Since making a low on Christmas Eve, equity markets have had a remarkable push higher. My bear market friends are quick to point out that some of the strongest rallies happen in a bear market. But we have also witnessed some very strong ‘V’ shaped recoveries in the past 5 years. While the debate rages on one thing is certain. Biotech stocks are outperforming.

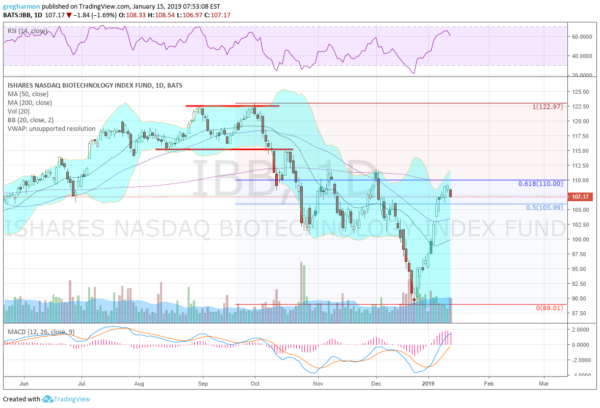

The chart of the Nasdaq Biotech Index, $IBB, below adds some color to that. Since making a bottom it has retraced between 50% and 61.8% if the move down. This is a 20% move higher. In contrast the S&P 500 has retraced about 38.2% of its move down and gained just under 12%. This is the kind of outperformance you want to look for in volatile markets.

The question now is, will it continue? That is not so easily answered. Momentum indicators suggest a pause at least and possibly some kind of reversal is in store. The RSI is pulling back and the MACD leveling. These are not bearish indications short term but waning momentum. It could lead to a consolidation to reset the indicators or it could result in a pullback in the Index.

The Index also has not made a higher high. Should it resume and move over the early December high more buyers would likely pile in. Another milestone would be a move over the 200 day SMA. This would also attract more buyers. A drop back under the 50 day SMA would suggest to me more pullback is coming.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.