Switzerland-based Actelion (OTC:ALIOF) confirmed that it is in preliminary talks with Johnson & Johnson (NYSE:JNJ), which is looking to acquire the company that is focused on the discovery, development and commercialization of drugs for diseases with significant unmet medical needs. Meanwhile, Juno (NASDAQ:JUNO) was hit by yet another clinical hold on its phase II ROCKET study.

Recap of the Week’s Most Important Stories

Actelion Shoots Up on Acquisition Talks: Actelion’s shares soared 34.9% ever since rumors surfaced about the company being in acquisition talks with Johnson & Johnson. While both companies confirmed that they are in discussions, a deal is yet to be announced. According to sources, J&J has hiked its offer though Actelion is reportedly not interested in a complete takeover. Actelion has often been considered an attractive takeover target mainly due to its rare disease portfolio. In addition to holding a strong position in the pulmonary arterial hypertension (PAH) market, Actelion’s portfolio also has treatments approved in certain countries for specialist diseases like type I Gaucher disease, Niemann-Pick type C disease, digital ulcers in patients suffering from systemic sclerosis, and mycosis fungoides type cutaneous T-cell lymphoma. We note that Actelion has consistently outperformed the Zacks categorized Medical-Biomedical/Genetics industry year-to-date (YTD) with the company gaining 50.7% while the Zacks categorized Medical-Biomedical/Genetics industry declined 23.5%.

Juno Hit by Another Clinical Hold: Juno’s phase II ROCKET study on JCAR015 has been placed on clinical hold after two patients suffered severe cerebral edema and died eventually. This is the second time this year that the ROCKET study, in adult patients with relapsed or refractory B cell acute lymphoblastic leukemia, has been placed on clinical hold. Earlier in July, the FDA had placed the pivotal study on hold after two patients died following the recent addition of fludarabine to the pre-conditioning regimen. The hold was subsequently lifted with the study continuing under a revised protocol.

With the latest clinical hold, some of the options for Juno include continuing the study with a modified protocol, starting a new study or terminating the JCAR015 program. The company’s decision regarding the path forward will take into account feedback from the FDA, the data safety monitoring board as well as the treating physicians in the study. Juno will provide an update once the analysis is completed. Not surprisingly, Juno’s shares were down on the latest clinical hold (Read more: Juno's ROCKET Study on Clinical Hold Again, Shares Down). Since the first clinical hold in July, Juno has been underperforming the Zacks categorized Medical-Biomedical/Genetics industry -- while the Zacks categorized Medical-Biomedical/Genetics industry gained 0.4% since July, Juno declined 48.1% during this period.

Amicus Shares Plunge on Fabry Drug Regulatory Update: Amicus (NASDAQ:FOLD) saw its shares declining 21.8% on the company’s regulatory update for its Fabry disease drug, migalastat. Migalastat is already approved in the EU under the trade name Galafold but the U.S. regulatory process has not been smooth. Based on discussions with the FDA, the company said that it needs to collect additional data on gastrointestinal (GI) symptoms in Fabry patients who have an amenable mutation. Amicus will be conducting a study, scheduled to start enrolling next year, with data expected in 2019. Although the FDA acknowledged that there is significant unmet medical need for Fabry disease, the agency also said that kidney globotriaosylceramide (GL-3) is currently not considered a basis for an accelerated approval under Subpart H (Read more: Amicus Provides Regulatory Update on Fabry Disease Drug). YTD, Amicus has underperformed the Zacks categorized Medical-Biomedical/Genetics industry with shares declining 32.9%.

Momenta Biosimilar Scores in Phase III Study: Momenta’s (NASDAQ:MNTA) confirmatory late-stage study on M923, its biosimilar version of AbbVie’s blockbuster drug Humira, met the primary endpoint in patients with moderate-to-severe chronic plaque psoriasis. We note that a biosimilar version of Humira has already been approved by the FDA -- in Sep 2016, Amgen’s (NASDAQ:AMGN) Amjevita (adalimumab-atto) was approved for use in all eligible indications of the reference product, Humira, which is used for a wide range of inflammatory diseases.

Full Approval and Label Expansion for ARIAD’s Iclusig: Cancer-focused ARIAD (NASDAQ:ARIA) gained full FDA approval as well as a label update for its leukemia drug, Iclusig. Iclusig was initially approved in Dec 2012 under the FDA’s accelerated approval program. Full approval was based on 48-month follow-up data from the pivotal phase II PACE study. ARIAD recorded Iclusig sales of $34.3 million in the third quarter of 2016 and $133.3 million in the first nine months of 2016. On its third quarter call, ARIAD had reaffirmed its guidance for global Iclusig net product and royalty revenue of $170 million - $180 million. ARIAD is a Zacks Rank #2 (Buy) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance

Medical - Biomedical and Genetics Industry Price Index

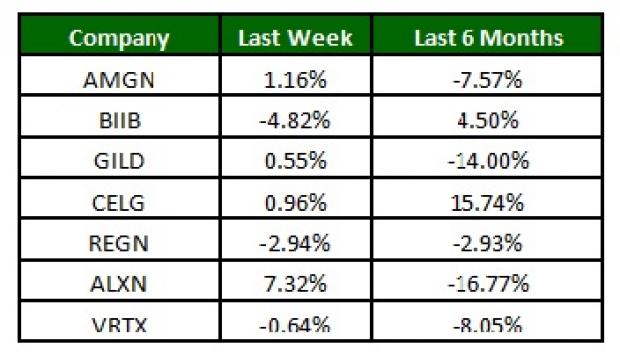

The NASDAQ Biotechnology Index declined 0.4% over the last four trading days. Among major biotech stocks, Alexion was up 7.3% while Biogen (NASDAQ:BIIB) declined 4.8% on concerns regarding its Alzheimer’s disease treatment following the failure of Lilly’s investigational Alzheimer’s disease treatment (Read more: Will Lilly's Solanezumab Setback Weigh on Other Alzheimer's Stocks?). Over the last six months, Celgene (NASDAQ:CELG) was up 15.7% while Alexion lost 16.8% (See the last biotech stock roundup here: Acorda Stops Ampyra PSWD Development, CRL for Spectrum's Qapzola).

What's Next in the Biotech World?

Watch out for the usual pipeline and regulatory updates from biotech companies. Several companies will be present at the upcoming meeting of the American Society of Hematology (ASH) with data on approved drugs as well as pipeline candidates.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trades >>

AMGEN INC (AMGN): Free Stock Analysis Report

ACTELION LTD (ALIOF): Free Stock Analysis Report

MOMENTA PHARMA (MNTA): Free Stock Analysis Report

BIOGEN INC (BIIB): Free Stock Analysis Report

AMICUS THERAPT (FOLD): Free Stock Analysis Report

JUNO THERAPEUTC (JUNO): Free Stock Analysis Report

ARIAD PHARMA (ARIA): Free Stock Analysis Report

Original post

Zacks Investment Research