mecarbil. Servier exercised its option to commercialize omecamtiv mecarbil in chronic heart failure in Europe, as well as the Commonwealth of Independent States, including Russia, which were added to the collaboration. Moreover, the omecamtiv mecarbil phase III development program will move forward in collaboration with Cytokinetics. A cardiovascular outcomes clinical study is scheduled to commence in the fourth quarter of 2016.

Meanwhile, Amgen gained FDA approval for the label expansion of its cancer treatment, Blincyto. The label now includes new data supporting the treatment of pediatric patients with Philadelphia chromosome-negative (Ph-) relapsed or refractory B-cell precursor acute lymphoblastic leukemia (Read more: Amgen Gets FDA Approval for Label Expansion of Blincyto).

Fast Track Status for Biogen Alzheimer’s Drug

Biogen’s (NASDAQ:BIIB) experimental treatment for early Alzheimer’s disease (AD) got Fast Track status in the U.S. – the designation supports the development of new treatments for serious conditions with an unmet medical need such as Alzheimer’s disease. Aducanumab is currently in a couple of late-stage studies (Read more: Biogen Aducanumab Gets Fast Track Status in the U.S.).

Performance

MEDICAL-BIOMED/GENETICS Industry Price Index

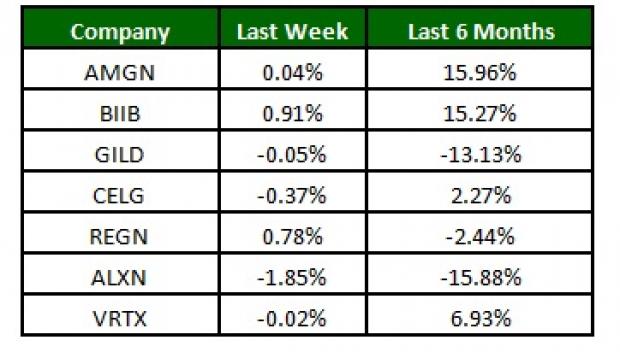

The NASDAQ Biotechnology Index was up slightly (0.4%) over the last four trading days. Among major biotech stocks, Biogen inched up 0.9% while Alexion (NASDAQ:ALXN) lost 1.9% over the last four trading sessions. Over the last six months, Amgen was up 15.9% while Alexion lost 15.9% (See the last biotech stock roundup here: Gilead in Patent Infringement Lawsuit, Enbrel Biosimilar Approved).

What's Next in the Biotech World?

An FDA advisory panel is scheduled to meet next week to discuss Spectrum’s (NASDAQ:SPPI) Qapzola -- the proposed indication is for immediate intravesical instillation post-transurethral resection of bladder tumors in patients with non-muscle invasive bladder cancer. Apart from this, watch out for the usual pipeline and regulatory updates from biotech companies.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

ALEXION PHARMA (ALXN): Free Stock Analysis Report

DYNAVAX TECH CP (DVAX): Free Stock Analysis Report

BIOMARIN PHARMA (BMRN): Free Stock Analysis Report

AMGEN INC (AMGN): Free Stock Analysis Report

BIOGEN INC (BIIB): Free Stock Analysis Report

SPECTRUM PHARMA (SPPI): Free Stock Analysis Report

COLUCID PHARMA (CLCD): Free Stock Analysis Report

Original post