A month ago the S&P 500 created the largest reversal pattern (bullish wick) since THE low in 2011. We shared this reversal pattern with our members the following morning.

What followed that reversal was almost historic, as the S&P 500 had its best month in four years and its 6th best October EVER.

October is now behind us, what's important to watch next?

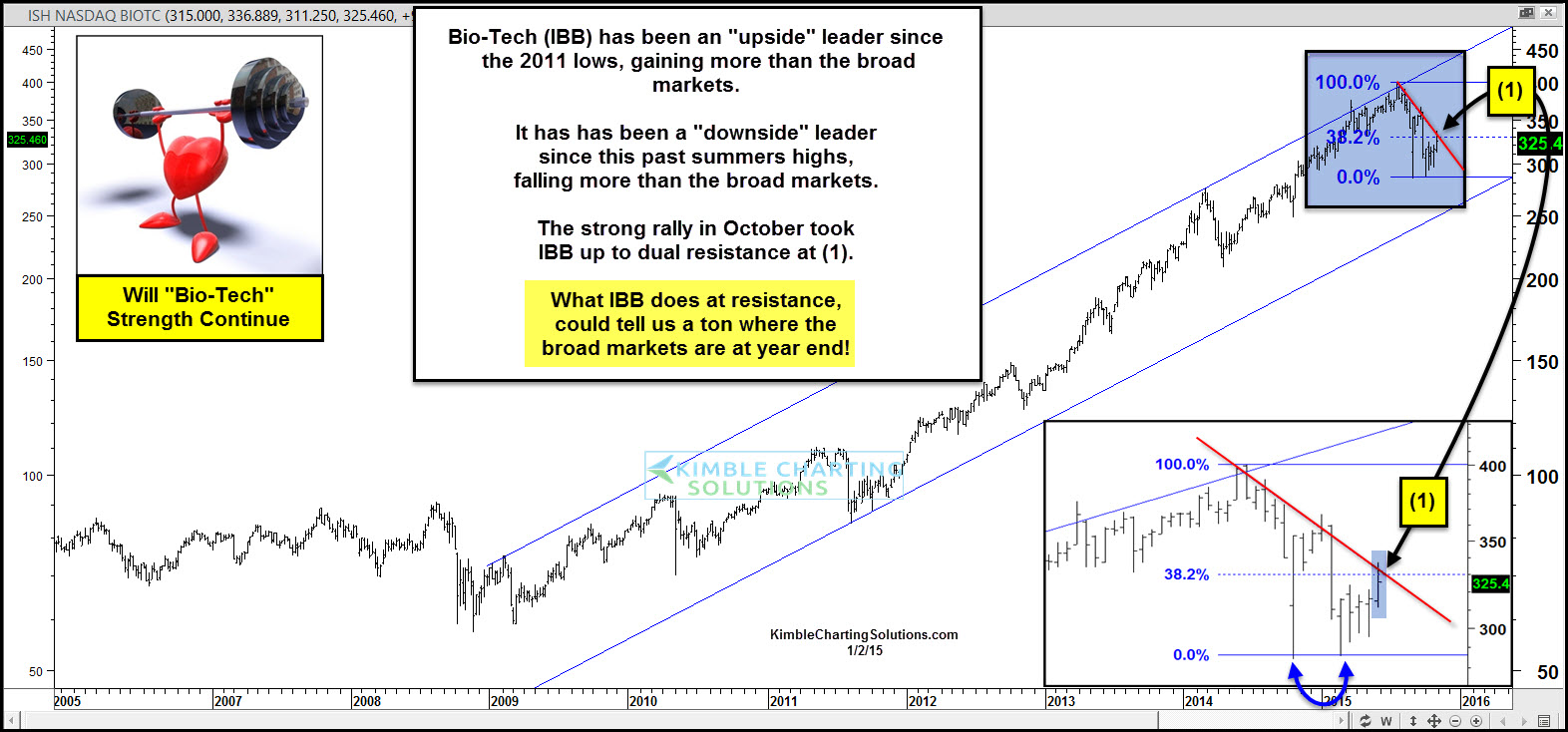

In our humble opinion, leadership remains a must monitor. Today we look at Biotech ETF (O:IBB), which has been in the leadership role since the 2011 lows. IBB fell harder during the summer softness and rallied over the past month along with the broad markets.

The rally now has IBB facing its 38% retracement level and falling resistance, based on weekly closing prices at (1) above.

What this leader does at (1) could tell us a ton about where the S&P is at year's end.