During the last 5 years, what sector has doubled the S&P 500's performance? And how is it doing lately?

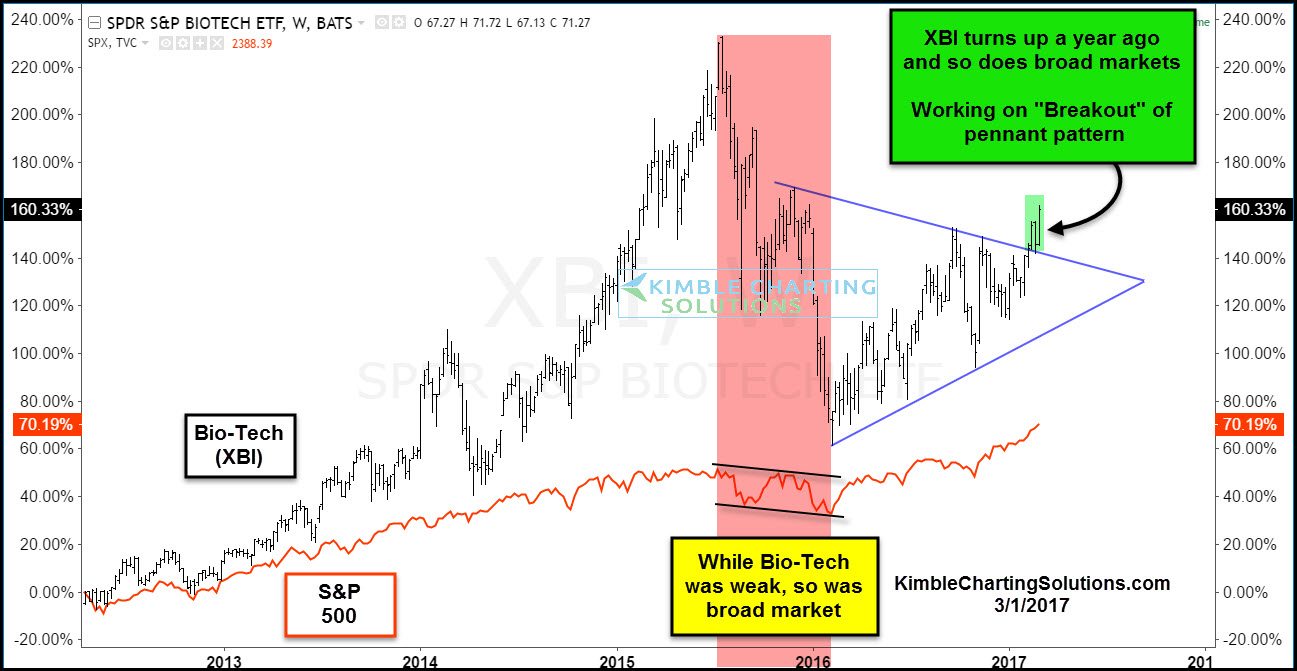

Below looks at the Biotech ETF XBI since 2012. The chart shows that over the past 5 years, the S&P 500 has done very well -- it's up 70%. During the same time frame, XBI is up 160%, gaining more than 100% more than the broad markets.

Biotech looks to have influenced the broad markets, as it declined from the summer of 2015 until Feb. 2016 along with the S&P 500. When Biotech turned higher 1 year ago, the broad market followed suit, although the broad market has lagged this leading sector since the lows.

Currently, XBI is working on a breakout of a year-long pennant pattern to the upside. If history continues to repeat, what this leading sector does going forward will have a big influence on the broad markets. Risk-on stock trade wants to see XBI clear the highs of late 2015 (where the top of the pennant pattern started). This level comes into play as a resistance test.

Full Disclosure: Premium Members are long XBI at this time, with a stop near the top of the pennant pattern.