Key highlights of the week include Alexion gaining on positive data on PNH candidate, Arena surges on ulcerative drug data, Solid Biosciences’ stock suffering a crash and Prothena teaming up with Celgene.

Recap of the Week’s Most Important Stories

Alexion Up on Positive Data From PNH Candidate: Shares of Alexion Pharmaceuticals (NASDAQ:ALXN) gained after the company reported positive data on candidate, ALXN1210 from a pivotal phase III study. This phase III randomized, open-label, active-controlled, multinational, and multicenter study evaluated the efficacy and safety of ALXN1210 compared to Alexion’s lead drug Soliris administered by intravenous infusion to adult patients with paroxysmal nocturnal hemoglobinuria (“PNH”) who are naïve to complement inhibitor treatment. ALXN1210 demonstrated non-inferiority to Soliris in complement inhibitor treatment-naïve patients with PNH based on the co-primary endpoints of transfusion avoidance and normalization of lactate dehydrogenase (“LDH”) levels. In addition, the study also demonstrated non-inferiority on all four key secondary endpoints — percentage change from baseline in LDH levels, change from baseline in quality of life as assessed by the Functional Assessment of Chronic Illness Therapy (“FACIT”) — Fatigue scale, proportion of patients with breakthrough hemolysis, and proportion of patients with stabilized hemoglobin levels. Alexion plans to submit ALXN1210 in PNH in the United States, EU, and Japan in the second half of 2018. (Read more: Alexion Gains on Positive Date From Lead Candidate)

Arena Pharma Gains on Positive Results on Ulcerative Colitis Candidate: Arena Pharmaceuticals (NASDAQ:ARNA) stock gained 29% after the company’s selective sphingosine 1-phosphate receptor modulator candidate, etrasimod met the primary endpoint in a phase II study, OASIS for the treatment of ulcerative colitis. The trial met primary and all secondary endpoints with statistical significance for patients receiving 2 mg dose of etrasimod for 12 weeks. Clinical remission (“CR”) was achieved in 33% of the patients on etrasimod versus 8.1% for placebo based on the three-component Mayo Clinic Scale. Moreover, 41.8% of patients achieved endoscopic improvement compared to 17.8% for placebo. The candidate achieved CR in 24.5% of patients compared with 6% for placebo based on a four-point Mayo Clinic Scale. Based on these data, Arena is planning to initiate a phase III program for further development of etrasimod for treatment of UC. (Read more: Arena's Etrasimod Meets Phase II Colitis Study Goal)

Solid Biosciences Plummets on Results on Lead Drug: Shares of Solid Biosciences (NASDAQ:SLDB) plummeted significantly after the FDA notified the company that its phase I/II trial, IGNITE DMD, on lead candidate SGT-001 has been put on clinical hold. SGT-001 is being evaluated for the underlying genetic cause of Duchenne muscular dystrophy (“DMD”) mutations in the dystrophin gene that result in the absence or near-absence of dystrophin protein. The clinical hold was placed after one of the patients was hospitalized due to laboratory findings which included a decrease in platelet count, followed by a reduction in red blood cell count and evidence of complement activation. As a result, enrolment and dosing has been stopped in the phase III study. (Read more: Solid Biosciences Hit by Clinical Hold on Lead Drug)

Regeneron’s Eylea Reports Positive Data From Non-Proliferative Diabetic Retinopathy Trial: Regeneron Pharmaceuticals (NASDAQ:REGN) announced that the phase III trial, PANORAMA, evaluating lead drug, Eylea in moderately severe to severe non-proliferative diabetic retinopathy (“NPDR”) met its 24-week primary endpoint. The results show that 58% of patients treated with Eylea experienced a two-step or greater improvement from baseline on the Diabetic Retinopathy Severity Scale at week 24, compared to 6% of patients receiving sham injection. The positive data from the trial will form the basis of a supplemental Biologics License Application which is expected to be submitted to the FDA later in 2018. Eylea is already approved for the treatment of neovascular age-related macular degeneration (wet AMD), diabetic macular edema (“DME”), macular edema following retinal vein occlusion, which includes macular edema following central retinal vein occlusion and macular edema following branch retinal vein occlusion. A potential label expansion will further boost sales. (Read more: Regeneron Eylea Hits 24-Week Primary Endpoint in Study)

Regeneron is a Zacks Rank #1 (Strong Buy) stock. You can see the complete list of today’s Zacks #1 Rank stocks here.

Prothena Gains on Deal With Celgene: Shares of Prothena Corporation (NASDAQ:PRTA) moved up following the news of a global collaboration with Celgene Corporation (NASDAQ:CELG) to develop new therapies for a broad range of neurodegenerative diseases. The multi-year agreementis focused on three proteins implicated in the pathogenesis of several neurodegenerative diseases, including tau, TDP-43 and an undisclosed target. Celgene will own the rights to license clinical candidates in the United States at the investigational new drug (IND) filing and if exercised, would also have a right to expand the license to global rights at the completion of phase I. Consequently, Celgene will be responsible for funding all further global clinical development and commercialization. In exchange, Prothena will receive a $100-million upfront payment. Celgene will also make a $50-million equity investment in Prothena by subscribing to approximately 1.2 million of ordinary shares at $42.57 per share. Prothena is also eligible for any regulatory and commercial milestones for each licensed program. Prothena will also receive additional royalties on net sales of any resulting marketed products. (Read more: Prothena Rallies on Multi-Year Collaboration With Celgene)

Performance

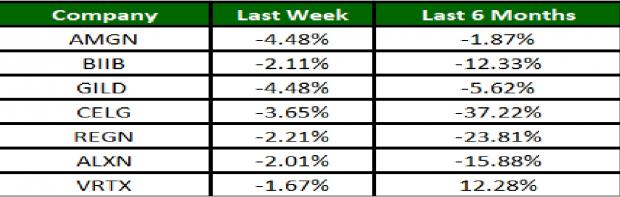

The NASDAQ Biotechnology Index lost 2.84% over the last five trading sessions. Among major biotech stocks, both Amgen (NASDAQ:AMGN) and Gilead lost 4.48%. Over the last six months, Celgene lost 37.2% while Vertex gained 12.3% (see the last biotech stock roundup here: Biotech Stock Roundup: REGN Cuts Praluent Price, OREX to File for Bankruptcy).

What's Next in the Biotech World?

Stay tuned for more regulatory and pipeline updates.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Arena Pharmaceuticals, Inc. (ARNA): Free Stock Analysis Report

Prothena Corporation plc (PRTA): Free Stock Analysis Report

Solid Biosciences Inc. (SLDB): Free Stock Analysis Report

Original post