Earlier this year, we argued investors should snatch up biotech bargains while they were hot.

And, boy, were we right.

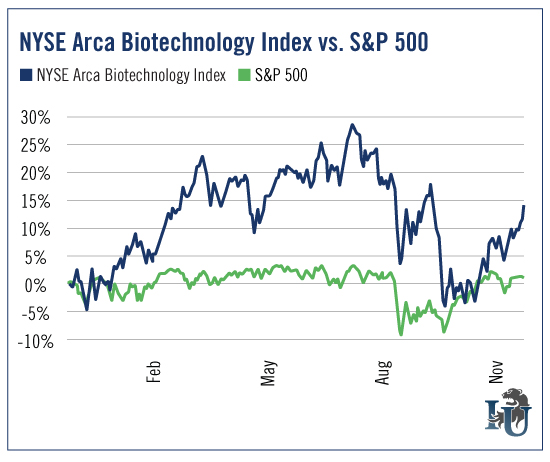

This week’s chart looks at the performance of the ARCA Biotechnologyand the S&P 500 since the beginning of the year.

As you can see, the biotech sector dropped more than 20% in August. It then made a solid 14% recovery before dropping again in September.

Since then, biotech is up more than 15%.

It all goes to support our thesis that big drops in this volatile sector are typically followed by even bigger uptrends.

Now, biotech stocks certainly come with their fair share of risks. But investors have a better chance of quickly generating huge returns here than in the broader market.

In fact, so far this year the S&P 500 has struggled to stay positive. It’s averaged only a 0.8% return. Compare that to the average 9.5% return from the biotech index.

Over the past 20 years, the healthcare sector as a whole has had one of the highest annualized gains of any other asset class... more than 12%.

And it’s showing no sign of letting up.

If you heeded our advice and grabbed some bargain biotech stocks, you likely turned a nice profit. If you didn’t, don’t worry. There are still plenty of opportunities ahead.

Recently, The Oxford Club’s No. 1 biotech enthusiast Marc Lichtenfeld identified what has the potential to be a $230 billion trend in the sector. This discovery not only could save your life, but also could make you a fortune.