BioDelivery Sciences International, Inc. (NASDAQ:BDSI) announced the retirement of its chief executive officer (CEO) for the last 12 years, Dr. Mark A. Sirgo by the end of 2017. Sirgo also held the position of president of BioDelivery Sciences. However, he will continue to serve as vice chairman of the board of directors. A successor is yet to be determined.

Under Sirgo’s leadership, the company reacquired worldwide rights to Belbuca in January 2017 from Endo International Plc (NASDAQ:ENDP) . Belbuca is approved for the management of pain severe enough to require daily, around the clock, long-term opioid treatment.

Moreover, the company is focused on commercial efforts for growing Belbuca sales, given significant opportunity for the product. Belbuca’s sales hit an all-time high in the second quarter of 2017 at $6.6 million. In June, Belbuca received approval in Canada and inked a deal with Purdue Pharma for commercialization in the country. A launch in Canada is expected in 2018.

BioDelivery is presently exploring other commercial options for longer-term growth for Belbuca within and outside the U.S. The company expects Belbuca’s positive growth trend to continue in the second half supported by the addition of new managed care contracts.

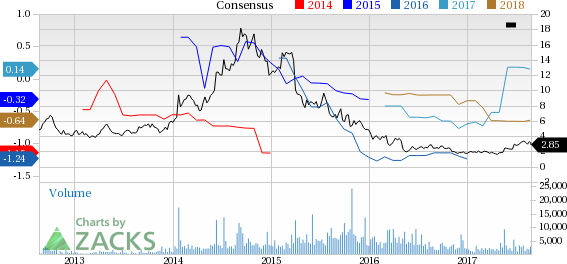

Investors seem to be encouraged by the news as the company’s shares rose 1.6% on Wednesday. In fact, shares of the company have increased 80% so far this year, significantly outperforming the industry’s gain of 6.9%.

Sirgo also led the company in successfully achieving approvals for the launch of Onsolis and Bunavail. BioDelivery has a licensing agreement with Collegium Pharmaceutical, Inc. (NASDAQ:COLL) to develop and commercialize Onsolis in the U.S.

BioDelivery is also working on improving Bunavail’s performance. The company has reduced the number of sales territories and is focusing on the most growth-oriented ones. Moreover, the company is working on securing new or improved positioning on other managed care contracts either on an exclusive or preferred status. The company is also running a highly targeted Bunavail-focused, direct-to-patient digital advertising campaign in four cities.

With a reduced cost structure combined with growth opportunities, BioDelivery expects Bunavail to reach profitability by the end of 2017. Moreover, in May 2017, the FDA approved a supplemental new drug application to expand Bunavail’s label to include induction of buprenorphine treatment for opoid dependence.

Zacks Rank & Stock to Consider

BioDelivery has a Zacks Rank #3 (Hold).

A better-ranked stock in the pharma sector is Corcept Therapeutics Incorporated (NASDAQ:CORT) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corcept’s earnings estimates increased from 26 cents to 42 cents for 2017 and from 49 cents to 70 cents for 2018 over the last 30 days. The company delivered an average earnings beat of 29.17% for the four trailing quarters. The stock is up 100.5% so far this year.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

BioDelivery Sciences International, Inc. (BDSI): Free Stock Analysis Report

Endo International PLC (ENDP): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL): Free Stock Analysis Report

Original post

Zacks Investment Research